Integrating with a payment API is something most — if not all — business-to-consumer platforms are forced to do at some point. It’s practically unavoidable if they wish to take credit card payments. The trouble is, for platforms dealing in bills and invoices, not just one-off charges, few payment APIs have all the features necessary to accommodate their workflows.

That’s why Ralph Rogge founded Crezco.

“Having worked with thousands of small businesses, it was clear that invoice payments remained an inconvenience, especially when compared to the frictionless checkout of consumer card payments,” Rogge said. (Previously, Rogge worked at YouLend, a startup offering a range of funding solutions targeted at merchants and small- and medium-business owners.) “Businesses should be building and selling products, not spending time and money setting up bill and invoice payments. Crezco makes these payments easy.”

So, does Crezco actually make payments easier? From the sounds of it, yes.

Crezco builds workflows for collecting bill payments — specifically account-to-account bill collection workflows. With these, payments, including overseas payments, are made directly from one account to another without transaction intermediaries like card networks involved.

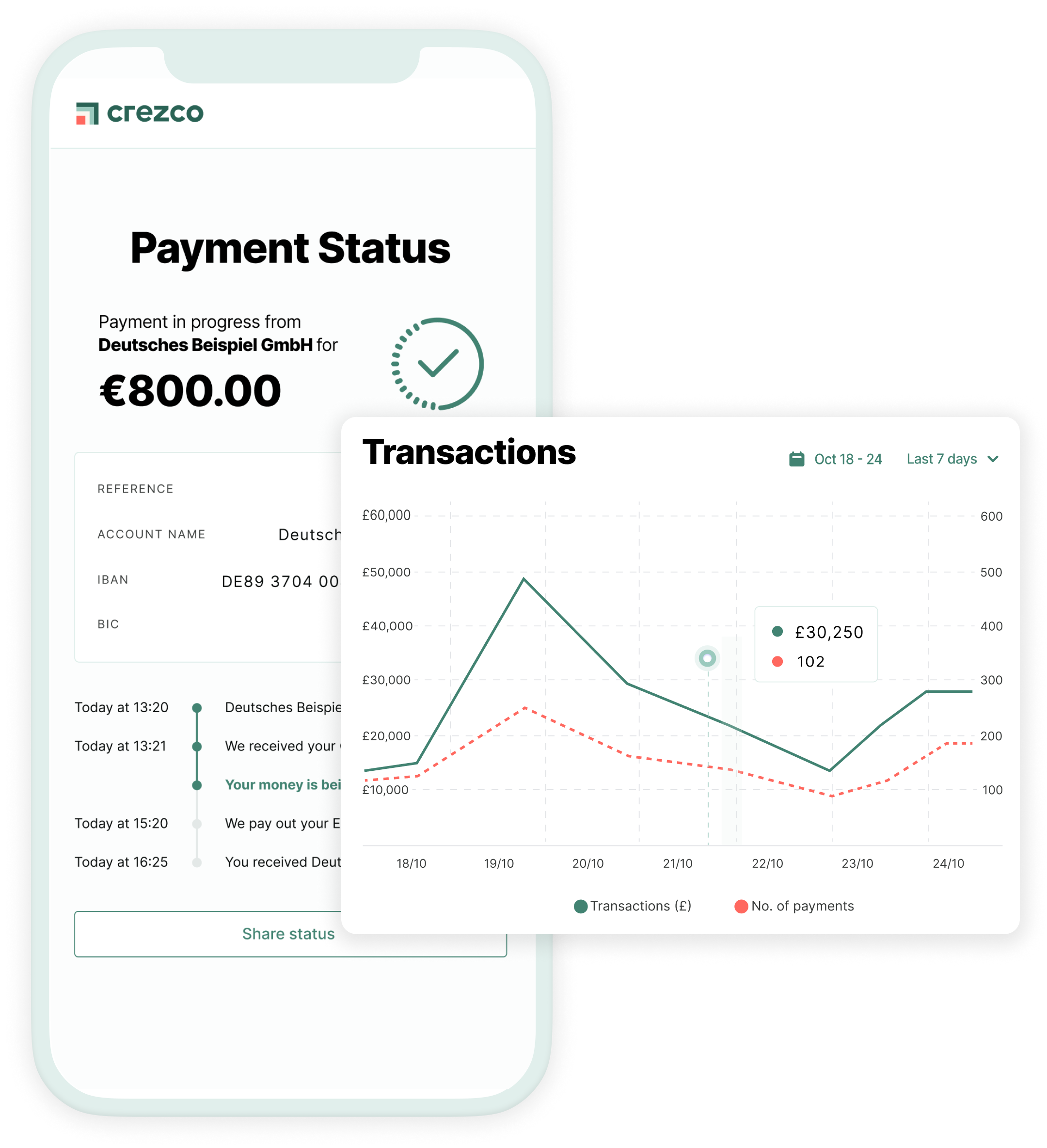

With Crezco, businesses get automatic invoice reconciliation integrated with their existing accounting software and tools that allow them to generate payment links, collect recurring payments and split payments between multiple accounts. Crezco also offers a built-in fraud detection system, plus “instant” payment notifications via the web and mobile.

“It’s not about replacing card payment with something cheaper, but replacing manual bank transfers with something more convenient,” Rogge said. “Account-to-account and real-time payments are the future. They’ll be increasingly adopted country-by-country. It’s Crezco’s job to connect these international payment rails to a single API for our partners and their customers; the end goal is to make it easy for businesses to send and receive payments, domestically and internationally, saving time and money.”

Image Credits: Crezco

Crezco doesn’t exist in a vacuum. Some of its more formidable competitors include Intuit and Wise, as well as Brite Payments, TrueLayer, Plaid, Melio and Tink (which Visa bought recently for $2 billion).

Rogge sees Crezco’s fraud prevention tech as a differentiator, among other capabilities.

“Beyond using account-to-account to process payments, Crezco leverages open banking to enhance its fraud systems by analyzing historic bank transactions,” Rogge said. “Most tools employ the same few data points, which are checked against public datasets, such as government sanction lists. Open banking provides 10 years of every historic credit and debit transaction.”

Crezco claims to have more than 10,000 active customers — and it’s hoping to dramatically increase that figure through a partnership with Xero, the U.K. accounting tech firm. Crezco will replace Wise, with which Xero previously had a deal for embedded bill payment solutions.

Investors seem pleased with Crezco’s trajectory. Today, the company announced that MMC Ventures and 13books invested $12 million in its Series A round, bringing Crezco’s total raised to $18 million. Rogge says that the proceeds will be put toward expanding Crezco’s accounts-to-accounts product and expanding the size of its team from 25 to 45.

“The structural tailwinds in business-to-business payments are significant,” Rogge said, “including the forced adoption of electronic invoicing, the rising use of accounting software and business-to-business platforms globally, the increasing adoption of accounts-to-accounts payments and open banking, and continued growing cross-border payments.”