The Ethereum ecosystem’s dependence on centralized stablecoins is forcing it to face a fundamental reckoning.

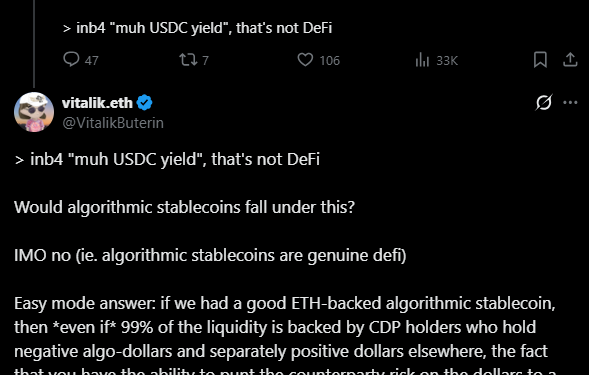

Vitalik Buterin, the network’s co-founder, has questioned popular stablecoin strategies in decentralized banking. He believes that many of the products currently on the market do not function as DeFi should. He made it clear in his remarks on X that the business has strayed from its primary objective of distributing risk, as opposed to merely profiting from centralized assets.

Buterin was certain that DeFi needed to change how risk was distributed and managed. Not only generate income from tokens owned by traditional companies, but it should also provide the decentralized risk management that DeFi was intended to.

He specifically criticized “USDC yield” products, saying they over-rely on centralized issuers and do not adequately reduce the dangers of having one company in charge. He noted that these lending models do not provide the decentralized risk management that DeFi was intended to, although he did not specifically mention any platforms.

Alternative models for stablecoin design

The Ethereum co-creator did not completely dismiss stablecoins. He outlined two different approaches that he thinks work better with DeFi’s original purpose. The first is a stablecoin backed by Ether using algorithms. The second is a stablecoin backed by real-world assets but with extra collateral to protect it.

Buterin clarified that the majority of people might acquire the stablecoin by borrowing against their cryptocurrency holdings with an ETH-backed alternative. Transferring risk from a single issuer to open markets is crucial. “The fact that you have the ability to punt the counterparty risk on the dollars to a market maker is still a big feature,” he stated. This places more faith in open markets than in a single company.

However, Buterin stated that if constructed appropriately, stablecoins that use real-world assets might still function. One unsuccessful investment would not destabilize the entire system when these coins have sufficient additional support and distribute their holdings widely. Holders are less at risk. He is more concerned with ensuring that they are protected by a robust, decentralized safety net than he is with utilizing any external resources.

Major platforms heavily dependent on USDC

The figures demonstrate the extent to which centralized stablecoins are used in current lending. Currently, there is over $4.1 billion in USDC in the Ethereum protocol on Aave’s primary Ethereum platform. The market is valued at approximately $36.4 billion overall, of which $2.77 billion has been borrowed, according to the dashboard data from the protocol. Critics call this a “single point of failure” that runs counter to distributed ledgers.

This shift is already being tested by the Sky Protocol (formerly MakerDAO), which estimates that its USDS supply will reach $21 billion by the end of 2026. Using a pipeline of various real-world asset yields, Sky is attempting to show that overcollateralized models are scalable enough to pose a significant threat to USDC’s market dominance.

Now, DeFi is stuck in a legacy trap. Many protocols sacrificed actual freedom for inexpensive liquidity in their pursuit of quick growth, ultimately becoming heavily dependent on centralized stablecoins. That’s where things get a little complex: it’s tough to call something “autonomous” when the entire base remains accountable to a corporate headquarters. If DeFi is meant to be a long-term solution, these centralized components should be considered as temporary support rather than the glue that keeps the system together.

Buterin’s recent comments build on his earlier criticism. On January 11, he argued that Ethereum needed more resilient stablecoins. Plans that overemphasize centralized companies and national currencies should be avoided, he said.

During the discussion, he stated that stablecoins need to address long-term problems, including unstable currencies and faltering regimes. They must also be resistant to pricing feed manipulation and coding faults. His main objective for DeFi is to develop self-sufficient, autonomous systems. He anticipates that the community will see past the short-term benefits and build something resilient to downturns in the physical and digital industries by encouraging risk-spreading mechanisms.