Legislative and procedural changes over the years have left expats puzzled about the requirements and processes for post-cessation encashment and remittance of those funds abroad.

At the heart of this lies the illusive concept of tax residency status.

Navigating the Residency Maze

South Africans fall into two tax categories: resident and non-resident. Each category impacts the tax and exchange control treatment of an individual. This means that the determination of one’s tax residency is central to the encashment of retirement savings despite not retirement age yet.

A common misconception among expats is that merely exiting South Africa, or penning a farewell note to SARS, will be enough to confirm one’s non-resident status.

Declaring tax non-resident status is a formal process requiring clear documentary evidence supporting the intention to stay abroad, submitted to the South African Revenue Service (“SARS”). However, this further impacts the exchange control treatment applicable to the individual, which means that alignment with the South African Reserve Bank (“SARB”) and relevant authorised dealers (banks) is also necessary.

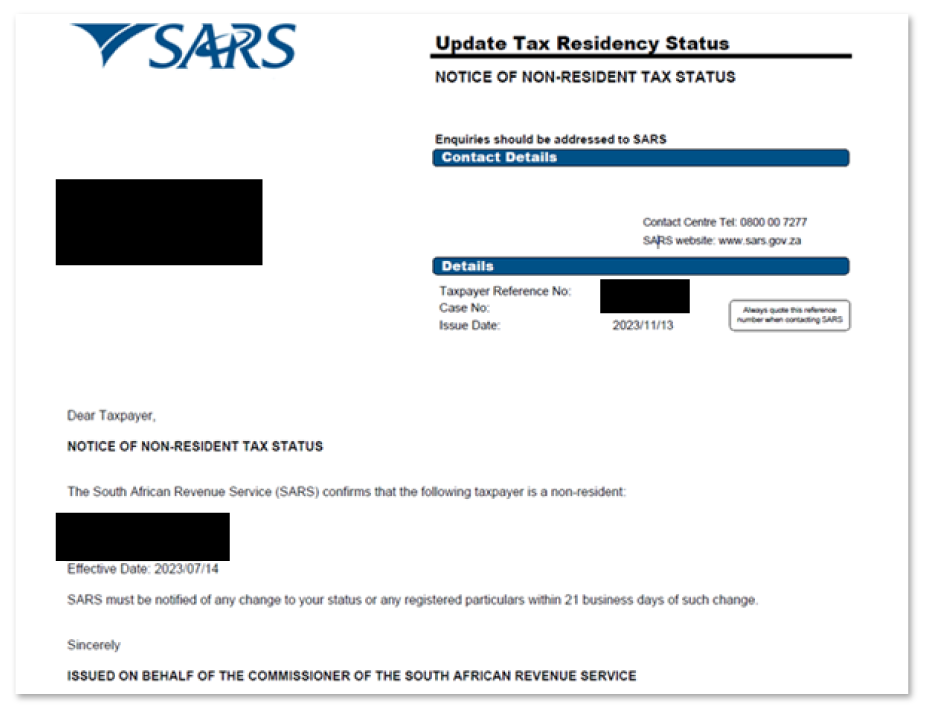

The conclusion of this administrative process is SARS’ confirmation of non-residency status, formally known as the Notice of Non-Resident Tax Status letter:

This letter serves as a crucial tool for safeguarding foreign income and ensuring non-resident status, forming an essential foundation for retirement fund encashment.

The residency cessation process remains administratively burdensome, demanding that individuals substantiate their intention to remain abroad with reference to objective factors and supporting documentation to this effect. A common thread is the request for a Tax Residency Certificate (“TRC”) from the current country of residence, providing further confirmation of one’s physical presence abroad.

This TRC not only confirms foreign residency for SARS during the cessation process, but is also vital for retirement policy providers, affirming compliance with foreign tax obligations. Below is an example of a Tax Residency Certificate issued by the Australian Tax Office:

Encashment – the Final Leg

Unlike the previous regime, retirement funds can now be remitted only after a minimum three-year non-residency period, being a departure from the earlier, more lenient process.

While navigating tax residency status, expats must remember that even confirmed non-residents are not exempt from tax on retirement savings encashment. Expats remain liable to tax on South African sourced amounts, per the relevant annual tax table applicable.

The Tape at The Finish Line

Achieving non-residency status and managing retirement policy encashment are often essential prerequisites for a clean fiscal break. Expatriates must be aware that effectively navigating matters involving tax residency requires strategic foresight and careful consideration of risk and compliance management. Professional assistance is highly recommended to ensure a smooth and compliant process throughout this intricate journey.