By Erik Feyen, Daniela Klingebiel and Marco Ruiz

Crypto-assets markets have grown significantly over the last decade and their footprint and market structures have evolved rapidly. The recent launch of exchange-traded products in the United States has further boosted interest in crypto-assets, as prices resumed a rapid rise. In this context, institutional investors, including central banks, have been exploring exposures to crypto-assets and reviewing whether including these instruments in their portfolios is desirable.

For central banks, the answer today is no. Crypto assets today fall short of meeting the basic requirements for reserve assets.

In contrast to traditional asset markets, crypto markets transcend national borders, operate 24/7 around the world, are fully digital, and aim to be decentralized. A new paper presents a conceptual framework to analyze whether crypto-assets could eventually serve as sound reserve assets for central banks and reserve managers.

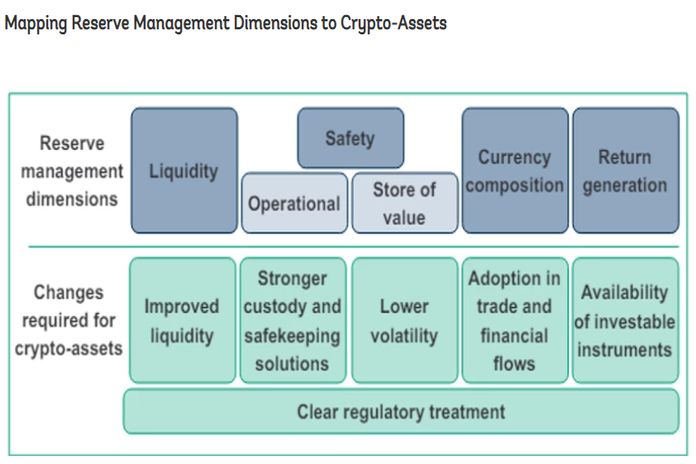

Reserve assets are foreign financial assets held by central banks for insurance purposes, to maintain economic and financial stability in times of adverse external shocks and to conduct foreign exchange policy. Traditionally, central banks follow a conservative investment approach, focusing on high-quality fixed-income assets denominated in US dollars and euros. As reserves are mostly needed during crises, the primary criteria for reserve assets are liquidity and safety. Less importance is given to return. We propose a simple conceptual framework to assess the viability of crypto-assets as reserve assets, focusing on several dimensions (see figure).

Liquidity refers to how quickly and easily an asset can be converted into cash without significantly affecting its price. Viable reserve assets must demonstrate high liquidity. Major cryptocurrencies like Bitcoin and Ethereum have substantial trading volumes, but volumes are still significantly below that of traditional reserve assets. Furthermore, the overall market depth and the potential for price manipulation continue to pose concerns.

Additionally, the liquidity of crypto-assets can be influenced by market sentiment, regulatory news, and technological developments, leading to periods of extreme volatility. Central banks require assets that can be reliably liquidated with limited market impact in times of economic stress, a criterion that crypto-assets cannot yet meet due to their relatively immature market structure.

Safety pertains to the stability and predictability of an asset’s value. Reserve assets must be low-risk to retain their value when inherently unpredictable shocks hit and markets’ ability to price assets may break down. Crypto-assets are inherently volatile, with prices subject to dramatic swings due to market speculation, regulatory announcements, and macroeconomic trends.

While blockchain technology underlying crypto-assets is designed to be secure, the overall ecosystem includes risks such as hacking, fraud, and operational failures. Crypto-asset safekeeping and custody crucially differ from those for traditional financial assets and are more akin to bearer instruments. Specifically, crypto-assets require careful management of the private cryptographic keys associated with the wallet containing and allowing access to a user’s funds

The lack of intrinsic value and reliance on speculative interest further undermine the safety of crypto-assets as reliable reserve assets. Central banks prioritize assets with minimal risk and the volatile nature of crypto-assets poses a significant challenge in this regard.

The composition of trade and financial flows largely determines the currency composition of foreign reserves in most countries. These cross-border payments remain largely denominated and executed in fiat currencies, especially the US dollar. Central banks are unlikely to include crypto-assets in their asset mix until such assets play a more substantial role in the global monetary system and they become widely accepted mediums of exchange and stores of value, neither of which appears likely soon. Stablecoins, too, are currently not widely used for payments, as they still pose various risks and regulatory uncertainty remains high.

Return on reserve assets is a secondary consideration for most central banks, behind safety and liquidity. Notwithstanding, generating sufficiently high returns helps central banks grow their reserves and generate income. Crypto-assets have shown the potential for high returns, often outperforming traditional assets, but these returns come with high volatility and risk which central banks typically avoid in their reserve management strategies.

Central banks require legal clarity and regulatory oversight to manage reserve assets effectively. The regulatory environment surrounding crypto-assets is still evolving. Many countries have yet to establish clear regulatory frameworks, and existing regulations vary widely. Indeed, implementation of international guidance and new binding rules is in its early stages and remains inconsistent across countries. Uncertainty in domestic regulation and international regulatory arbitrage poses risks to the acceptability of crypto-assets. The lack of consistent regulatory frameworks can lead to legal and operational risks, making it difficult for central banks to incorporate crypto-assets into their reserve management strategies.

Despite high returns and growing liquidity, crypto-asset markets and players must overcome multiple obstacles to become an eligible foreign reserve instrument. A significant increase in liquidity and a reduction in trading costs would be required, as well as a meaningful reduction in price volatility, strengthened custody and safekeeping solutions, increased availability of suitable investable instruments, and widespread adoption in trade and global financial flows. The foundational requirement for clear, comprehensive, consistent international and domestic regulatory and supervisory treatment is a precondition that cuts across all reserve-management dimensions.

Ongoing developments in the crypto market, including stronger regulation and improved market infrastructure may gradually address these concerns. However, currently, it seems unlikely that crypto-assets will be able to meet these criteria anytime soon.