Central banks across the globe hold a very important position in the world’s economic growth as they primarily manage a country’s money supply and interest rates.

Central banks are also heavily involved in the regulation and supervision of other financial institutions that operate in its jurisdiction. Added to their role is ensuring healthy financial stability in the country while promoting and maintaining economic growth.

A central bank’s wealth is often measured by its assets, which can include gold, foreign currencies, and government bonds.

The assets of Central banks across the globe most times, is a reflection of how well the country’s economy is doing.

10 richest central banks in the world

According to his Sovereign Wealth Fund Institute (SWFI), below are the top 10 richest central banks in the world;

| Rank | Profile | Total Assets | Region |

|---|---|---|---|

|

1. |

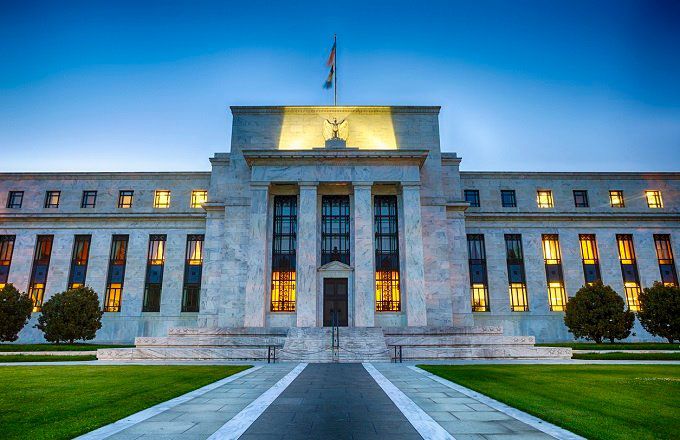

Federal Reserve System (USA) |

$7,835,559,000,000 |

North America |

|

2. |

People’s Bank of China |

$6,004,919,369,845 |

Asia |

|

3. |

Bank of Japan |

$5,543,058,448,125 |

Asia |

|

4. |

Deutsche Bundesbank (Germany) |

$2,776,759,343,640 |

Europe |

|

5. |

Bank of France |

$2,011,001,711,400 |

Europe |

|

6. |

Norges Bank (Norway) |

$1,632,986,563,336 |

Europe |

|

7. |

Bank of Italy |

$1,383,293,987,542 |

Europe |

|

8. |

Bank of England |

$1,288,250,668,160 |

Europe |

|

9. |

Bank of Spain |

$1,049,435,626,385 |

Europe |

|

10. |

Swiss National Bank |

$944,013,351,477 |

Europe |

In qualifying a Central bank’s asset, some major factors are considered which include the foreign exchange reserves which include monetary gold, foreign exchange funds, special drawing rights (SDRs), and a reserve position in the IMF.

The absence of African Central banks in the list can be related to the region’s challenges ranging from the worsening inflation rise, fragile financial markets, and weak monetary policy transmission system.

These challenges, however, are not peculiar to just African central banks as noted in the S&P Global Market Intelligence‘s annual list of the world’s largest banks by assets (2024). The list showed that dozens of lenders (47 Banks) dropped in the ranking due to the effect of monetary policy tightening in many regions.

According to the International Monetary Fund (IMF), African central banks can deal with reduced growth and higher inflation by carrying out foreign exchange interventions, restricting capital flows and to address structural problems.