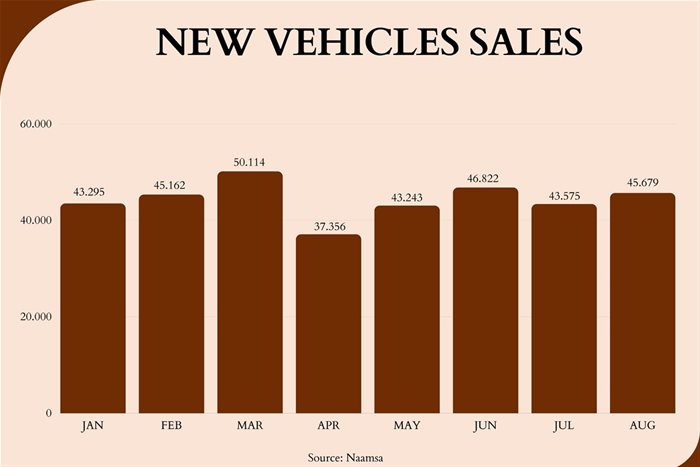

South Africa’s automotive industry recorded a 14% increase in new car sales in 2022, with 298,901 vehicles sold, according to the latest data from the National Association of Automobile Manufacturers of South Africa (Naamsa). However, the sector still faces challenges and uncertainties, as evidenced by a 3.1% drop in sales in August 2023 compared to the same month last year.

Ford Ranger production line at the Silverton assembly plant. Source: Quickpic

The car market in South Africa has been on a roller coaster ride for the past decade. It peaked in 2013 with 614,900 sales, but then declined steadily until 2016, when it reached a low of 523,254 sales. A slight recovery in 2017 was followed by another slump in 2018 and 2019. The Covid-19 pandemic dealt a heavy blow to the industry in 2020, causing a 29.4% plunge in sales.

Naamsa said that the post-pandemic recovery was driven by strong demand from consumers and businesses, as well as low interest rates and improved availability of stock.

However, it also warned that the outlook for the rest of the year remains uncertain, due to factors such as supply chain disruptions, rising fuel prices and political instability.

Fortunately, the fluctuations do not respond to a structural problem in the South African automotive industry; but to:

- the disruption in the global supply chain caused by the lack of raw materials, particularly for the production of microchips, and

- the government’s pressure towards the electric vehicles production, an expensive alternative for low-income consumers.

“The resilience of South Africa’s automotive retail industry in 2023 continues to surprise us, but we knew there had to be a turning point, and this is what happened in August,” said Brandon Cohen, the national president of the National Automobile Dealers’ Association.

In this respect, he asserted that:

- the increase in interest rates, fuel and vehicle prices; along with both,

- a significant increase in the cost of living and

- decrease in the household spending capacity,

were detrimental to consumers. Regarding the factors listed above, Cohen asserts that it is the interest rates that represent the biggest obstacle to vehicle sales, as it not only puts pressure on individuals with existing financial commitments but also “each increase changes the affordability model in terms of the maximum rand value for which they can get loan approval from a financial institution”.

Even so, the August numbers represent a 5.3% improvement compared to July 2023 when 43,389 units were purchased. “Overall, out of the total sales reported by the industry (45,679 vehicles) it is estimated that 38,292 units, or 83.8%, represented dealership sales. 12.2% represented sales to the vehicle rental industry, 2.8% to corporate fleets, and 1.2% to government sales,” Naamsa detailed.

It’s worth noting that, as has been happening in recent months, light commercial vehicles were one of the categories that showed growth in the eighth month of the year, with registrations totalling 13,652 units, a 2.7% increase compared to the 13,289 in the same month in 2022. In total, 102,833 light vehicles have been sold so far this year, a 19% increase compared to the same period last year.

Vehicle exports reflected a substantial increase

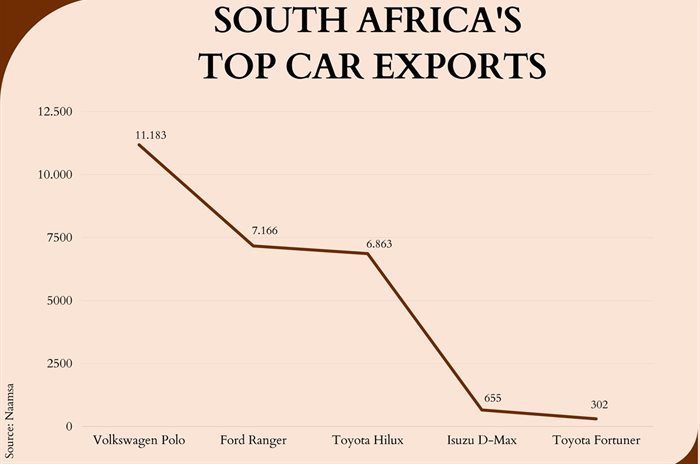

Regarding exports, the situation is more encouraging, with a 33.5% year-on-year increase reported. In detail, 41,462 vehicles were exported. It means 10,405 units more than in August 2022 when the number was 31,057. In fact, during the first eight months of the year, exports were 12.4% higher than the same period in 2022.

In this context, the Volkswagen Polo led the export charts in August with 11,183 units shipped from the Kariega factory. Meanwhile, the Ford Ranger came in second (7,166 units), and the Toyota Hilux was third (6,863 units), with just a couple of hundred units of difference. The top 5 is completed by the Isuzu D-Max (655 units) and the Toyota Fortuner (302 units).

Naamsa emphasised that export growth prospects for the rest of the year remain optimistic, thanks to the introduction of new models by major exporters in the domestic market.

Best-selling car brands

As usual, without much surprise, Toyota remains the favorite in South Africa and tops the car manufacturers’ ranking. By the end of August, the Japanese giant recorded 12,233 units, representing a market share of 26.8%.

On the other hand, the Volkswagen Group (including the Audi brand) took the second position with 5,972 units, and Suzuki closed the podium with 4,332 vehicles. This month, Ford moved up and landed in fourth place – as it did in April – with 2,724 units, causing Hyundai to drop to fifth place with 2,637 units.

The list of the most positioned manufacturers in South Africa is complemented by Nissan (2,377), Isuzu (2,045), Haval (1,819), Renault (1,750), and finally, Kia (1,550). Chery, which was among the top 10 in July, fell to the 11th position with just 52 units in August.

In this line, the Toyota Hilux became the best-selling vehicle in the country again with 3,309 registrations, marking the fourth time it surpassed the 3,000 units mark this year. Additionally, the Volkswagen Polo Vivo remained in second place with 2,452 units, and the Ford Ranger came in third with 2,367 units.

In the case of used cars, AutoTrader presented a report covering the first half of the year. Just like with new vehicles, Toyota was the leading brand with the sale of 28,061 units, accounting for a 17% share of the used car market.

However, the preferred model was not from the Japanese factory, but it was the Ford Ranger with 9,301 units sold, representing 6% of the total sales figure. The report also highlights that there are four used car models that do not appear among the most requested new vehicles. These are the Toyota Corolla Cross, Toyota Hiace, Toyota Starlet, and Suzuki Swift.

“In the first six months of 2023, there were more than 263 million vehicle searches on AutoTrader. This translates to more than 17 consumer searches per second. This is, of course, indicative of an automotive industry segment that is gaining momentum,” said George Mienie, CEO of AutoTrader.

Mienie stated that the South African automotive industry has shown remarkable resilience and progress.

“Collaborative efforts between car manufacturers, dealers, and tech giants have accelerated supply and demand, ensuring the industry’s competitive advantage on a global scale,” he added.