The Bitcoin mining sector has stirred significant controversy in the past. While many activists were attacking both the industry and BTC holders, there appears to be a shifting narrative. A recent study conducted by the Institute of Risk Management [IRM] has brought about a new perspective. The report, “Bitcoin and the Energy Transition: From Risk to Opportunity,” suggested that Bitcoin can play a role in driving a global energy transition. It is clearly moving on to the other side of the climate change debate.

Bitcoin mining has the potential to contribute to an 8% dip in global emissions by 2030. The king coin has done so through the conversion of wasted methane emissions into less harmful forms. The report read,

“We have shown that while Bitcoin is a consumer of electricity, this does not translate to it being a high emitter of carbon dioxide and other atmospheric pollutants. Bitcoin can be the catalyst to a cleaner, more energy-abundant future for all.”

Furthermore, the report illustrates this through a theoretical scenario, suggesting that utilizing captured methane to fuel Bitcoin mining operations could effectively decrease the release of methane into the atmosphere.

Alongside, KPMG’s recent report highlights Bitcoin’s potential to fulfill various ESG [Environmental, Social, and Governance] roles. This included aiding power grid stability, promoting renewable energy investments, utilizing stranded energy resources, and reducing methane emissions. This report aligns with new research from Cambridge University and Bloomberg Intelligence. These show that Bitcoin’s environmental impact is smaller than initially believed.

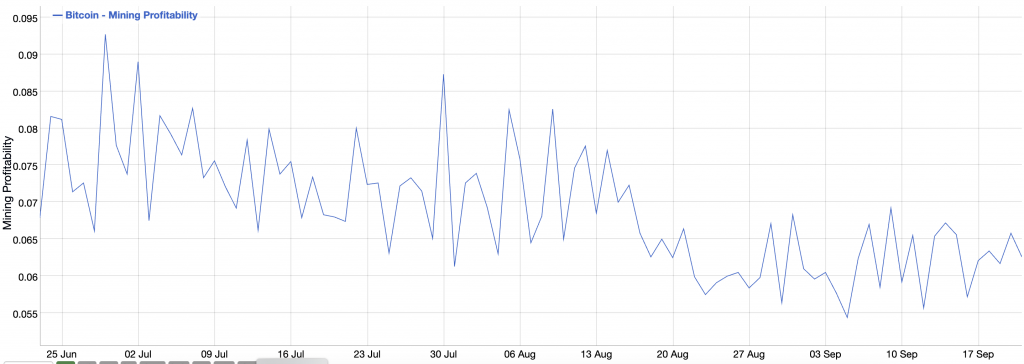

Although the mining industry has improved its environmental efficiency, the aspect of profitability is dipping. Recent data revealed that Bitcoin mining profitability has fallen to 0.0616 USD per day for every 1 THash/s, marking a notable drop since the beginning of July.

Also Read: Mining One Bitcoin is Less Expensive Than Drying Clothes

Bankrupt Bitcoin Miner Core Scientific’s Big Bet

Despite limited profitability, a bankrupt mining firm was seen making big purchases. Core Scientific has announced its acquisition of 27,000 BTC mining servers from Bitmain. The transaction will involve a payment of $23.1 million in cash and $53.9 million worth of common stock. This agreement was initially discussed as a component of Core Scientific’s bankruptcy strategy. Additionally, Anchorage Digital, a crypto firm, might also be considering an equity stake in the company.

Core Scientific anticipate the arrival of these units, which could potentially contribute 4.1 exahashes to its hashing power, during the fourth quarter of this year. Bitmain CEO Max Hua added,

“Core Scientific is an important contributor to the strength and stability of the Bitcoin Network, and we look forward to working closely with their team to help realize Bitcoin’s full potential.”

Also Read: Bitcoin: Europe Is the Costliest BTC Mining Hub