The US was stripped of its top-tier sovereign credit grade by Fitch Ratings, which criticized the country’s ballooning fiscal deficits and an “erosion of governance” that’s led to repeated debt limit clashes over the past two decades.

The credit grader cut the US one level from AAA to AA+, echoing a move made more than a decade ago by S&P Global Ratings. Tax cuts and new spending initiatives coupled with multiple economic shocks have swelled budget deficits, Fitch said, while medium-term challenges related to rising entitlement costs remain largely unaddressed.

“The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades,” Fitch said in a statement.

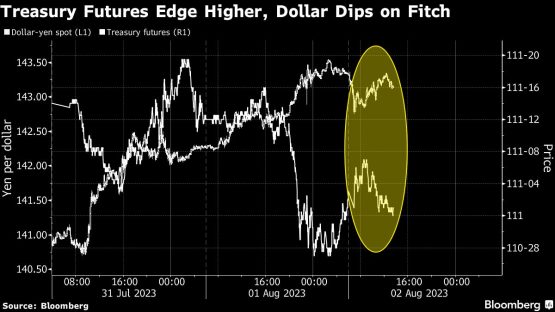

Treasury Secretary Janet Yellen quickly responded to the downgrade, calling it “arbitrary” and “outdated.” Treasuries edged higher in early Asia trading after the Fitch announcement amid modest demand for haven assets.

“Fitch’s decision does not change what Americans, investors, and people all around the world already know: that Treasury securities remain the world’s preeminent safe and liquid asset, and that the American economy is fundamentally strong,” Yellen said in the statement.

Fitch had warned that it was weighing cutting the nation’s credit grade back in May, when Democrat and Republican lawmakers were at odds over raising the nation’s borrowing limit and the US Treasury was only weeks away from running out of cash.

While that crisis was ultimately averted, Fitch nonetheless said that the repeated debt-limit clashes and eleventh-hour resolutions have eroded confidence in the nation’s fiscal management.

Tuesday’s statement also attributed the downgrade to the country’s rapidly swelling debt burden, which it forecasts to reach 118% of gross domestic product by 2025, more than two-and-a-half times higher than the ‘AAA’ median of 39.3%. The rating company projects the debt-to-GDP ratio to rise even further in the longer-term, increasing America’s vulnerability to future economic shocks, the report said.

Several economic commentators were surprised by the news. Mohamed El-Erian, the chief economic adviser at Allianz SE and a Bloomberg Opinion columnist, said on social media he was puzzled by “many aspects” of the announcement, including the timing.

“The United States faces serious long-run fiscal challenges,” said former Treasury Secretary Larry Summers in a similar posting. “But the decision of a credit rating agency today, as the economy looks stronger than expected, to downgrade the United States is bizarre and inept.”

Treasuries react

Yields on two-year Treasuries fell one basis point to 4.89% in Asia trading, while those on 10-year US bonds edged one basis point higher to around 4.03%. The dollar dipped against the euro and yen.

S&P’s downgrade of the US credit rating in 2011 triggered a selloff in risk assets like equities around the world, but ironically boosted Treasuries as investors sought out havens.

“I suspect the market will be in two minds about it – at face value, it’s a black mark against the US’s reputation and standing, but equally, if it fuels market nervousness and a risk-off move, it could easily see safe haven buying of US Treasuries and the dollar,” said David Croy, strategist at Australia & New Zealand Banking Group in Wellington. “It’s finely balanced.”

The yield on 30-year US debt rose to the highest in almost nine months Tuesday as the Treasury Department prepared to ramp up issuance of longer-dated securities to fund its widening budget deficit.

On Monday, the Treasury increased its net borrowing estimate for the July-through-September quarter to $1 trillion, more than some analysts expected and well above the $733 billion it had predicted in early May. The Treasury will preview its quarterly financing plans on Wednesday at 8:30 a.m. in Washington.

Washington responds

The move by Fitch now gives the US two AA+ ratings. That could raise a problem for funds or index trackers with a AAA only mandate, opening up the possibility of forced sales for compliance reasons.

Moody’s Investors Service still rates the US sovereign Aaa, its top grade.

Democrats in Congress seized on the downgrade to blame Republicans for holding up the US debt ceiling increase earlier this year.

“This is the result of Republicans’ manufactured default crisis. They’ve repeatedly put the full faith and credit of our nation on the line, and now, they are responsible for the second downgrade in our credit rating,” Democrats on the Ways and Means Committee said in a statement.

House GOP campaign spokesman Jack Pandol said on X, formerly known as Twitter, that the cause of downgrade was “Bidenomics.”

© 2023 Bloomberg