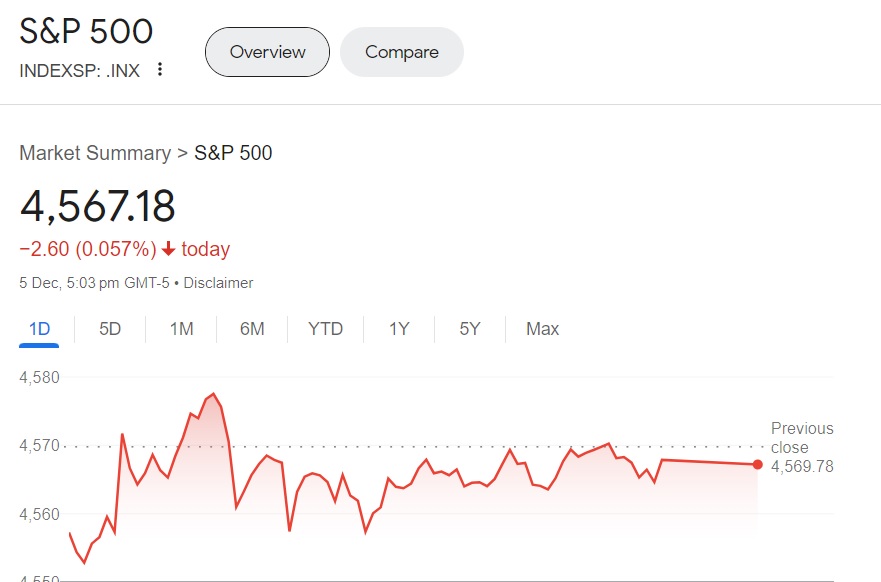

The S&P 500 index currently stands at 4,567 on Tuesday and remains mostly in the red in December this month. The slump comes after the softening of the U.S. dollar as the Federal Reserve is looking to cool down hiking interest rates. Nasdaq, Dow Jones, and the S&P 500 indexes are now holding on to their resistance level of support. JP Morgan’s top strategist estimates that the S&P 500 index could crash between 23% to 25% in the short term.

Also Read: Nigeria Ready To Join BRICS As Argentina Rejects the Alliance

S&P 500 To Crash 25%: Predicts JP Morgan Financial Strategist

Wall Street has experienced a significant departure of bullish sentiments as the bearish claws have taken over the global markets. All economic indicators point towards a downturn forecasting a recession to hit the markets sometime in 2024.

Jason Hunter, JP Morgan’s head of technical strategy explained that S&P 500 is facing a substantial reversal. Hunter warned that the S&P 500 is signaling an upcoming new low in 2024 that could pull it down to the 3,500 level. That’s a steep fall of nearly 25% from its current price of 4,567.

Also Read: BRICS: 150 Countries To Pay Chinese Yuan, Not USD for Loan Repayment?

“Stocks should pull back. In my base case on the technical side, the S&P 500 is gonna drop to 3,500,” Hunter said during an interview with CNBC’s Squawk Box.

Hunter reasons that the catalyst driving the bearish trend includes the looming recession. He stressed that the risk could materialize despite a possible “soft landing” for the U.S. economy. Therefore, stock prices could come under tremendous pressure, which could push the S&P 500 to new multi-year lows.

Also Read: Don’t Expect Gold Prices To Stop at $2,100: Market Analysis

“When you look at the timing since curve inversion, and go back into the 1960s and take yield curves that go back that far, as we move into next year, as that window continues to progress, you tend to find your way into a bear market that’s eventually associated with a recession way more often than not,” he summed it up.