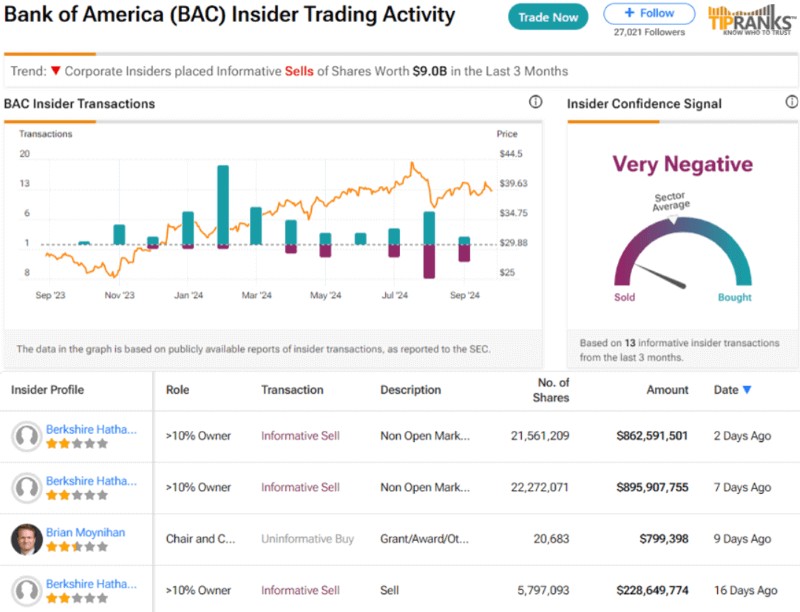

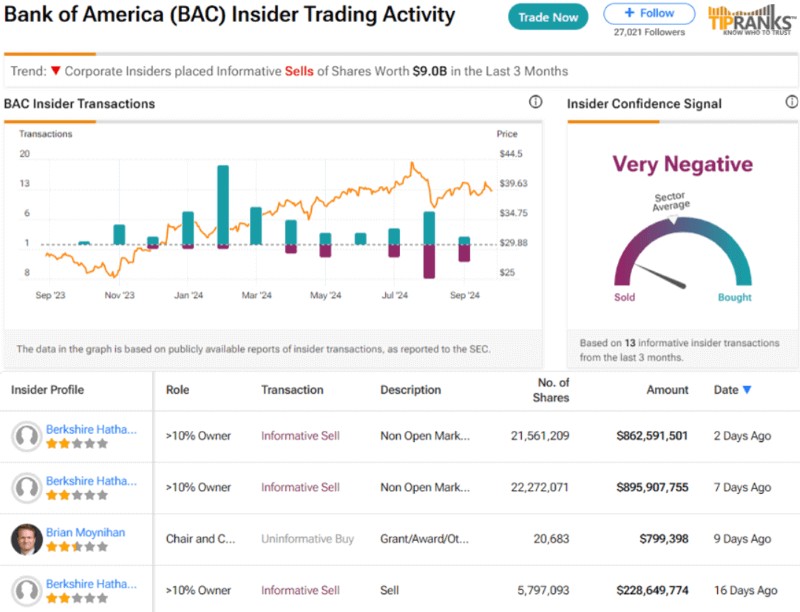

Ace investor Warren Buffett is on a stock-selling spree in September 2024. The CEO of the investment arm Berkshire Hathaway initiated sell-offs close to a billion dollars last week. According to the latest report from TipRanks, Warren Buffett has sold Bank of America (BAC) shares worth a whopping $863 million.

Also Read: US Stock: Apple Price Prediction For 2025

The sell-off was initiated between September 20 to 24 and Bank of America experienced a dip during Warren Buffett’s profit-booking. Bank of America was trading at $40.40 on September 20 and dipped to $38.07 minutes after the sell-off.

The recent data shows that Warren Buffett’s Berkshire Hathaway sold 22.3 million Bank of America shares worth $863 million. Berkshire Hathaway is the largest holder of BAC shares and has overall sold a whopping $9 billion in multiple trading sessions.

Also Read: US Dollar Dominates, But De-Dollarization Advances Rapidly

Bank of America CEO Reacts To Warren Buffett Selling Shares

Brian Moynihan, the CEO of Bank of America reacted to Warren Buffett selling the company’s shares recently. “I don’t know what exactly he’s doing because, frankly, we can’t ask, and we wouldn’t ask. But on the other hand, the market is absorbing the stock, and it’s a portion of the volume every day. And we’re buying the stock, a portion of the stock, and so life will go on,” he said.

Also Read: Buy CrowdStrike Shares: Target $325, Profit of 10.5%

Warren Buffett’s Berkshire Hathaway now holds a stake of 10.5% in Bank of America. “I think if you look at the track record, maybe every couple decades, he comes out and explicitly says: ‘Hey, stocks are really cheap or stocks are expensive.’ He hasn’t done that recently. So I take him at his word, and I don’t think he thinks it’s really extreme either way,” said portfolio manager Haruki Toyama.

Wondering which stocks to buy after Warren Buffett sold Bank of America shares? Read here to know the top two stocks to buy that could deliver more than 50% in profits.