By Leon Usigbe

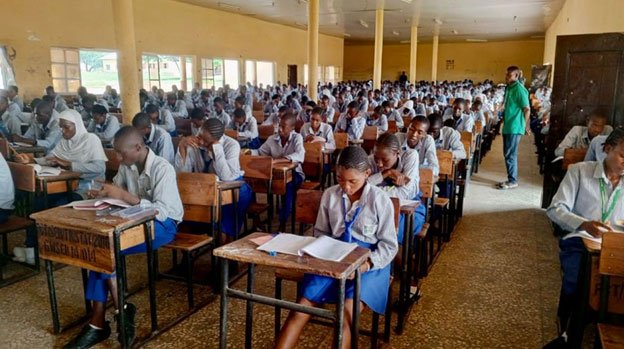

Wisdom Ajah, an 18-year-old senior secondary school graduate living in Karshi, a satellite town in Nigeria’s Federal Capital Territory, dreams of a university education that will secure him a good job after graduation and help support his family. But it is a distant dream considering how many obstacles he has faced trying to acquire a secondary school certificate.

Born into a poor family that can barely afford the necessities of life, Wisdom was forced to shoulder responsibilities far beyond his tender age, combining his studies with taking on manual labour at construction sites to pay his way through high school and supplement his family’s meagre income.

Now engaged in menial house painting jobs, a skill he acquired at the construction sites, saving enough money to fund his university education remains a significant hurdle.

But this may be about to change, as Nigeria’s federal government has recently passed a law establishing a student loan scheme aimed at providing financial assistance to individuals from poor backgrounds. Under the scheme, eligible applicants will receive up to N500,000 (approximately $650) per academic session.

Signed into law by President Bola Tinubu on 12 June, the Access to Tertiary Education Act, also known as the Student Loan Act, is expected to provide easy access to higher education for poor students through interest-free loans.

Government officials believe that the initiative will enable indigent students to access federal government loans to fund their university education, much like what happens in the United States and other developed countries.

The scheme ensures equal rights to eligible applicants to access the loan without discrimination based on gender, religion, tribe, social position, or disability.

“The student loan scheme is a boon to our youths, to our students nationwide,” said Dele Alake, the president’s spokesperson.

The government is confident that students facing financial hardships, including individuals like Wisdom, who meet the set criteria, will be able to access the loan and repay over a period of 20 years interest-free.

“A typical public university student can survive effectively on a tuition fee of N250,000 ($325) per session, and an all-in-one annual loan of N500,000 ($650) can take a student through each academic year,” affirmed Dr. Dasuki Arabi, the Director-General of the Bureau for Public Sector Reform.

“With what we have now, nobody should say it was a lack of money that did not allow them to go to school. The opportunity will be there. It will be inclusive, and it will be equitable,” said David Adejoh, Permanent Secretary in the federal Ministry of Education, in an interview with Africa Renewal.

The Nigerian Education Bank will supervise and co-manage the loan scheme starting September 2023.

The law stipulates two years imprisonment or a fine of N500,000 ($650) or both for students who default in repayment, or anyone found aiding defaulters.

Nigeria has up to 18 per cent annual school dropouts attributed to financial constraints.

The National Association of Nigerian Students (NANS) has welcomed the scheme as necessary to address the dropout challenge, as well as help combat suicidal tendencies and deter desperate poor students from engaging in vices.

“The rate at which students commit suicide due to depression when they drop out of school and the prevalent of vices among female students carried in order to pay their fees will decrease or cease because there will be no more financial pressure to warrant such acts,” said Akinteye Afeez, a spokesperson of the student association.

However, the Academic Staff Union of Universities (ASUU), an organisation that represents Nigerian public university lecturers, has doubts about the practicability of the new scheme due to the country’s high rate of graduate unemployment

Nigeria’s Punch newspaper reports that approximately 40 per cent of those holding a Bachelor’s degree and 59 per cent of those with Higher National Diplomas are currently unemployed.

Also, the renowned global tax and audit services firm, KPMG, projects that Nigeria’s unemployment figure will rise to 40.6% in 2023, from 37.7% in 2022.

With the current economic conditions in Nigeria, a student loan scheme will create more problems than the ones it is attempting to solve, said Prof. Emmanuel Osodeke, the President of ASUU.

“ASUU will never support the issue of education banks because the poor will not benefit from it,” he insisted.

The union maintains that the best solution to the problems of Nigerian universities is adequate funding.

Anticipating an increase in access to tertiary education, the government plans to put in place supportive structures and implement economic reforms that will absorb more graduates into the work force.

Source: Africa Renewal, United Nations

IPS UN Bureau