Everyone knows that the Fed is going to cut rates at some point this year. That is the worst kept secret on the planet helping to explain how we keep making new highs for the for the S&P 500 (SPY). Unfortunately that creates an interesting predicament for stocks after rates are cut. Plus another hurdle in the 2024 Presidential election. Steve Reitmeister is here to share his insights on the market outlook along with a preview of his top 12 stocks to outperform. Read on for more.

Week by week we dig into the minutia to appreciate new facts that could change the course we are on. Yet now as we are about to close the books on a rather profitable first quarter for the S&P 500 (SPY), I thought it would be beneficial to pull back and review the big picture.

This culminated in a new live presentation I gave to the MoneyShow audience last week where I updated my 2024 stock market outlook. Gladly you can get free access to the webinar replay now: Watch Here >

In this week’s written commentary, I will add some fresh updates to make sure we are staying one step ahead of the market.

Market Commentary

In short, this is a bull market. Not much argument with that. But with nearly 50% gains in the last 18 months means we are running a bit too hot when 8% annual returns is more the norm.

At this stage, what happens next is all about the Fed. As in, when are they going to start lowering rates???

There is no question this is going to happen. Just a matter of when which is why investors keep bidding up shares even as the starting line has been pushed back time and again.

I believe this sets up the market for a classic “Buy the Rumor, Sell the News” event.

Meaning that stocks keep rallying in advance of this positive catalyst for the economy because there is no secret it will happen. So, once it does finally take place, there are already big gains in place making it an attractive time to take some profits off the table.

No…I am not saying that will happen the second the announcement is made. Perhaps it is more like stocks rally another 1-2% on the news. And then we are set up for the classic 3-5% pullback. Yet some of the more overbought stocksperhaps sell off more like 10% (I see you NVDA).

What I share above is something that likely happens in June/July. Then stocks probably bounce from there only to run head long into another negative cyclical event.

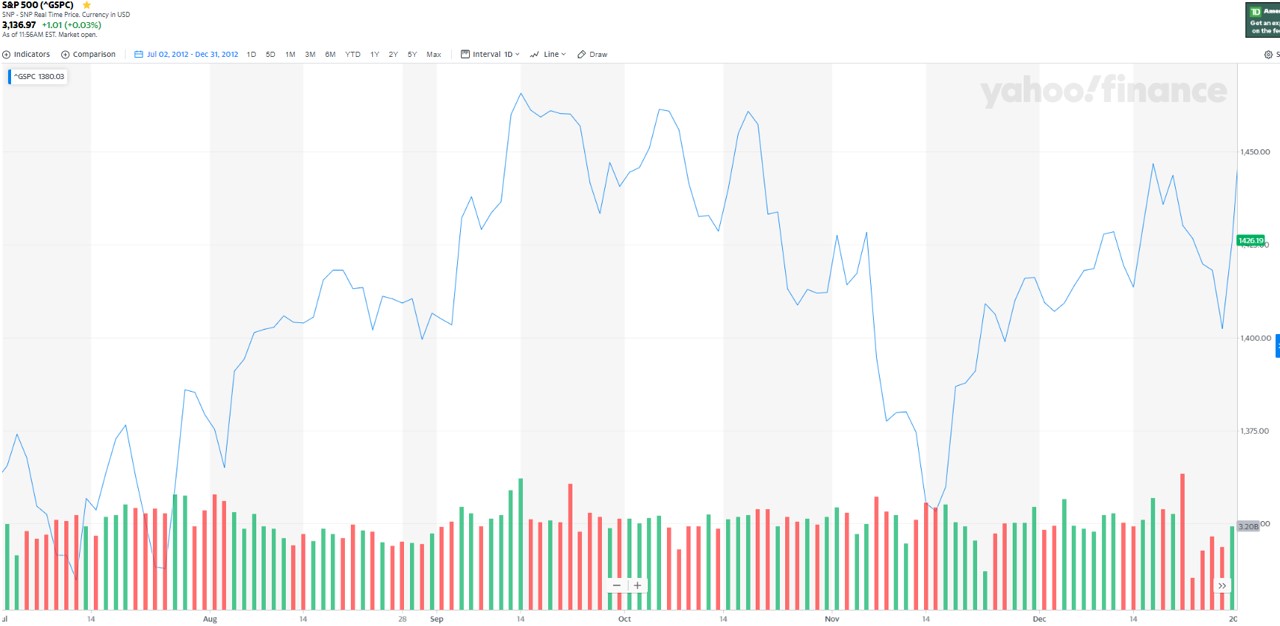

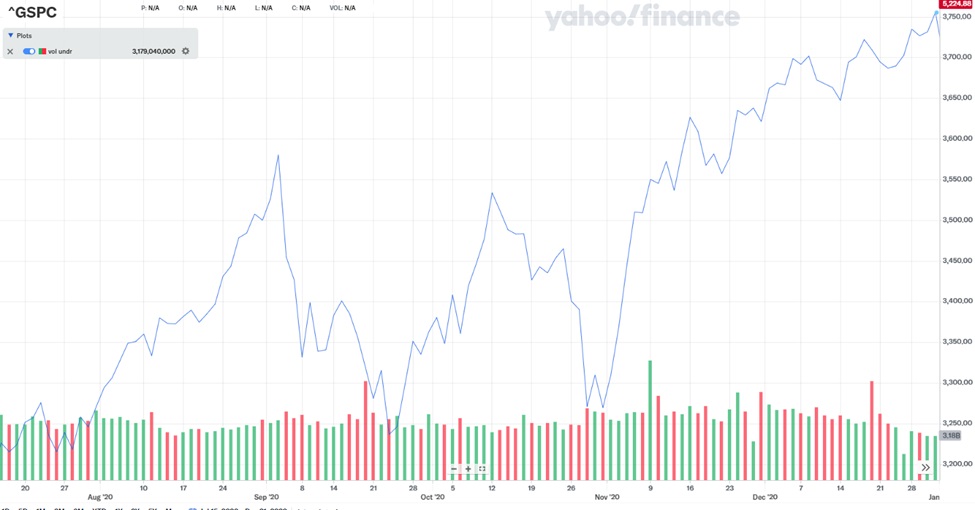

I am talking about the typical market pullback that takes place coming into a Presidential election. Here are the charts from the last 3 Presidential cycles to easily see this taking place.

2012 Election Tops Out Mid September

2016 Election Also Tops Out Mid August

2020 Election Also Tops Out Early September

The declines starting late summer/early Fall are noticeable. What is also noticeable is that the market spikes regardless who wins the election.

Or to put it another way, the market hates uncertainty. Thus, with question marks arising over the election outcome leads to a pullback in stocks. And the resolution of that matter = clarity = rally on the way.

I am not recommending that you go to cash later this summer because this seasonal pattern is not a guarantee. However, it would not be crazy to take 20-30% out of the market.

Or perhaps buy a little 3X inverse ETF like TZA to have some fun. Even a modest pullback in the overall market would produce a tidy 10%+ trading profit.

Again, stocks will rebound once the election results are in hand. Then tack on the typical Santa Claus cheer for stocks and that points to a likely 5,500 target for stocks coming into the year end.

That equates to a 17% gain on the year when you include dividends. About 2X the average annual return.

Unfortunately, when you add that to the even more impressive 26% return for stocks in 2023, then I believe the bull will grow tired. This sets us up for the typical lame 3rd year for a bull market where 0-5% is a very likely outcome. This digestion period typically paves the way for superior gains in the 2-3 years that follow.

Pulling back to the big picture…it’s still bullish til proven otherwise. Just a matter of what stocks we are going to invest in to top the market averages.

My favorite hand picked stocks are shared in the next section…

What To Do Next?

Discover my current portfolio of 12 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

This includes 5 under the radar small caps recently added with tremendous upside potential.

Plus I have 1 special ETF that is incredibly well positioned to outpace the market in the weeks and months ahead.

This is all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these lucky 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares were trading at $520.79 per share on Tuesday afternoon, up $1.02 (+0.20%). Year-to-date, SPY has gained 9.91%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

More…

The post Investor Alert: “Buy the Rumor, Sell the News!” appeared first on StockNews.com