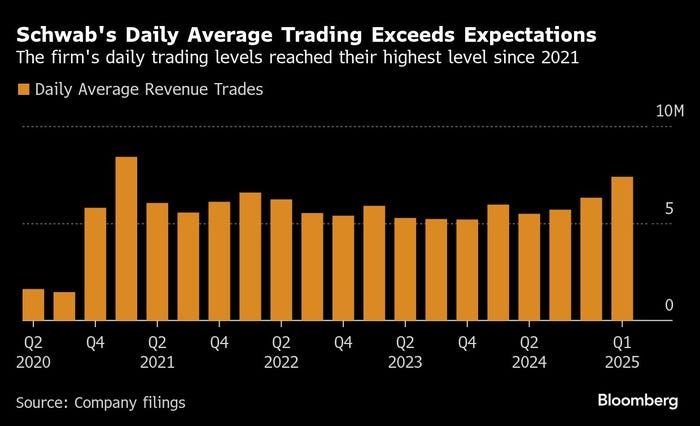

(Bloomberg) — Charles Schwab Corp.’s daily average trades exceeded expectations as retail investors rushed to respond to market volatility in the first three months of the year, with company executives saying drivers of future earnings are in flux.

Schwab’s daily average trades jumped 24% in the first quarter to 7.39 million, above analysts’ forecasts of 7.17 million. The firm advises its clients to take a long-term view on investing, but the company said it saw “client net selling following the re-emergence of market volatility.”

“Investors turned to Schwab to navigate an increasingly uncertain environment,” Chief Executive Officer Rick Wurster, who stepped into the role in January, said in a statement. “Schwab delivered growth on all fronts during the first quarter.”

Wurster said Schwab amassed $138 billion in core net new assets during the quarter, a 44% increase from a year earlier.

Future earnings will be affected by factors that are “evolving,” Chief Financial Officer Michael Verdeschi said on a conference call with analysts Thursday, and the company will provide an update to its outlook in July.

Shares of Schwab climbed 3.5% to $78.38 at 9:33 a.m. in New York. They have gained 6.3% since the start of the year, outperforming the S&P 500 Financials Index, which has slipped 3.9%.

Read More: At Charles Schwab, a Fresh Start After a Close Call

The company has sought to differentiate itself as the elder statesman among a handful of relative newcomers to investing and wealth management. Schwab competes with Robinhood Markets Inc. and Webull Corp. for the business of newer, younger investors while still fighting for greater market share with industry stalwarts Fidelity Investments and Vanguard Group. Robinhood, for example, started a wealth-management service in March.

To keep an edge, Schwab has also been expanding, including making a recent investment of an undisclosed size in Wealth.com to build out its estate-planning offerings for customers.

“Wealth.com is an important first step in building out a support ecosystem for our adviser clients as they respond to investors’ needs, while also providing a scalable and easy-to-use solution for our retail clients to meet more of their financial needs at Charles Schwab,” Wurster said in a statement announcing the investment.

Total client assets totaled $9.93 trillion in the quarter. While that was up 9% from a year earlier, it was slightly below the $10 trillion threshold the firm crossed late last year.