Of the nearly 100 executive orders signed by President Donald Trump so far in his second term, at least half a dozen directly impact the energy industry. The most notable, perhaps, is the declaration of a “national energy emergency.”

Oil and gas companies operating in all major stages of production stand to benefit. Still, midstream energy companies, in particular, offer distinct benefits to investors looking to take advantage of this renewed focus on domestic fossil fuel production:

-

Increased merger and acquisition activity under the Trump administration could provide a catalyst for investors to embrace the new midstream energy business model that’s developed since 2020. Any move toward less stringent permitting for pipelines would also be a positive.

-

Midstream energy infrastructure should continue to capitalize on the need to ensure power grid stability and meet expanding energy demand.

-

The sector remains well-positioned to benefit from growing U.S. hydrocarbon production volumes while maintaining limited commodity price exposure.

What Is Midstream Energy?

There are three major stages of oil and gas industry operations. Upstream energy refers to raw crude oil and natural gas production, which is subject to dramatic price swings as well as the high costs of exploration and production. Downstream energy refers to refining crude oil into gasoline, diesel, jet and other fuels – a capital-intensive process that requires constructing plants and refineries. And midstream activities include processing, storing, transporting and marketing oil, natural gas and natural gas liquids.

Investors who’ve considered midstream companies in the past might want to give them a second look. Following the COVID-19 pandemic, midstream companies made significant changes to increase free cash flow; some reduced dividends/distributions, while others reduced capital spending. The result is that they no longer need to access the equity or debt capital markets to finance projects, enabling them to naturally de-leverage balance sheets, buy back stock and/or increase dividends/distributions.

The U.S. Asserts Itself As an Energy Superpower

The drivers of strong performance for midstream energy infrastructure in 2025 are clear. Investors are recognizing the strong growth outlook for pipelines, in particular natural gas pipelines, which are being driven by the need to ensure power grid stability and meet energy demand from a variety of sources, such as artificial intelligence (AI) and data centers. There’s also the potential for increased liquified natural gas (LNG) exports, especially to European countries looking to reduce reliance on Russia.

Demand for U.S. oil and gas is increasing, meanwhile, amid continued concerns about geopolitical risks in the Middle East and Europe. The U.S. has surpassed Russia and Saudi Arabia in production of crude oil, and it is seeing substantial growth in LNG exports as it asserts its growing presence as an energy superpower. In addition, the new federal administration is expected to be less onerous in its regulatory framework, with less stringent controls on exports as well as pipeline permitting, all of which provide a fair degree of confidence in the future of U.S. oil and gas production growth and the placement of midstream businesses to capture value.

Other drivers of global energy demand include the transition from coal to natural gas power plants, electrification of a wide range of goods for which natural gas stands to benefit as a backup to renewable energy sources and reshoring of manufacturing.

Such hydrocarbon production growth is positive for midstream energy, which is well-positioned to benefit from growing volumes while maintaining limited commodity price exposure. Production growth, combined with capital discipline on the part of midstream companies, provides optimism about free cash flow, revenue, distribution and EBITDA growth in the sector as a whole, which has moved from being free cash flow negative to free cash flow positive.

The sector would also benefit from deregulation. An environment of greater M&A and capital markets activity broadly would add another catalyst. M&A activity could provide an incentive for investors to embrace the new midstream energy business model, while any move toward less stringent permitting for pipelines would also be a positive.

What to Look for in Midstream Investments

Balance sheet leverage (debt/EBITDA) has decreased significantly, strengthening capital profiles. With little to no need for midstream companies to access capital markets for the foreseeable future, excess cash flow – above and beyond capital spending and dividends/distributions – should be used for incremental share buybacks and further raising dividends/distributions.

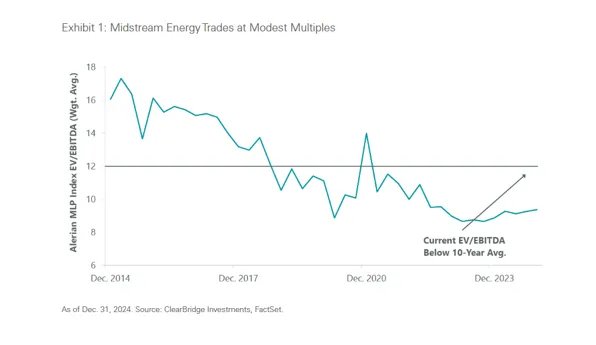

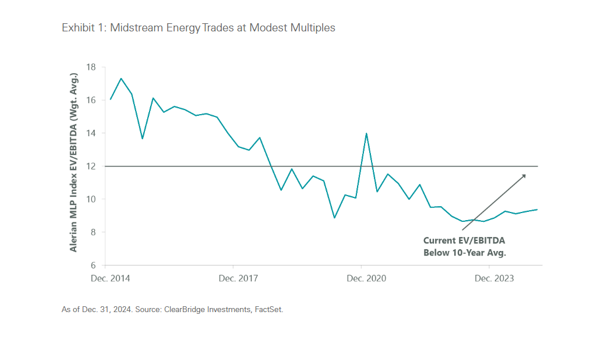

Meanwhile, midstream energy valuations remain attractive. For example, comparing a company’s enterprise value (EV) to its earnings before interest, taxes, depreciation and amortization (EBITDA) is one way to assess its value and profitability. The Alerian MLP Index, a composite of publicly traded energy master limited partnerships in the midstream energy infrastructure space, is still trading at modest multiples, especially compared to its long-term history (Exhibit 1).

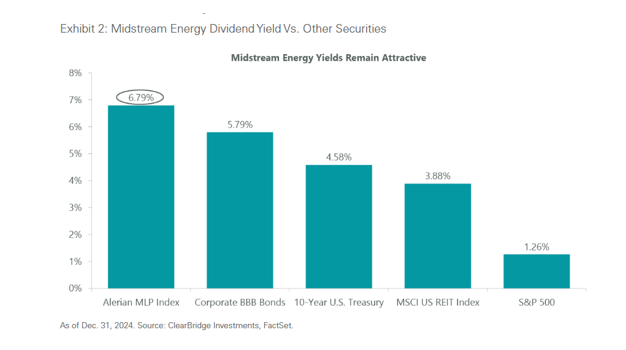

In addition, based on current distribution yields, the Alerian MLP Index not only screens attractive on a relative and an absolute basis compared to yields in other equity asset classes, but also against high-quality fixed income securities (Exhibit 2).

The best way to take advantage of this opportunity is with an active diversified portfolio emphasizing fundamental characteristics such as balance sheet strength, asset footprint diversity and quality while employing only prudent leverage. Companies that exhibit these characteristics include Targa Resources, which is focused on natural gas and natural gas liquids; ONEOK, likewise focused on natural gas; and Energy Transfer LP, which owns and operates natural gas transportation pipelines and storage facilities.