The automated logic behind many financial decisions — for example, decisions that determine whether a client is approved for a credit line — is hard-coded. Often, it’s not easily changed. If a head of credit at a bank wanted to adjust the bank’s lending criteria, for example, they’d likely have to raise a ticket with IT.

Entrepreneurs Maximilian Eber and Maik Taro Wehmeyer, who met while studying at Harvard, ran up against the limitations of financial decisioning logic while at QuantCo, a company building AI-powered apps for enterprise customers. In 2020, the pair decided to found a startup, Taktile, to make modifying automated decisioning logic a more self-service process.

“We realized that we were building the same things over and over again, and decided to leverage our learnings to build a platform around it,” Wehmeyer, Taktile’s CEO, told TechCrunch in an interview.

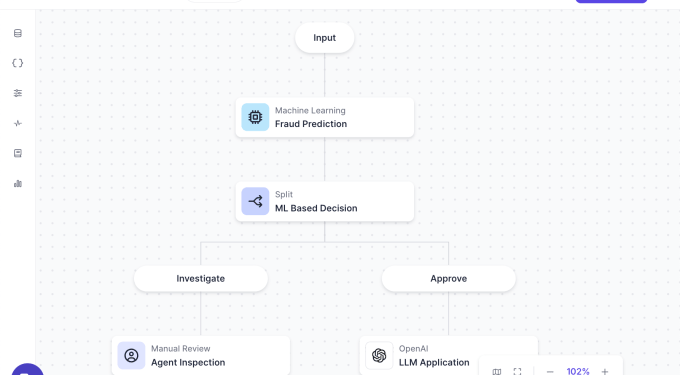

Taktile’s platform — which we’ve written about before — lets risk and engineering teams at fintech firms create and manage workflows for automated decision-making. Users can experiment with data integrations and monitor the performance of predictive models in their decision flows, and perform A/B tests to evaluate each flow.

For example, a bank could use Taktile to anticipate how moving the minimum age to apply for an account from 25 to 21 might affect customer churn. Or a loan provider could build a workflow that automatically extracts information from documents, summarizes cases, and recommends next steps for manual review.

“[W]e have invested [significantly] in our data layer,” Wehmeyer said, “which lets users build a complete picture of their end customers across all relevant decision moments, from initial onboarding to fraud checks, and operational decisions like collections.”

There is competition in the space. Noble, for example, offers a rules-based engine to edit and launch credit models, and vendors like PowerCurve sell comparable tools focused on unblocking risk teams.

Taktile appears to be growing at a healthy clip, however. Annual recurring revenue climbed 3.5x year-over-year in 2024, and the company’s client base recently expanded to include fintech companies such as Zilch and Mercury.

“[Legacy] software is just hopelessly outdated,” Wehmeyer said. “We’ve won many pitches because even if we were weaker than a specialized vendor in one case, customers want an end-to-end solution.”

This week, New York-based Taktile announced that it closed a $54 million Series B funding round led by Balderton Capital with participation from Index Ventures, Tiger Global, Y Combinator, Prosus Ventures, Visionaries Club, and OpenAI board member Larry Summers. This brings the 110-person company’s total raised to $79 million; the new capital will be put toward product development and building out Taktile’s enterprise sales organization.

“There was no need to raise from a money perspective — we still had more than two years of runway — but we saw huge investor demand because of strong growth in 2024,” Wehmeyer said. “Fintech and financial services tends to be a low-margin business, so people do care about the unit economics a lot. Vendor consolidation is something that people are looking at this year.”