Fintech trade groups play an important role in fostering the growth and evolution of the sector.

They help shape the regulatory landscapes, foster partnerships, and establish industry standards. But despite their importance, these organizations face significant challenges, including resource constraints and fragmentation, according to a study by the Cambridge Centre for Alternative Finance (CCAF).

Trade groups are organizations formed by businesses within the same industry to promote their share interests. They advocate for favorable policies, share market intelligence, and coordinate on common priorities. By doing so, they amplify their members’ influence and strengthen their industry’s position in the marketplace

In the fintech sector, these associations act as a collaborative voice, ensuring that the interests of diverse fintech firms are represented. They promote collaboration, facilitate knowledge-sharing, and engage extensively with financial institutions and regulators to shape policies, improve interoperability, and expand market opportunities.

Resource constraints among top challenges

The CCAF study, conducted in partnership with the Alliance of Digital Finance and Fintech Associations (AllianceDFA), with the support of the Gates Foundation, surveyed 65 digital finance and fintech industry associations in more than 40 jurisdictions across both advanced economies (AEs) and emerging markets and developing economies (EMDEs) in 2024.

The study found that capacity and resource constraints are the biggest challenge faced by fintech associations, reported by 77% of respondents. This reflects the fact that many organizations are lacking sufficient resources to meet the increasing demands of a developing industry, the report says.

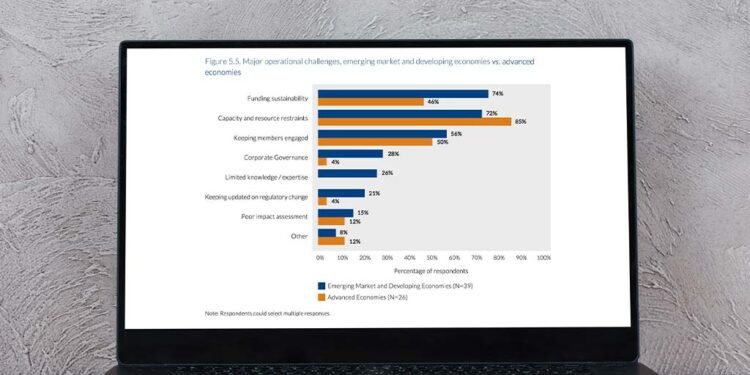

Funding sustainability was identified as the second biggest hurdle, named by 63% of respondents. This suggests challenges in securing sponsorships and funding for events and initiatives.

Keeping members engaged was cited as the third biggest challenge, reported by 54% of respondents. This issue was especially pronounced among associations with no code of conduct (74% versus 39%), reflecting the fact that codes of conduct typically include expectations of members and member behavior, which in turn drive member engagement.

Generally, associations in EMDEs reported additional challenges compared with those in AEs: 28% of fintech associations in EMDEs cited issues with corporate governance, compared with only 4% in AEs; limited knowledge and expertise was cited by 26% of associations in EMDEs but not reported at all by associations in AEs; and 21% of associations in EMDEs identified difficulties in keeping with regulatory change, compared with just 4% in AEs.

The study also identified strategic challenges faced by fintech trade groups. More than half of the surveyed industry associations (51%) considered fostering partnerships to expand the industry association’s reach and influence as a major strategic challenge.

Staying agile amid fintech industry changes and technological advancements was identified as the second most significant strategic challenge, cited by 45% of respondents.

In addition, about one in three of respondents (35%) considered fragmented industry representation and lack of a strong, collective voice of stakeholders a major strategic challenge. This reflects the proliferation of industry associations, professional organizations and advocacy groups over the past years.

Contributing to the fintech ecosystem

Fintech associations are contributing significantly to the development of their jurisdictions’ fintech ecosystems. These organizations play a critical role in advocating for fintech related policy, legislative, and regulatory changes in their jurisdictions (77%), and by representing their industry in key regulatory and policy making bodies (71%). They also provide key mechanisms for facilitating sharing good practices and mutual learning with domestic organizations (71%).

Fintech trade groups also engage with established institutions to facilitate partnerships, support joint research and development, and address specific issues, such as fraud and financial inclusion.

In India, for example, the Fintech Association for Consumer Empowerment (FACE) partnered with Google and other industry stakeholders in October 2023 to combat predatory digital lending apps on the Play Store.

In Mozambique, the Mozambique Fintech Association (Fintech.MZ) aims to contribute to financial inclusion by participating in working groups to support the National Financial Inclusion Strategy. The organization has also been confirmed as a member of the Steering Committee and the Supervisory Body for the new National Financial Inclusion Strategy for 2024-2030.

Similarly, in South Africa, the Fintech Association of South Africa (FINASA) is supporting the development of fintech solutions that cater to underserved populations. It also works to empower consumers with knowledge, resources, and training to navigate the fintech space confidently.

Featured image: Edited by Fintech News Africa, based on image by freepik via Freepik