Jumia, an African e-commerce company, is closing down its food delivery arm, Jumia Foods, in the seven countries it operates by the end of this year. According to the company, it wants to focus on expanding its online retail business.

Jumia has been unprofitable since inception and lost $19 million in Q3 2023. Year-to-date, its adjusted EBITDA loss stands at $61 million, down by 61% from the first nine months of 2022. But since Francis Dufay became CEO last year, the company has been cutting its weight to find profit. It stopped food delivery operations in Egypt, Ghana and Senegal; suspended logistics-as-a-service in all markets except Nigeria, Morocco and Ivory Coast; discontinued Jumia Prime across all its markets; and scaled back first-party groceries in Algeria, Ghana, Senegal and Tunisia.

However, of all the streamlining efforts, its exit from the food delivery business across seven markets was the most unexpected. Jumia Food comprised approximately 11% of the company’s gross merchandise volume (GMV) until Q3 2023. It was also the fastest-growing category on the e-commerce platform and the second-largest category behind fashion in volume terms for years.

Jumia’s decision comes after Bolt Food, another major player in the food delivery market, announced its exits from Nigeria and South Africa in December, citing difficulties. It also follows the collapse of Kune Food, a Kenyan food delivery firm that operated a dark kitchen model, which shut down in June, less than a year after raising $1 million in pre-seed funding. The company’s founder and chief executive, Robin Reecht, said they “ran out of money completely” and could not find investors or a buyer. However, insiders allege mismanagement also played a role, according to WeeTracker.

High growth, low profit

Bolt Food, Glovo and Jumia have long been at the forefront of Africa’s food delivery market. Statista projected revenue in this market to reach $7.45 billion this year, so players have thrown hats in the ring for it. Jumia also launched a grocery delivery offering, Jumia Food Mart, last year. Some other notable challengers have also emerged in recent years. One is Y Combinator-backed Chowdeck, which recently reached $1.2 million in monthly GMV (gross merchandise value).

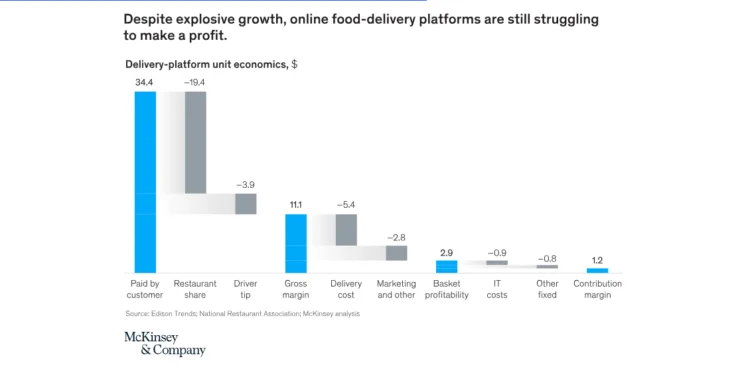

But Jumia’s high-speed growth era seems to have reached an end. This year will mark Jumia’s first time losing annual active customers in the company’s history. And now that it wants to focus on profit, it’s a good time to bring up this chart by McKinsey. It’s from 2021 and based on US data, but still relevant.

Yes, we’re using a US-based McKinsey report from 2021 because there’s no data on Africa. That leaves e-commerce players depending on a lot of experimental strategies. For instance, Jumia sought to break into the rural markets earlier this year.

Getting (and staying) profitable from food delivery is hard, and Jumia is just an example. Jumia’s CEO holds the same sentiment. In the shutdown statement, Dufay called it “a segment that’s very difficult across the world, with very challenging economics and big losses.”

Big-league companies have to spend heavily on marketing and delivery costs. “When a company advertises 30% off, including free delivery, you can be sure they’re losing money on every single order. It’s justified by the fact that they’re burning money to grow and buy market share,” Dufay said in an interview with TechCrunch. This is why many often seek ways to own more parts of the value chain.

Now that Bolt Foods and Jumia Foods have wound down, others have a real challenge. They would have to take this low-margin market Jumia and Bolt are leaving behind, and make money in it at scale.