by Fintechnews Africa

21 March 2024

The banking industry stands at the brink of a major transformation, driven by rapid technological advancements and changing customer expectations in a dynamic digital landscape.

This transformation is not without its challenges, as banks grapple with the critical task of bridging the gap between traditional banking services and the demands of a digital-first customer base.

Factors such as the unbanked population, system outages, cybersecurity threats, and the rise of fintechs pose significant barriers to this connection, underscoring the urgent need for banks to fortify their operational resilience (OpRes) and Information Technology resilience (ItRes).

In this context, the notion of resilience transcends its conventional boundaries to become a catalyst for intelligence within the banking sector.

Redefining resilience is not a mere response mechanism to adversity but a proactive enabler of intelligence, innovation, and inclusive financial services.

The disconnect between banking services and customers

The banking industry faces several obstacles in maintaining a seamless connection with its customers, each presenting unique challenges that necessitate a reevaluation of traditional operational frameworks.

The unbanked or underbanked populations remain largely isolated from financial services due to geographical, socio-economic, or regulatory barriers. System outages further exacerbate this disconnect, eroding trust and reliability in digital banking platforms.

Cybersecurity threats loom large, instilling fear and apprehension among customers concerning the safety of their personal and financial data.

The emergence of fintechs has introduced a layer of disintermediation, weakening the direct relationship between banks and their customers by offering alternative, often more user-friendly and innovative, financial solutions.

Huawei’s steps towards resilient banking

In this complex backdrop, the concept of resilience emerges as a cornerstone for not only safeguarding against these challenges but also as a springboard for leveraging intelligence and innovation.

Resilience in the banking sector must evolve beyond the traditional focus on recovery and stability, to encompass the enablement of dynamic, intelligent systems that can anticipate change, mitigate risks proactively, and offer personalised, real-time services to customers.

Huawei has been at the forefront of this transformation, partnering with some of the world’s largest banks across Germany, Singapore, Italy, Brazil, and South Africa, and serving over 3,300 financial customers globally.

The company’s strategic focus on building resilient infrastructure, accelerating application modernisation, enhancing data-driven decisions, and enabling business scenario innovation, marks a significant leap towards redefining resilience in the banking sector.

The Four Zeros: A new paradigm for banking resilience

Drawing inspiration from Brett King’s Bank 4.0, Huawei proposes a paradigm shift towards ‘Bank Four Zeros’ – zero downtime, zero wait, zero-touch, and zero trust.

This model prioritises the delivery of always-on, stable, and reliable services, underpinned by multi-technology collaboration and a ‘design for failure’ approach that embraces chaos engineering principles.

Such a framework not only ensures operational continuity and security but also facilitates digital engagement, real-time insights, and hyper-personalisation, thus redefining the essence of resilience in the digital banking era.

Zero Downtime: Ensuring continuous banking operations

Huawei addresses the challenge of zero downtime through its deployment of advanced, multi-active system architecture (MAS) solutions, such as its distributed database and cloud-native infrastructure.

Huawei’s MAS architecture is designed to support real-time, uninterrupted banking services, ensuring that financial institutions can offer their customers 24/7 access to banking operations.

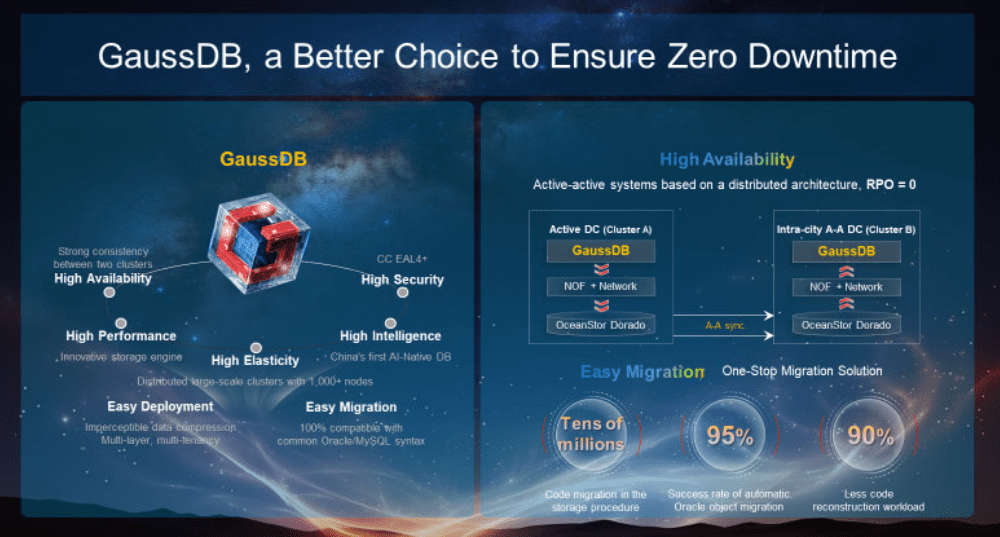

This approach is complemented by Huawei’s GaussDB, a next-generation distributed database that enhances the resilience and scalability of banking systems, thereby minimising the risk of service interruptions and achieving the high availability that modern banking demands.

In the last decade, GaussDB has been deployed on a large scale across multiple top banks in China. Thanks to its focus on security, availability, and performance, GaussDB has supported over two billion peak daily transactions since its launch in April 2022.

This is the world’s largest cloud-native core development practice, Going forward, GaussDB will be an ideal choice to ensure Zero Downtime.

Zero Touch: Automating and streamlining operations

Huawei’s commitment to zero-touch is evident in its development of AI, machine learning, and robotic process automation (RPA) technologies. These technologies automate routine banking operations, from customer service to compliance checks, reducing manual interventions and the potential for human error.

Huawei Autonomous Driving Network has been enhanced from 1-3-5 to 0-1-3-5 (“0” means “0 Human Errors”), helping the finance industry embrace Zero Touch operations.

Digital Map, as a critical capability, has helped a leading bank achieve 88 percent faster troubleshooting, one-click simulation of application changes, and 50 percent faster risk assessment. It also ensures 100 percent accuracy in network configuration changes while reducing touch time by 90 percent.

By adopting Huawei’s zero-touch technologies, banks can not only enhance their service quality but also redirect their resources toward innovation and strategic growth initiatives.

Zero Trust: Enhancing cybersecurity measures

In alignment with the zero-trust principle, Huawei offers a comprehensive suite of cybersecurity solutions designed to protect banks’ digital infrastructure and customer data from evolving threats.

Huawei has provided the industry’s first multi-layer anti-ransomware solution. It uses firewalls to detect and the storage air gap to isolate viruses in seconds, preventing intrusions in a timely manner.

By implementing Huawei’s zero-trust security model, financial institutions can build a robust defence against cyber threats, ensuring the integrity and confidentiality of their digital transactions and fostering trust among their customers.

Zero Wait: Delivering real-time banking services

To achieve zero wait, Huawei leverages its expertise in data analytics and artificial intelligence, enabling banks to process transactions and customer inquiries with minimal latency.

Huawei Data Intelligence Solution is tailored to enhance the speed and efficiency of banking services, ensuring instant response times for customer interactions and real-time processing of financial transactions.

By integrating Huawei’s cutting-edge technology, banks can significantly improve their operational efficiency and customer satisfaction, offering a seamless and responsive banking experience that meets the expectations of today’s digital-savvy consumers.

Resilience as the bedrock of intelligent banking

The banking industry is at a pivotal moment, facing the dual forces of challenge and opportunity as it moves towards digital transformation. This journey, while complex, opens doors to greater innovation, intelligence, and accessibility within the sector.

Redefining the concept of resilience is key to this transformation. It enables banks to move beyond traditional operational boundaries, embracing new possibilities for growth and customer engagement.

Huawei’s approach to building a resilient and intelligent banking ecosystem serves as a guiding framework for the industry, helping banks adapt and thrive in a digital-first world.

Resilience is vital to the banking industry’s future development. Huawei’s focus on the “Four Zeros” – zero downtime, zero wait, zero touch, and zero trust – outlines a comprehensive strategy for banks to address the evolving demands of digital transformation.

By leveraging Huawei’s advanced technologies and solutions, financial institutions can maintain continuous operations, offer instant services, streamline processes through automation, and ensure robust cybersecurity measures.

Collaborating with Huawei allows banks to improve their operational efficiency and intelligence, positioning them well in a competitive and changing financial landscape.