Policymakers from Washington to Frankfurt head into the final quarter of 2023 with tentative grounds for optimism that their fight against inflation is making progress.

With Federal Reserve chief Jerome Powell and his European Central Bank counterpart Christine Lagarde both due to speak in the coming week, investors will scrutinise any reaction from them to a transatlantic double whammy of data that offered hints of cheer.

ADVERTISEMENT

CONTINUE READING BELOW

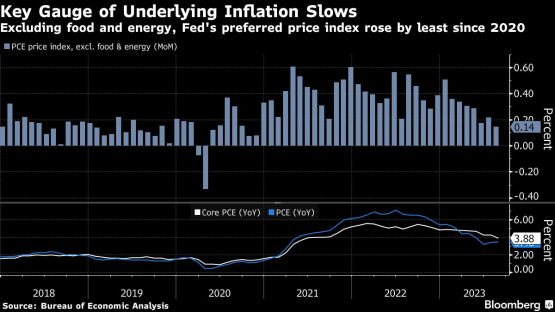

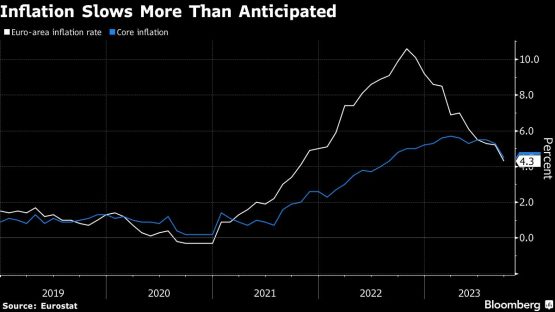

Friday’s reports showed euro-zone core inflation — which strips out volatile elements such as energy — running at the slowest pace in a year, and hours later, the Fed’s preferred measure of underlying price growth was revealed have risen the least since 2020.

With a government shutdown averted on Saturday, US central bankers are set to see another round of that data series, as well as other inflation numbers, before their decision on November 1. The numbers released so far could allow them to start building a case to refrain from a November rate hike.

The ECB will only have a fuller version of the September inflation number to go on before its October 26 gathering, with both the report for October and the estimate of third-quarter growth scheduled for after the meeting.

A further increase in borrowing costs isn’t currently anticipated in October, and Friday’s report may start to undermine any push for an ECB hike in December.

Powell will join Philadelphia Fed President Patrick Harker for a round-table discussion with workers and small-business leaders on Monday. Regional Fed presidents Loretta Mester, Raphael Bostic and Mary Daly are also scheduled to speak in the coming week.

Lagarde, the ECB president, will deliver the welcome address on Wednesday to a conference hosted by her institution. Vice President Luis de Guindos will speak the same day in Cyprus, and other speakers for the week include chief economist Philip Lane and central-bank chiefs from Germany and France.

What Bloomberg Economics Says:

“The ECB has probably finished raising interest rates. Numerous measures of underlying price increases are falling, surveys are pointing to a significant deterioration in activity and credit extension is weaker than it was in the depth of the euro crisis. However, the ECB will still need a long time to have sufficient confidence to lower rates.”

—David Powell, senior economist.

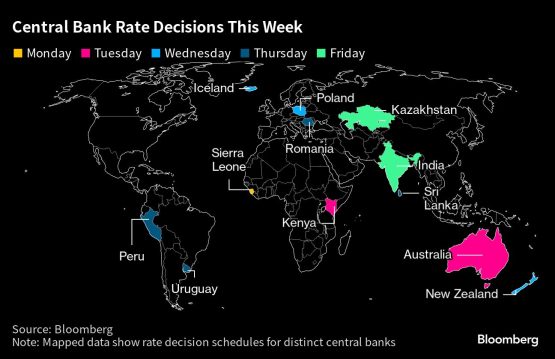

Elsewhere, several central-bank decisions are due around the world, with rates likely to be unchanged from Australia to India.

US and Canada

This week’s economic data includes a pair of high-profile reports on the state of employment. August’s JOLTS report on Tuesday and September’s nonfarm payrolls on Friday are expected to show a markedly looser labor market.

The ratio of job openings to unemployed persons — a key barometer of job-market tightness for the Fed – probably declined to 1.4, according to Bloomberg Economics. Hiring likely came down sharply last month after the summer’s temporary bump in the leisure and hospitality sector from Taylor Swift and Beyonce concert tours.

Private-sector numbers will also be in focus.

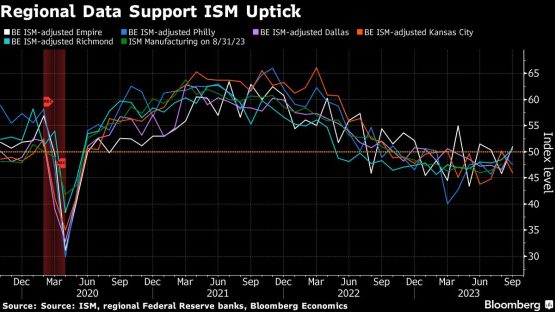

On Monday, the Institute for Supply Management’s manufacturing index is expected to show an 11th straight month of contraction. ISM’s index of services activity, due Wednesday, is seen showing slightly slower growth.

Also on Wednesday, data from the ADP Research Institute are projected to show moderating growth in private-sector employment.

Looking north, Bank of Canada Deputy Governor Nicolas Vincent will speak to Montreal’s Chamber of Commerce as the central bank weighs a recent inflation uptick against the backdrop of a slowing economy.

Jobs data for September will provide an important guidepost for the bank after the August report blew past expectations with double the anticipated employment gains and wage growth at 5.2% on the year.

Asia

China is set for a week-long holiday, a break that may be a litmus test for consumption showing how much people are willing to travel and spend. Ahead of that, Saturday’s PMI data showed manufacturing activity returned to expansion for the first time in six months, another sign that parts of the economy are finding their footing again.

South Korean trade numbers on Sunday showed a slump in exports eased further in September — a positive sign that global trade is regaining ground. PMI figures come on Monday, including from Indonesia, Malaysia, Thailand and Vietnam.

ADVERTISEMENT

CONTINUE READING BELOW

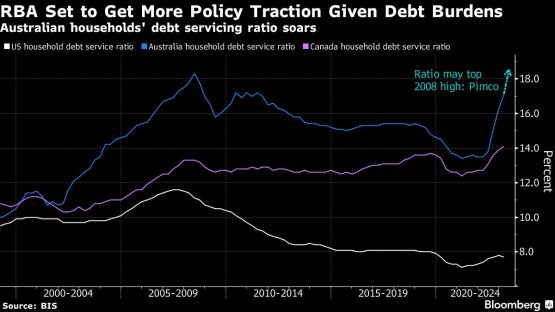

On Tuesday, the Reserve Bank of Australia meets for the first time under new Governor Michele Bullock, with central bankers expected to hold rates steady. The board may discuss the possibility of some form of quantitative tightening.

That will be followed by New Zealand’s central bank rate decision Wednesday. Analysts forecast no change there or from the Reserve Bank of India on Friday. Thailand, the Philippines, South Korea and Taiwan will release inflation figures during the week.

Tankan data from the Bank of Japan on Monday will indicate the latest state of corporate confidence, while Japanese wage data at the end of the week could have implications for monetary policy depending on how much pay growth continues to lag inflation, a key point of concern for the BOJ.

Europe, Middle East, Africa

In the UK, the Bank of England’s Decision Maker Panel survey will be released on Thursday, informing officials on cost pressures in the economy. Policymakers scheduled to speak in the coming week include Catherine Mann and Deputy Governor Ben Broadbent.

Industrial data may draw attention in the euro zone, with German exports and orders due toward the end of the week. French production numbers will be published on Thursday.

Swiss inflation may creep up toward the central bank’s 2% ceiling in a release on Tuesday.

In the Nordics, Sweden’s Riksbank on Monday will reveal the minutes of its recent decision to raise rates and keep the door open to another move.

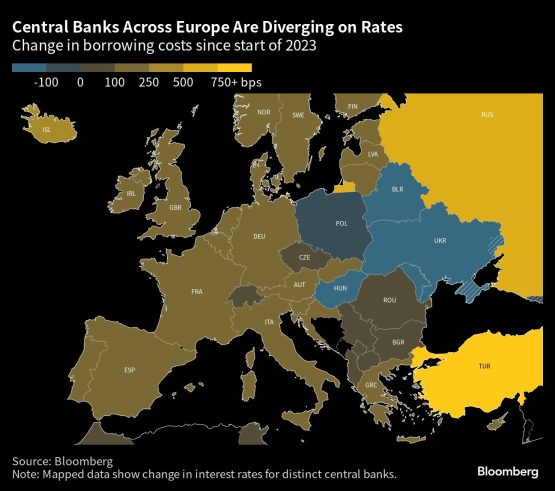

Across Europe and beyond, several rate decisions are scheduled:

- Iceland’s central bank on Wednesday will decide whether to extend Western Europe’s longest tightening cycle. Some lenders see scope for a quarter-point increase.

- The same day, Poland’s central bank may cut borrowing costs again at its final policy meeting before a parliamentary election, but the decision hangs in the balance after September’s shock 75 basis-point reduction blindsided investors.

- Romania’s central is expected to keep borrowing costs unchanged at 7% the next day as inflation hovers close to 10%.

- On Friday, the National Bank of Serbia could maintain its key rate at 6.5% for a third month at a time when inflation is easing.

- Turning to Africa, Kenya’s central bank will probably leave its rate unchanged at 10.5% on Tuesday. Governor Kamau Thugge has said officials see inflation at 5.5% to 6% by year-end on lower food prices and a decline in fuel consumption.

On the same day, Turkish data will likely show inflation accelerated to 61% in September, according to a Bloomberg survey of analysts. That’s even as the central bank hikes rates significantly to fight the country’s cost-of-living crisis.

Latin America

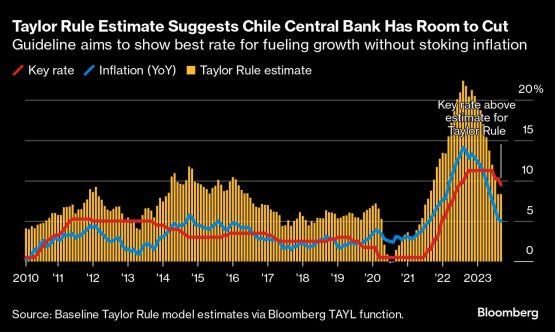

Chile’s August’s GDP-proxy reading posted on Monday may show the economy stumbled in August after July’s better-than-expected reading. Activity is widely expected to rebound in the fourth quarter without triggering central bank alarm bells.

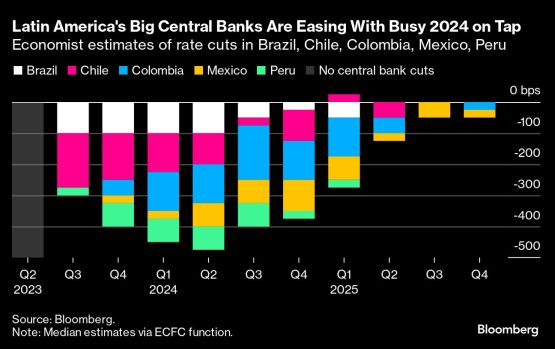

In a similar vein, the September consumer price report will likely show inflation slowed for a 10th month, more than enough to keep Banco Central de Chile on track for a third straight rate cut in October, from the current 9.5%.

Peru’s central bank is expected to extend its easing cycle with a second straight quarter-point cut to 7.25%. Peru’s annual inflation slowed more than expected in September, to 5.04%, and central bank chief Julio Velarde expects it to ease to 3.8% by year-end.

In Colombia, the minutes of Friday’s central bank meeting and September inflation readings should go a long way to firming up bets that Banco de la República becomes the fourth of the region’s big inflation-targeting central banks to begin unwinding record hiking cycles.

Economists surveyed by the central bank see a quarter-point cut to 13% in October and a year-end rate of 12.5%. The early consensus puts the September inflation print at just around 11% from the March cycle high of 13.34%.

© 2023 Bloomberg