- The World Bank initially modelled blue bonds on green-label lending.

- John Nuveen founded the organization as an investment banking company specializing in underwriting and distributing municipal bonds.

- Ecuador sold a new blue bond that will funnel at least $12 million a year into the conservation of Galapagos Island.

Seychelles’ economy has taken a positive turn, with its blue bond economy roadmap drawing attention from international organizations. Nuveen, a global asset manager, has expressed interest in purchasing Ecuador’s new $656 million blue bond. If Nuveen can acquire this economic goldmine, it would significantly bolster the African island’s overall trajectory through its primary source of revenue.

Seychelles leading Africa’s blue bond economy

Seychelles is a small African nation comprising several islands. The nation’s blue economy is a significant pillar of its overall economy. As a result, Seychelles has constructed a well-defined roadmap that focuses on improving its marine economy to open up more opportunities locally, continental and internationally.

Seychelles’ roadmap consists of four main pillars that, if completed, would achieve the economic development the country has learned from. The main pillars include economic diversification, resilience, shared prosperity, food security, the integrity of habitats and ecosystem services, sustainable use and climate resilience.

Given the country’s geographical positioning, Seychelles is well known for its innovative financing tool for casual and marine resources. The government is famous for developing the world’s first Blue bond economy.

A blue bond is an innovative best-for-nature conversion strategy keen on improving Seychelle’s economy. In 2016 the nation completed its blue bond, raising funding to buy $21 million from sovereign investors to refinance several natives.

Unfortunately, this only scratched the surface of its roadmap since it realized it requires a sustainable funding stream. In 2018, Seychelles took its Blue bond economy to the next level and launched a sovereign blue bond. This bold move paid off as the African country successfully raided $15 towards improving the governance of fisheries, developments of the blue economy and expansion of Marine Protected Areas.

Fortunately, this significantly boosted its operation, attracting organizations like Nuveen to its blue bond economy. Within the same year, Nuveen invested alongside other international organizations requiring an ample portion of its lucrative blue bond economy.

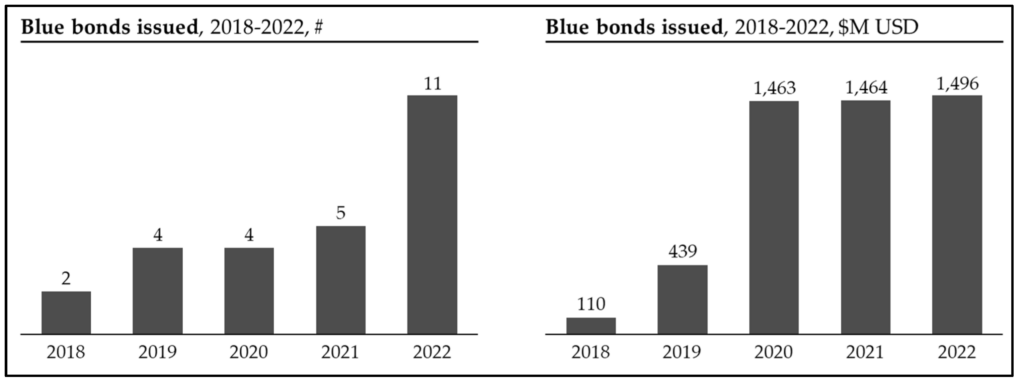

The World Bank initially modelled blue bonds on green-label lending, with issuance estimated to reach $254 billion in the first quarter of 2023. Seychelles’ economy is among the few African countries to attain such a feat since its marine life accounts for nearly 97 per cent of its annual export earning. Furthermore, it employs 17 per cent of the country’s population.

Read: Seychelles: AfDB approves $20 million loan to support Covid-19 recovery

Ecuador’s role in Seychelles’ blue bond economy

Ecuador recently followed the steps of Seychelles’ blue bond economy and sealed the world’s largest best-for-nature swap within a year. It sold a new blue bond that will funnel at least $12 million a year into the conservation of Galapagos Island. This feat has inevitably transformed the region’s economic growth trajectory, as the blue bond will run until 2041. According to bankers, it is worth $656 million, giving investors a 5.645 per cent interest rate.

Fortunately, Seychelle’s blue bond economy has inspired Nuveen to explore the possibility of purchasing Ecuador’s blue bond. By investing in this new project, Nuveen aims to contribute to the preservation of the natural wonders of the Galapagos. Furthermore, Nuveen now has a significant voice in both blue bond economies.

Fortunately, Nuveen seeks to leverage the Seychelles economy’s expertise to expand its reach into Ecuador. International asset management is now the world’s biggest buyer of blue bonds and will finance ocean-based projects to promote Seychelles and Ecuador’s economic development.

About Nuveen

Nuveen is one of the oldest corporations dating back to 1898. John Nuveen founded the organization as an investment banking company specializing in underwriting and distributing municipal bonds. In 1969 Invesos Diversified Services purchased the organization but soon sold it to ST. Paul Companies in 1974.

Today Nuveen is a privatized investing company owned by Madison Dearborn Partners and have invested in numerous project. In 125 years, the organization has supported the financial futures of millions of investors. According to its official website Nuveen invests in several industries.

Some include investing in the growth of businesses, real estate, infrastructure, farmland, forests and other sectors. In addition, the organization has expertise across income and alternatives. Due to its long history, Nuveen is one of the first cooperation to have responsible investing, and its years of success have ascertained this fact.

Nuveen is among the signators of the “Principles for a Responsible Civilian Firearms Industry”. This policy seeks to engage firearms manufacturers.

Read: Africa’s untapped blue economy stymying economic growth