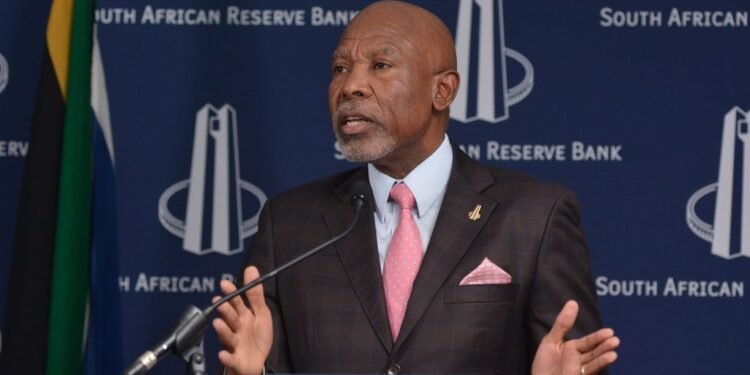

“Rates are where they are because inflation is what it is,” Kganyago said in an interview with Bloomberg in São Paulo on Wednesday on the sidelines of a Group of 20 meeting of finance chiefs and central bank governors. “The task of taming inflation is not yet done. Until that is done, I don’t see why there should be a change in the monetary stance.”

ADVERTISEMENT

CONTINUE READING BELOW

The central bank has kept its benchmark interest rate at an almost 15-year high of 8.25% since May, and Kganyago’s remark echoed a line he has repeatedly used to argue that it is premature to loosen policy.

The central bank prefers to anchor inflation expectations at the 4.5% midpoint of its target range. Inflation has been above that level since May 2021 and is only expected to settle there next year.

“The inflation outlook is uncertain, it’s been volatile. Until inflation stabilises where we want it, at 4.5%, and is sustained there, we don’t see reason why we should change our monetary policy stance,” he said.

Election pressures

The governor listed food prices, geopolitical risks and their impact on global supply chains and energy markets as some of the upside risks to the inflation outlook. He also said the bank won’t succumb to election pressures as the country prepares to vote on May 29.

Read: Godongwana rebuffs ruling party call to pressure Sarb

The ruling African National Congress faces the biggest threat to its national majority since coming to power three decades ago, amid rising unemployment and power blackouts that have stalled economic growth.

That’s led to renewed calls for the central bank to expand its mandate to include employment and economic growth.

“They can’t put pressure, they can make noise. Constitutionally, we are supposed to act independently,” said Kganyago.

“What is important is that the central bank is shielded from political interference.”

The monetary policy committee will deliver one more rate decision before the elections when it gathers at the end of next month.

Gold reserves

ADVERTISEMENT

CONTINUE READING BELOW

Finance Minister Enoch Godongwana last week announced a plan to ease the debt pressure on South Africa’s finances by tapping R150 billion from profits on the country’s Gold and Foreign Exchange Contingency Reserve Account, held at the central bank.

Read: Treasury taps into R500bn contingency reserve account

Asked about the drawdown and plans to transfer future profits from the account to Treasury, the governor said it should come with a “permanent framework” that is transparent and shows how reserves can be drawn and how liquidity is neutralised.

Inflation target

On plans to revise the central bank’s inflation target, which has received National Treasury backing, Kganyago said a revision could only be lower than the midpoint of 4.5%, not higher.

Read: Treasury backs Sarb inflation target review

Treasury said last week that work was underway to examine whether adopting a narrower inflation target range or shifting to single point goal made sense.

Kganyago, who was first appointed as governor in 2014, is currently serving his second five-year term, which ends in November.

© 2024 Bloomberg L.P.