South Africa beat England in World Cup games in cricket and rugby last week. The latter, a semi-final match-up, was a nail-biter that the Boks managed to win despite an overall subpar performance. There was similarly good and bad news in the latest South African inflation data. The bad news is that the consumer price index was 5.4% higher in September compared to a year ago. This is up from the 4.8% annual increase in August.

The big culprit is fuel prices, though food inflation also remains stubbornly high. The inland price of 95 unleaded petrol jumped by R1.71 per litre in September to a 13-month high of R24.54. This means the transport category contributed 0.6 percentage points to the 5.4% annual CPI increase.

ADVERTISEMENT

CONTINUE READING BELOW

Read:

Consumer inflation spikes again to 5.4%

Ouch! Brace for another petrol price jump

October saw the petrol price jump another R1.14 per litre to R25.68. This is 14% higher than a year ago. However, despite the oil price volatility in the wake of the explosion of violence in Israel and Gaza, we are on track for a fuel price cut of almost R2 per litre next month.

Longer term, the petrol price is unpredictable. We do not know what the oil price will do in the days ahead, much less where it will be a year or two from now. It adds noise to the local inflation rate but tells us little about underlying price pressures. The oil price can remain high at $91 per barrel, but if it doesn’t rise any further, the rate of change drops to zero.

Read: The future of oil prices and how to benefit from it

Inflation doesn’t measure whether things are expensive but how fast prices change. Price changes of a single item like fuel are also not what we mean when we talk about ‘inflation’. Rather, we are referring to an increase in the broad price level of goods and services.

Underlying inflation, therefore, has much more to do with the behaviour of consumers and companies in South Africa than volatile global energy prices. What matters more is whether firms pass cost increases on to consumers and whether consumers accept these. This, in turn, depends on what people expect future inflation will be, the extent of the pricing power held by firms (which is usually inverse to how much competition there is), and overall demand.

Read: Inflation expectations drop for the first time in two years

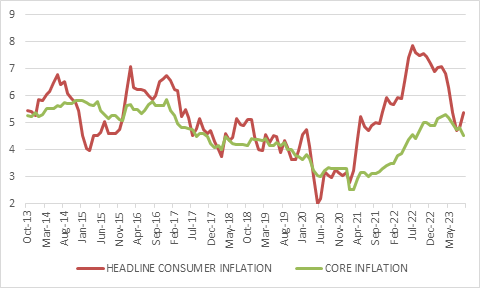

That is why economists like to look at alternative measures of inflation, like core inflation, which excludes food and fuel prices. Of course, fuel and food prices matter greatly to consumers. We all need to eat and move. However, core inflation is a better indicator of whether underlying price pressures are increasing or abating.

This is where the good news comes in. Core inflation declined to 4.5% year-on-year in September and is now in line with the Reserve Bank’s target.

SA inflation rates

Source: Stats SA

The biggest component of core inflation is housing costs, which remain muted. Rental inflation was only 2.6%, as was the increase in owner’s equivalent rent, the implied rent homeowners would pay themselves.

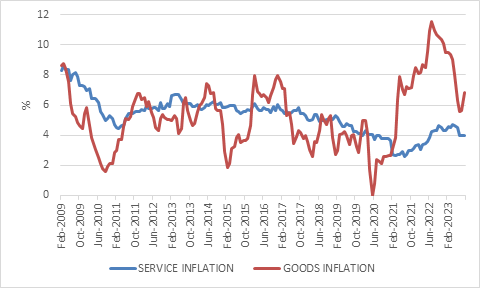

Overall, service inflation was only 4% in September. Services tend to be very local in nature and dependent on domestic conditions. In contrast, goods are often traded internationally and, therefore, subject to exchange rate movements, commodity price fluctuations and other supply-side factors. Goods inflation is typically also more volatile in nature. Goods inflation was 6.8%.

SA goods and services inflation

Source: Stats SA

The main risks to the inflation outlook remain largely on the supply side. El Niño-related pressure on food prices could be a factor next year, and of course, an escalation in the Israel-Hamas conflict could send the oil price higher, as could any number of other events.

Read: Rising oil prices, surging inflation: The Arab embargo 50 years ago weaponised oil

Fortunately, load shedding seems less of a threat to inflation. The odds of a demand-led surge in electricity prices seem slim since household income growth is tepid.

Does it matter?

Why does inflation matter? There are three reasons. The first is that inflation erodes the purchasing power of consumers. The higher the inflation rate, the less you get for each rand you spend. Consider the experience of the past few years.

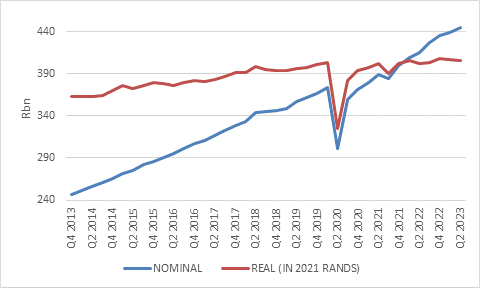

South Africa suffered an unprecedented nominal income shock during the lockdowns of 2020. Consumers had far fewer rands to spend. It was unlike anything the economy had ever experienced.

And though the growth rate of disposable household income has more or less returned to the pre-Covid trend, the lost income of 2020 was never recovered.

This was followed by the global inflation surge of 2022, which saw domestic inflation spike to 7.8%. Consumers experienced a real income shock – they got less for each rand they spent.

The real income shock of 2022 and early 2023 does not stand out historically since South Africa had episodes of high inflation before. However, it was still serious, especially for lower-income households who spend a higher portion of their incomes on food and fuel.

Stats SA data shows that the inflation rate for the poorest 10% of consumers peaked at 11%.

Looking ahead, if inflation is relatively stable at around 5% over the medium term and incomes can grow steadily in nominal terms, there is real income growth for the consumer. People will have more rands to spend and get a bit more in terms of goods and services for each rand. That points to reasonable but unexciting growth for the economy, bearing in mind that consumer spending is 60% of GDP.

Household disposable income

Source: SA Reserve Bank

The IMF recently forecast South Africa’s growth at 1.8% in 2024 and 1.6% in 2025. This year’s growth forecast was raised to 0.9%, given that load shedding has been less severe than feared. If economic growth is going to beat expectations over the medium term, the source will likely come from higher levels of private investment in infrastructure.

Interest rates

The second reason inflation matters is that it impacts the Reserve Bank’s interest rate stance. The Reserve Bank targets inflation of 4.5%, the midpoint of the official target range. A big reason for having a specific target is precisely that it anchors expectations of future inflation among firms, workers and households.

The more people believe inflation will be around 4.5%, the more likely that will be the outcome on average.

ADVERTISEMENT

CONTINUE READING BELOW

Low and stable inflation has long-term benefits for the economy, but getting there might require short-term pain in the form of a higher repo rate that weakens demand and reduces price pressures. Clearly, higher rates will work better when inflation is largely caused by strong demand, as is the case in the US now, whereas central banks can do little about supply shocks apart from reminding everyone that they remain serious about keeping inflation in check. Since domestic inflation has been more of a supply than a demand story, this suggests the Reserve Bank will not raise interest rates much further, and probably not at all.

Read:

South Africa needs to do more on inflation: Kganyago

One more Sarb hike on the cards – Bank of America

However, South Africa is in the unfortunate position where fiscal policy is a big driver of the level of interest rates. Concerns over government debt mean government bond yields remain extremely elevated, independent of market expectations of future inflation and the repo rate. And while consumer interest rates are typically linked to the prime rate, which is directly linked to the repo rate, consumers are still impacted indirectly by what happens in the bond market.

If banks can earn 13% per year lending to the government (by buying 20-year government bonds), they are unlikely to charge consumers much less for a 20-year mortgage loan. In other words, banks will adjust the spread they charge over the prime rate to reflect the risks and opportunities in the bond market.

These concerns were reiterated in the Reserve Bank’s latest bi-annual Monetary Policy Review. Not only does the government need to borrow large amounts of money, but a current account deficit means South Africa needs to maintain higher levels of capital inflows.

In an environment of higher-for-longer global interest rates, countries like South Africa, which rely on foreign savings to supplement the lack of domestic savings, face stiff competition.

Like water flows downhill, capital flows naturally to higher potential risk-adjusted returns. Given the risks in South Africa, higher interest rates are needed to attract global capital.

Often, a sharp currency depreciation is part of the equation. The more the currency falls, the cheaper South African goods, services, bonds and equities become to foreigners. This has, of course, already played out to a degree, with the rand trading near record lows of around R19 per dollar.

Read:

This is what a currency crash looks like

Foreigners flee SA stocks, sending volumes on JSE tumbling

However, foreigners lose money on their existing South African investments when the rand falls, and reflexive behaviour can cause the sell-off to accelerate. The Reserve Bank is always fearful of a sustained disorderly depreciation that pushes domestic inflation above target and destabilises the financial system. Higher interest rates are a form of insurance against such an outcome.

Mini-budget

It means that the 1 November mini-budget or Medium-Term Budget Policy Statement (MTBPS) and subsequent market response will be an important input into the 23 November Monetary Policy Committee (MPC) meeting. A poorly received MTBPS will put pressure on bond yields and the rand and increase the odds of a rate hike that otherwise seems unlikely.

Listen: Could November be the end (of the rate hike cycle)?

While we should not expect fireworks at the MTBPS, Treasury is likely to continue to tread carefully in balancing the need for longer-term fiscal sustainability with the need to maintain an adequate level of spending to support public services.

Given next year’s election, any changes will likely be phased in over time rather than being front-loaded. However, since there is little room to raise tax rates – and taxes are normally not adjusted in the MTBPS – the hard work will have to happen on the spending side.

The government will simply have to be more efficient, doing more with less. The finance minister has already mentioned that spending cuts will likely be smaller than the amount government underspends anyway.

Beating inflation

Finally, how should individual investors think about inflation?

Inflation matters to investors in two ways.

It reduces the real return. If your investment is growing at 5% a year, but the cost of living rises by 6%, you are getting poorer in real terms, not richer. Over the long term, keeping pace with inflation is crucial to any investor.

In contrast, if you owe money to someone, inflation reduces the real burden of that debt. Every rand that you return to your creditor is worth less to both of you in terms of the goods and services you can purchase with it.

Therefore, inflation also alters the behaviour of asset classes. Fixed-income investments become less attractive when inflation rises.

The relationship with equities is a bit more complicated. Equities can benefit from inflation if companies can pass on costs to consumers and grow earnings. But inflation spurts tend to reduce the multiple on equities. In other words, inflation can boost the E (earnings) while lowering the PE (price-earnings) ratio.

Listen: Investment winners: Stocks benefiting from higher-for-longer inflation

The added complication is that the South African equity market tends to be more responsive to global events than local, such that global inflation trends probably matter more to the overall JSE (the picture is different at the level of individual companies).

Nonetheless, it is South African inflation you need to beat as an investor if you live here.

When there are short-term inflation spikes, as we saw last year, equities do not provide much protection. In fact, almost nothing does, not even inflation-linked bonds.

Over longer periods of time, however, a portfolio of equities, local and global, still offers the best source of inflation-beating returns. Like a World Cup semi-final, equity markets can give you heart-stopping moments of volatility, but they deliver the goods in the end.

Izak Odendaal is an investment strategist at Old Mutual Wealth.