After launching broadly in May of last year, about 300 firms have started using Catchlight, the lead generation software developed by Fidelity Innovation Labs that promises to identify which prospects in an advisors’ pipeline have the highest chance of converting to clients, and helps advisors reach out to them effectively.

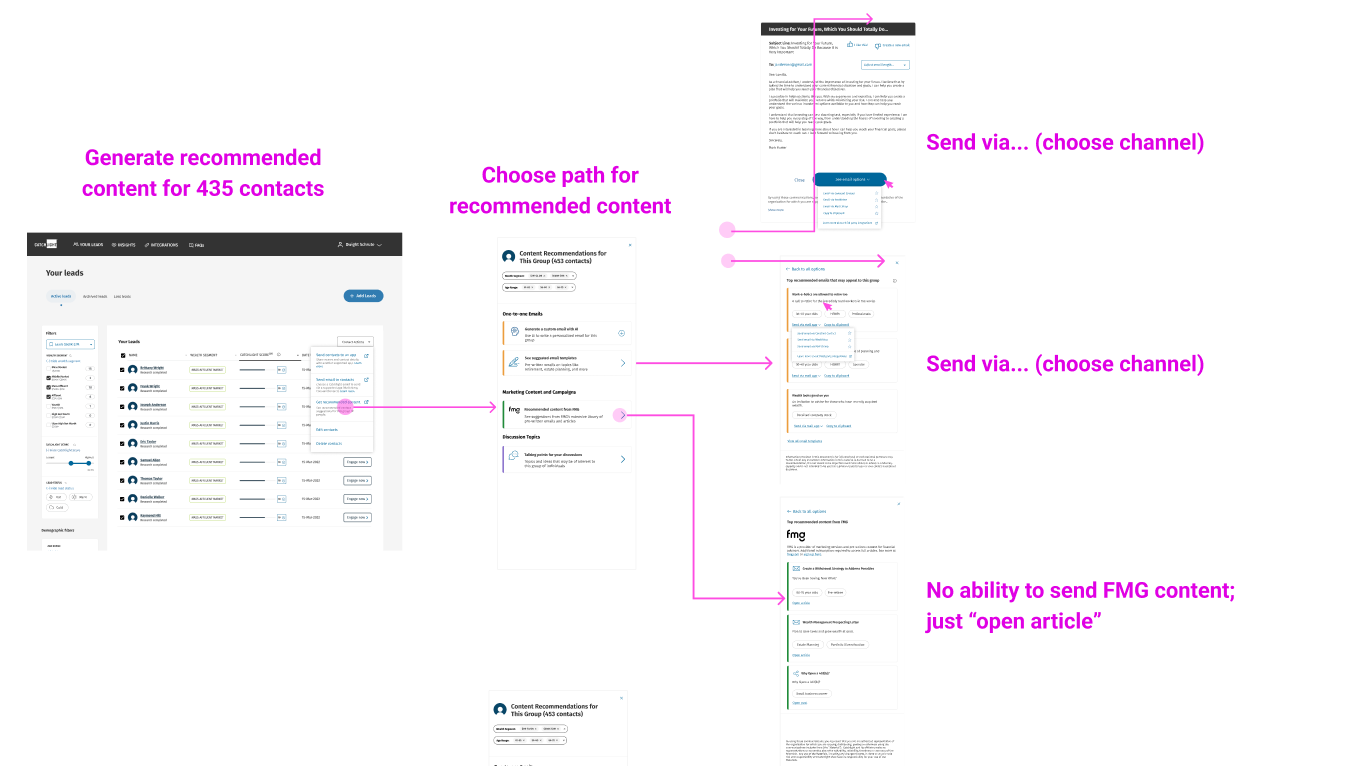

This week, Catchlight rolled out an upgrade to the service that, the company says, makes it easier for advisors to segment that prospect list by certain characteristics, and to create marketing campaigns for each. While it was possible to manually sort prospects into groups before, the new tool is meant to make it simpler to connect with specific prospect segments, en masse, in a more personal way.

The Catchlight algorithm learns which combinations of characteristics and behaviors are most likely to result in a lead conversion and uses “hundreds of thousands” of additional data points gained through partnerships to create campaigns that go beyond basic demographics, incorporating things such as financial background, goals, habits and hobbies.

“We’re allowing the machine to choose what’s statistically important, and we’re retraining that model on a regular basis,” said Catchlight’s co-founder and Head of Product Yelena Melamed. “So, at any given point, depending on what’s happening in the world, we see that slightly adjusts itself and changes the weights about which characteristics are more important.”

In certain market climates, for instance, offering a specific service, tailoring educational materials or increasing the frequency of outreach may help an advisor to win over a prospect who is on the fence about which firm to hire or whether they even need advice.

Prospects are assigned a score based on those specific situation and characteristics, while generative AI provides suggestions around content and communication channels. The software won Catchlight a 2023 WealthManagement.com Industry Award for Marketing Automation in September.

Melamed said Catchlight has been focused on enabling more meaningful one-on-one connections, but it quickly became apparent that reaching out individually, even if only to prospects identified as likely to convert, was still a time-consuming endeavor for many advisors.

“So, now we’re enabling folks to do a one-to-many,” she said. “At the segment level, I can look at the top prospects within that segment and engage with them, but if I could engage with the top 100 right away, that’s an immediate lift.

“We’re upgrading our engagement capabilities and really mapping to digital marketing content, like from FMG or any other topics that potential clients might, in aggregate, be thinking about. Or generative emails for cold, warm, and hot prospects that are created for the segment as opposed to just an individual.”

Catchlight never sends any communications without the approval of the advisor, she noted.

“We enable an advisor to massage that from a compliance standpoint or drop it into their digital marketing solution or work within their digital marketing solution, whichever is their choice,” she said. “We are all about advisor efficiency and the numbers play goes right along with that.”

Carson Group is among the firms who have partnered with Catchlight, incorporating the software into its home-grown lead generation program, as are Bluespring Wealth Partners, XML Financial and financial advisor marketing firm Advisors Excel, to name a few.

“We’ve really been impressed with Catchlight and their technology and their consulting ability,” former Bluespring President David Canter told WealthManagement.com this summer after the firm launched a multi-tiered lead conversion program leveraging Catchlight.

“I have referred to Catchlight as a practice management company around lead generation that just happens to be in the AI-powered lead optimization business,” he said. “They have great team members with consulting expertise who know what’s worked in the marketplace. And they have a great sense of what the leading and innovative lead generation practices are.”

“We’re going to be doing other things,” Melamed said. “There’s a really cool collection that’s dropping throughout the end of the year that will really reinforce how an advisor is equipped to go after some of these opportunities or even engage with their clients in a compelling, personalized way—and really be able to do that at scale.”