(Bloomberg Opinion) — “We don’t have red flags,” Blue Owl Capital Inc.’s Marc Lipschultz said on the private asset manager’s earnings call this month. “In point of fact we don’t have yellow flags,” the co-chief executive officer continued somewhat tortuously. “We actually have largely green flags.”

Investors don’t see it that way and have been pulling money from the firm’s various private credit vehicles. Blue Owl’s decision this week to block redemptions from one of those funds looks like a huge red flag. By closing the gates on this fund and selling $1.4 billion of loans held by three of its vehicles, the firm is shoring up cash holdings to reassure institutional and individual investors. But this is a febrile moment for private credit, and every move can be read as good or bad by supporters and naysayers. More than anything, this episode renews doubts about whether such private funds are suitable for retail investors at all.

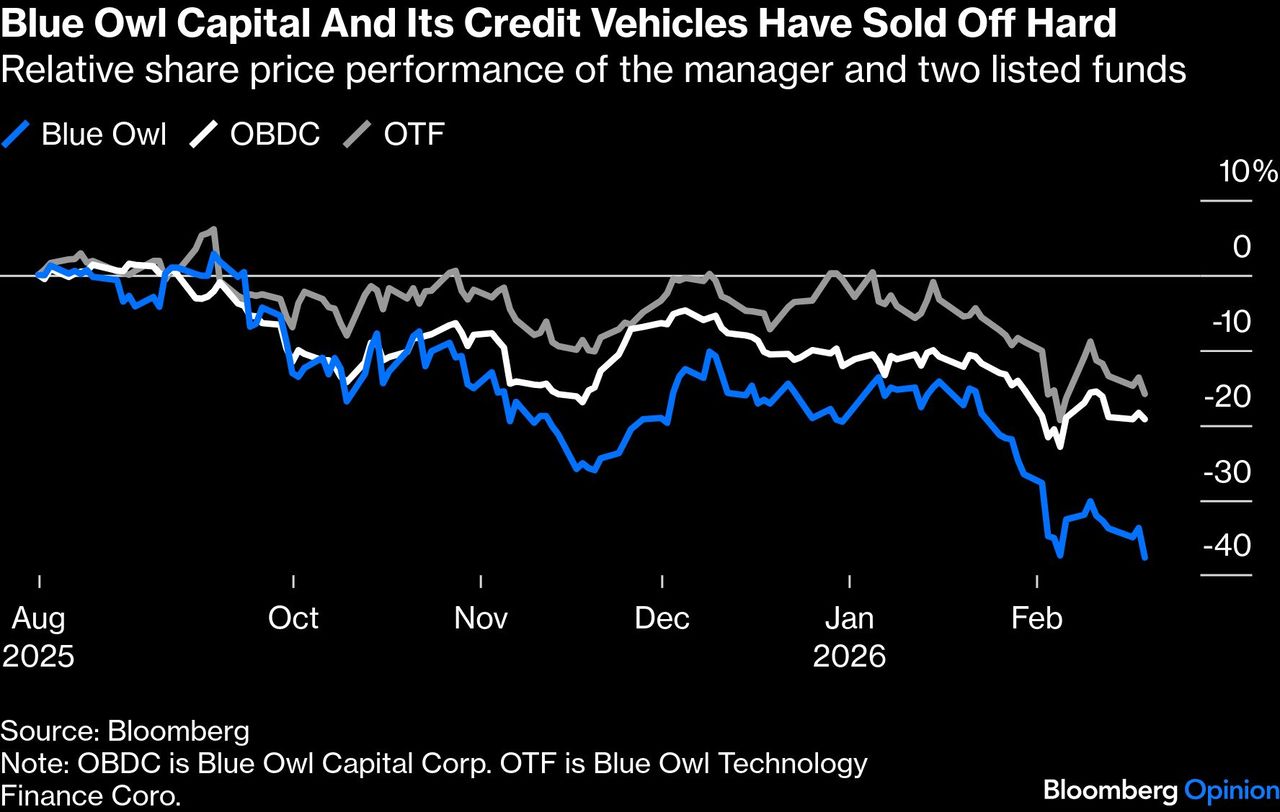

Blue Owl isn’t alone in suffering redemptions. Fears about what artificial intelligence will do to software companies have hit private asset managers as well as public stock and bond markets. But one of Blue Owl’s technology focused credit vehicles saw bigger withdrawals than several rival funds in the final quarter of last year.

The loan sales that Blue Owl completed this week will restore the cash available in this entity and a listed credit fund. But $600 million of the money raised will mainly be used for a special payout to investors in a third unlisted vehicle, Blue Owl Capital Corp. II; that handout is worth 30% of its net asset value.

This fund, known as OBDC II, caused controversy last November when Blue Owl made an abortive attempt to merge it with a listed sister vehicle, called OBDC. The point of the merger was to give investors in OBDC II an easier exit; as part of the listed fund, they could sell shares if they wanted out. The deal fell apart because the terms looked likely to cost investors in the unlisted version as much as 20% of their money.

Blue Owl said after markets closed on Wednesday that the unlisted ODBC II would no longer offer quarterly redemptions for investors, but instead would make regular payouts funded by income, loan repayments and further opportunistic loan sales. From now on, individual investors have no say over when they get their money back. This is never a good look for a fund manager and has hurt the reputation of firms and less liquid asset classes, like private credit and real estate, in the past.

Blue Owl executives put a positive spin on the loan sales because they achieved prices worth 99.7% of their face value — and the largest industry sector in the pool sold was internet software and services, the epicenter of current investor fears. For comparison, software debt in the market for leveraged loans, which trade more regularly than private credit, are currently priced at around 91 cents on the dollar. However, when any manager is under pressure, they tend to sell their best-priced assets first. The bearish view is that the loans left behind are weaker. “Investors are likely to focus on what wasn’t sold – both within ODBC II and across [Blue Owl’s] broader credit platform,” wrote Glenn Schorr, an analyst at Evercore ISI.

And of course, if there wasn’t the pressure to pay out cash to skittish clients, the firm wouldn’t be selling assets at all, as Bloomberg Intelligence analysts put it.

The positive spin was no help to shares in Blue Owl or its listed credit funds. Stock in the firm itself is down nearly 40% over the past six months and hit its lowest level in nearly two and a half years on Thursday. ODBC is down nearly 20% in six months, while Blue Owl Technology Finance Corp., another listed vehicle, is down 16%.

As bad as it is for sentiment, limiting withdrawals from vehicles that own less liquid assets, like the Blue Owl funds, is often the right thing to do. It’s a matter of fairness to all investors and of stopping a fire sale in which everyone ends up worse off. The more assets get sold, the more likely it is a fund really is left with only the bad stuff and the greater the chance that contagion hits more prices and funds across the market. At its worst, the dynamic is no different from a bank run.

Individual retail investors in illiquid assets like private credit should always be aware of this possibility – and of the fact that unlike banking, there is no government-run insurance scheme to stop them losing everything if panic gets really out of control.

More from Bloomberg Opinion:

-

Schroders’ US Buyer Is Just

-

AI May Trigger a Singularity in

-

Matt Levine’s Money Stuff:

Want more from Bloomberg Opinion? OPIN <GO>. Or subscribe to our daily newsletter .

To contact the author of this story:

Paul J. Davies at [email protected]

©2026 Bloomberg L.P.