Approximately three-quarters of registered investment advisory firms were hiring in 2023, including some with hundreds of open positions, according to a report released Thursday by Charles Schwab Advisory Services.

It’s a trend industry experts don’t see slowing anytime soon. As the battle for talent has intensified over recent years, Schwab found that firms are becoming more proactive. A growing number are offering not only an attractive paycheck but implementing a range of other organizational initiatives, compensation methods and professional support systems to seduce desired talent and engender loyalty.

Now in its 10th year, the Schwab RIA compensation report draws on responses provided in a larger annual benchmarking study conducted early this year to provide insights regarding best practices and potential opportunities for attracting and retaining talent. This year’s benchmarking study included 1,300 respondents accounting for more than 14,500 employees at firms of all sizes, the largest in its history and the largest of its kind in the industry. Among those, 1,044 participated in the compensation study.

As advisory firm principals move toward retirement, higher education remains slow to churn out new candidates and the world’s wealth continues to grow, the battle for talented professionals has gotten fierce. Speaking at the MarketCounsel Summit in Las Vegas this week, Mark Hurley said the days of collegiality in wealth management are over and predicted firms will only see competition and poaching intensify over the coming decade.

Identified by RIAs as their top strategic priority in 2022, recruitment dropped to second spot behind referral-driven client acquisition in 2023. Staff development, however, took sixth place this year, climbing from No. 10 in 2021 and No. 8 in 2022.

“When I talk to groups of advisors, I find there’s a deep appreciation that talent is really the differentiator of the future,” said Lisa Salvi, Schwab’s managing director in charge of business consulting and education. “So, I’m seeing a lot of focus on those talent-related programs right now.”

“Firms are really looking at how to support and grow the talent they have,” she explained. “What kind of opportunities are they given to grow? We love to see firms have career paths in place for client facing individuals and their operational or back-office staff.”

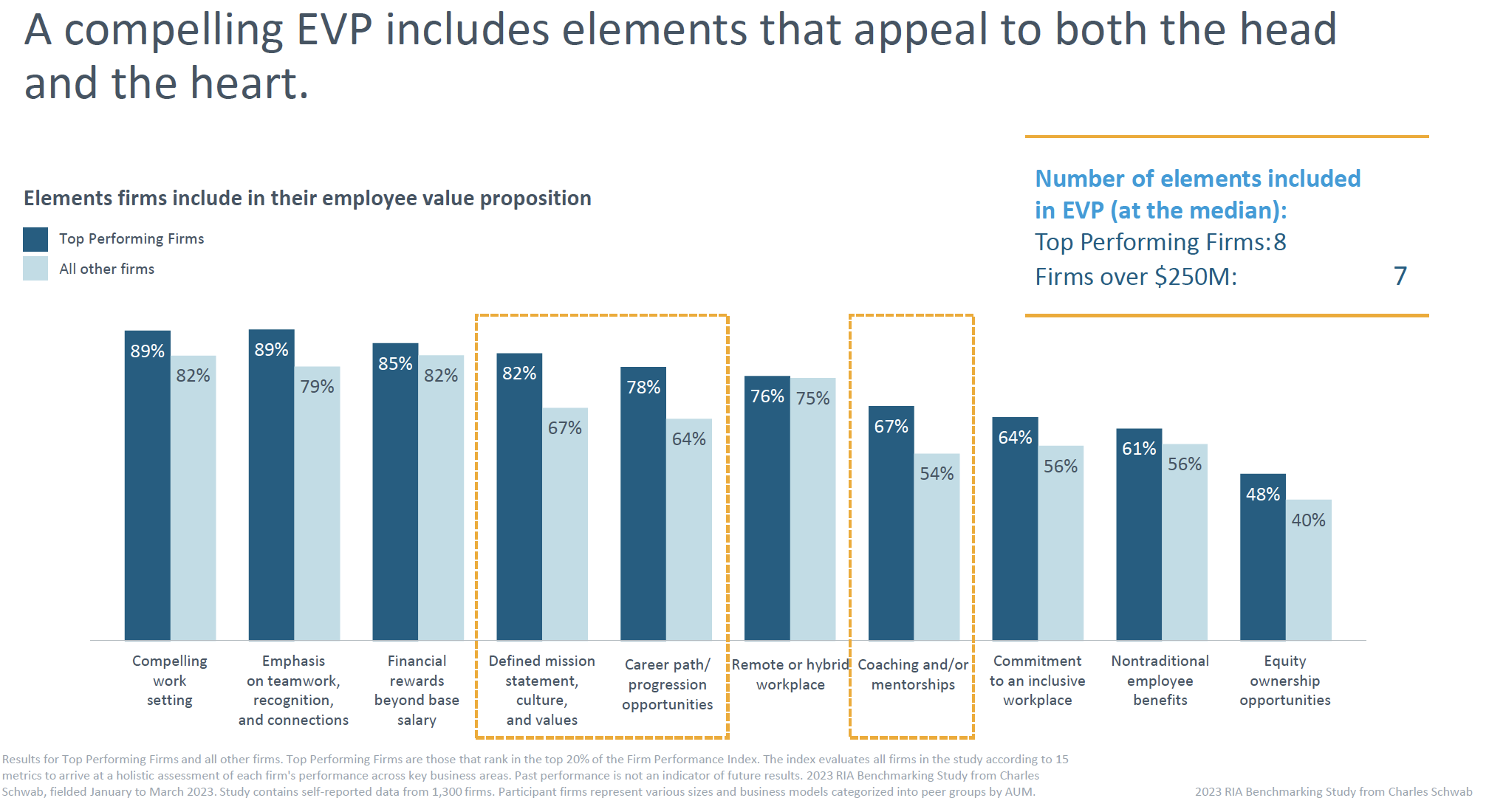

Career progression opportunities, and how to advance among them, should be contained in a document outlining the firm’s employee value proposition or EVP, according to Salvi. Creating this plan, she said, is the single most important thing a firm can do to arm itself in the war for talent.

“Just like advisory firms are remarkable at having a really well-defined client value proposition, you have to have that for your employees too,” she said. “We call it the give/get pact. It’s what you give to your employees to attract and keep them. So, all those programs and things that you invest in to help them grow and what you expect back from them to contribute to your success, your client experience and your long-term growth—and we want to see that appeal to their head and their heart.”

Salvi said education and coaching/mentorship programs, specifically, can go a long way toward not only attracting talented individuals, but also keeping them on staff. This is particularly important to younger and more diverse employees, who may not have family members or existing relationships to which they can turn.

Across 27 firm roles identified, median cash compensation increased by 17% between 2018 and 2022. Even so, cash salaries only comprised 70% of total compensation among revenue-producing roles (it comprised 89% among the rest of the staff, however). Other forms of compensation make up far less on average, including equity earnings and incentive- or revenue-based payments.

While a large majority only receive one type of incentive compensation (77%), nearly a fifth receive two and a vanishingly few (0.2%) can count on as many as four forms of additional income. While most incentive compensation is discretionary, almost a quarter are predicated on firm goals and 9% are based on either team goals or business development results.

Schwab found firms offering performance-based incentives saw AUM grow 24% more than their peers who did not over a five-year period. Performance-based firms also gained 38% more clients and increased revenue by 19% more on average. These firms were also significantly more likely to have documented business strategies outlining a strategic plan, ideal client persona, client value proposition and marketing strategy.

Equity is another tool by which firms demonstrate value and keep staff loyal. In both 2022 and 2023, the median firm indicated that one in three staff members were equity owners. Percentage of ownership drops with the size of the firm, and C-suite positions and client-facing advisors are most likely to own equity, followed by portfolio managers. But a small number of firms are offering even their departmental associates small fractions of the pie.

Other topics covered in the survey include organizational structure and the importance of having an “intentional” human capital strategy (most firms have a least one client associate by the time they’re managing $500 million and start adding executive management roles over $1 billion); the role nontraditional benefits have to play (Salvi said she knows of one firm that offers pet insurance and another that provides time off to go horseback riding); and how much it costs to offer training and education and cover professional dues for employees.

Eight in 10 survey respondents said they were looking to add talent last year, and 77% in 2023 reported that they ended up doing so. Expectations were more muted this year, with just three-quarters saying they had plans to hire.

Most firms will need to add at least four new roles over the next five years to support expected growth, according to Schwab, and top performing firms will require twice that. A majority (56%) of respondents said they sourced new talent through personal and professional networks in 2022, while 37% recruited from colleges and universities. More than a quarter (27%) targeted other RIAs and a fifth found hidden talent outside of the sector altogether.

Salvi said she knows a Florida firm that has found success with individuals working in other areas of the service industry, leveraging their ingrained focus on client satisfaction and training them in suitable roles.

“It’s a little bit beholden to where you are in the country, where you’re hiring and what kind of roles there are there,” she said. “But it’s been kind of fun to see the way advisors are opening up their mindset and thinking outside of the box and really having some good results in a lot of places.”