Fintech is, at its core, a business of compliance—especially as you grow and scale your operations.

When you’re just starting out, you might fly under the radar, but as your volumes increase, every regulator and politician will start asking questions. In Africa, securing a license to ground or expand your fintech isn’t just a matter of compliance—it’s a strategic necessity.

Let’s set the record straight: there’s no such thing as a “fintech license” in Tanzania, or in most other countries, for that matter. Fintech companies may be licensed as banks, microfinance institutions, or, more commonly, as payment service providers (PSPs). Understanding the licensing landscape is crucial to ensuring your fintech operates within the bounds of the law while scaling effectively.

A “fintech license” refers to the regulatory approval required for companies in the financial technology (fintech) sector to operate legally. While the term “fintech license” is often used informally, in practice, fintech companies usually need specific licenses depending on their business model and services offered. These licenses ensure that fintech operations comply with legal and regulatory standards related to financial services.

Securing the right license in Tanzania is a critical step for any company aiming to offer financial services in the country. As the fintech landscape continues to evolve, Tanzania has established a robust regulatory framework to ensure that financial services are delivered securely and transparently.

The Bank of Tanzania (BoT) is the primary regulator, overseeing the licensing and operation of fintech entities. However, other regulatory bodies—such as the Capital Markets and Securities Authority (CMSA), Social Security Regulatory Authority (SSRA), Tanzania Communications Regulatory Authority (TCRA), and Tanzania Insurance Regulatory Authority (TIRA)—also play significant roles as secondary regulators, each governing specific aspects of the financial ecosystem.

In Tanzania, securing the appropriate license is vital for any company operating within the financial sector. The following are key licenses that fintech companies may require, along with examples of entities that hold these licenses:

This license is required for institutions providing traditional banking services such as accepting deposits, issuing loans, and offering money transfer services. These banks play a critical role in the financial system, serving both individual and corporate clients.

Example: National Bank of Commerce (NBC) is one of the largest banks in Tanzania, offering a wide range of financial services, including retail and corporate banking.

This license allows companies to issue electronic money, enabling them to offer mobile money services. These services include the storage of funds in digital wallets, money transfers, bill payments, and more. EMIs are crucial in expanding financial inclusion, especially in rural areas.

Although restricted since 2020, This licence is the one that the 6 mobile money operators hold including Mpesa and Airtel to operate mobile money services.

Large microfinance institutions that accept deposits from the public and offer a range of financial services, including loans and savings products, require this license. These institutions typically serve low-income individuals and small businesses.

Example: FINCA Microfinance Bank offers deposit-taking services, loans, and other financial products targeted at micro and small enterprises.

This license is for medium-sized microfinance institutions that primarily focus on providing credit services. It includes non-deposit-taking microfinance institutions that cater to small and micro-entrepreneurs.

Example: Y9 is an example of a fintech offering credit to underserved communities.

Fintech companies that facilitate payment processing, offer cross-border money transfer services, or provide digital money services must obtain this license. PSPs are essential in enabling seamless and secure financial transactions.

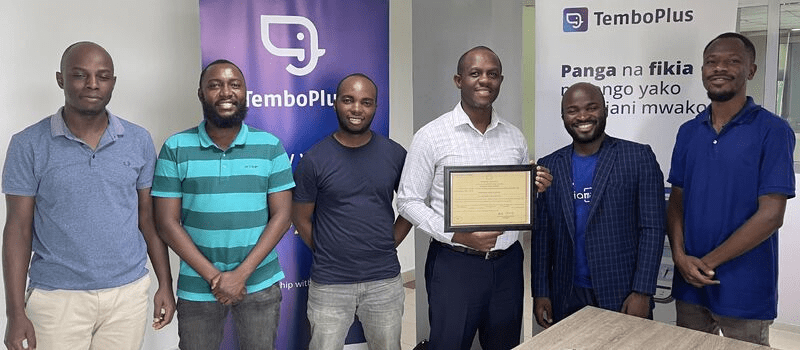

Examples: Tembo, Nala, Flutterwave, Unlimit, AzamPay, Selcom and majority of fintechs hold a version of this licence to offering a variety of digital payment solutions, including mobile payments, POS services, and payment gateways.

www.temboplus.com

Insurance License, its Agents and Brokers:Companies offering a range of insurance products, such as life, health, property, and casualty insurance, require this license. Issued and regulated by Tanzania Insurance Regulatory Authority (TIRA)

Example: Apart large insurers like Jubilee, An insurtech like Bimasokoni is also licensed by the same regulator.

This license is necessary for firms involved in investment-related activities, such as brokerage, fund management, and securities trading. These entities play a crucial role in the capital markets by facilitating investment and the trading of financial instruments. These are issued and regulated by Capital Markets and Securities Authority (CMSA)

Example: Itrust Fintech and Orbit Securities is a leading stock brokerage firm in Tanzania, offering services such as trading of shares and bonds.

Companies managing pension funds, which are essential for providing retirement benefits to workers, require this license. These entities ensure that contributions are managed and invested to provide future financial security for retirees.

This license is for companies offering leasing services, such as leasing vehicles, equipment, or machinery. Leasing is a vital service for businesses that need access to assets without committing to full ownership.

Example: EFTA, Tata Finance (Alliance) and Toyota Finance (Salute) offer financial leasing services, enabling businesses to lease equipment and machinery.

Navigating the regulatory landscape is not just a requirement for fintech companies; it’s a cornerstone of building a sustainable and scalable business. As your fintech grows, the importance of compliance cannot be overstated—every move you make will be scrutinized by regulators, and securing the right licenses is essential to operating legally and efficiently.

In Tanzania, there is no one-size-fits-all “fintech license.” Instead, fintechs must align themselves with existing regulatory frameworks, whether as banks, microfinance institutions, or payment service providers. Each license comes with its own set of requirements, responsibilities, and opportunities, all governed by the Bank of Tanzania and other regulatory bodies such as CMSA, SSRA, TIRA, and TCRA.

Understanding and obtaining the necessary licenses is not just a legal obligation but a strategic move that positions your fintech for success. By securing the appropriate licenses, you not only ensure compliance but also gain the trust of customers, investors, and regulators alike. In a region where financial inclusion is rapidly evolving, being licensed and regulated opens the door to new opportunities, allowing your fintech to expand and thrive in the dynamic Tanzanian market.

QA: What do you think of this article? did you find it helpful? what did we get wrong? we need to improve? Do you think we should do an article on how to apply for some of these licences?

This article first published on https://reubenmars.substack.com/p/do-you-know-what-are-the-top-10-most

You can subscribe to Reuben’s Newsletter here

Featured image credit: edited from freepik