South Africa’s gross domestic product (GDP) decreased by 0.2% in the third quarter of 2023, Statistics South Africa said on Tuesday.

The economy shrank as logistics constraints and a chronic electricity shortage took their toll. Most economists were expecting output to shrink 0.1% in the period.

ADVERTISEMENT

CONTINUE READING BELOW

Read: Secret cabinet report confirms government’s unconstitutional conduct

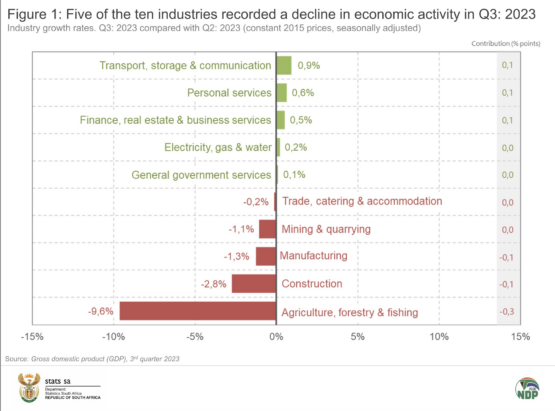

“The agriculture, forestry and fishing industry decreased by 9.6% in the third quarter of 2023, contributing -0.3 of a percentage point to the negative GDP growth. This was primarily due to decreased economic activities reported for field crops, animal products and horticulture products,” Stats SA said.

After two consecutive quarters of growth, South African real gross domestic product (#GDP) contracted by 0,2% in the third quarter (July–September) of 2023.

Read more here: https://t.co/MmYU8rgfXz#StatsSA pic.twitter.com/oNHCH54z0B

— Stats SA (@StatsSA) December 5, 2023

The economy was 0.7% smaller when compared to the same quarter in 2022. However, the seasonally adjusted quarter-on-quarter decline of 0.2% is what economists and market watchers pay attention to.

The year-on-year slump follows a 2.2% annual contraction in mining and a 3.2% slowdown in utilities over the three-month period. Agriculture shrank 19.9% from a year earlier, while construction contracted 2%.

Read/listen:

Transnet accelerates Durban port deepening project as backlog eases

Transnet gets R47bn Treasury ‘support package’

Transnet, Eskom crises cause SA economy to miss the boat

Source: Statistics South Africa

Household spending, which has come under pressure from high living and borrowing costs, shrank 0.3% in the quarter. The SA Reserve Bank has increased its benchmark rates by 475 basis points since November 2021 to a 14-year high of 8.25%.

The fall in household expenditure also comes amid pressure on money supply and credit extension, with the amount of money flowing into the economy and loans extended to consumers and private businesses posting their weakest growth in almost two years in October, according to central bank data released last week.

Read:

Kganyago sees 2024 elections among top risks for South Africa

Sarb’s Tshazibana sees case for rates staying higher for longer

Repo rate remains at 8.25% – Kganyago

In its latest Financial Stability Review, the bank also flagged stresses on lenders, which it said are beginning to take strain from the high interest rate environment, spurring more careful lending approaches.

Meanwhile, Stats SA reported that total gross fixed capital formation decreased by 3.4% in the third quarter of 2023.

“The main negative contributors to the decrease were machinery and other equipment [-3.2% and contributing -1.3 percentage points], transport equipment [-6.7% and contributing -0.7 of a percentage point], other assets [-5.7% and contributing -0.6 of a percentage point] and construction works [-3.1% and contributing -0.5 of a percentage point],” it said.

ADVERTISEMENT

CONTINUE READING BELOW

“There was a R44.5 billion drawdown of inventories in the third quarter of 2023 [seasonally adjusted and annualised value]. Large decreases in three industries, namely manufacturing; mining and quarrying; and transport, storage and communication, contributed to the inventory drawdown,” added Stats SA.

Commenting on the GDP decline, FNB senior economist Thanda Sithole said: “The economy unexpectedly shrank by 0.2% quarter-on-quarter in 3Q23, receding from the quarterly momentum that materialised in 1H23. The outcome was below our expectation of a 0.1% quarterly expansion and slightly worse than Reuters consensus expectation of a mild 0.1% contraction.”

Sithole noted that there was a retrospective 0.1 percentage point downward revision for 2Q23, to 0.5% GDP growth quarter-on-quarter.

This mainly reflected a significant downward revision in the volatile agricultural, forestry and fishing sector, he said.

“Overall, domestic demand weakened … and there were specific shocks, namely the burning of trucks along key national corridors, as well as a protracted taxi strike and flooding in the Western Cape, which also disrupted economic activity in the reference quarter.

“The economy expanded by 0.3% in the nine months to September (YTD), putting downside risk to our current-year growth projection of 0.8%.”

Negative factors

NWU Business School economist Professor Raymond Parsons commented: “The decline in 3Q GDP growth to -0.2% from 0.5% in 2Q 2023 was worse than expected, negative factors having clearly dominated the positive ones to a greater extent than anticipated in that period.

“Although there was a temporary betterment in energy availability in that quarter, several other key high frequency indices at the time already warned of a loss of economic momentum. Five out of 10 sectors in the economy have now shown a decline in 3Q GDP growth.”

Parsons warned that similar economic trends are set to prevail “in shaping a likely weak GDP growth outcome” in the current and final quarter of 2023.

“The decline in fixed capital formation in 3Q 2023 is also a red flag.

“The year is likely to end with muted economic activity. SA must now avert the possibility of a ‘technical recession’ [two consecutive quarters of negative growth] developing against the poor economic background of 3Q 2023.”