The Bitcoin [BTC] market took a big hit earlier today, The asset plunged to a low of $57,800 all the way from a high of $61,055. At press time, BTC was trading at $58,854.99 with a 3.60%. The rest of the market followed suit as strong players like Ethereum [ETH] and Solana [SOL] dipped by 4.40% and 8.96% over the past 24 hours.

The asset is currently 20.2% below $73,750.07, its all-time high. March 2024 was just four months ago when this high was reached. The price of BTC is currently at a two-month low. After years of delayed deadlines, several experts have connected the most recent dip to Mt.Gox’s intention to begin returning funds that were taken from customers in a 2014 breach in July 2024. Repayments will be made in Bitcoin and Bitcoin Cash [BCH], which may put pressure on the market to sell. While the market is drowning in bearish sentiment, certain assets continue to look on the brighter side.

Also Read: Bitcoin To Hit $150,000, Fundstrat’s Tom Lee Confirms

Bitcoin Investors Remain Bullish

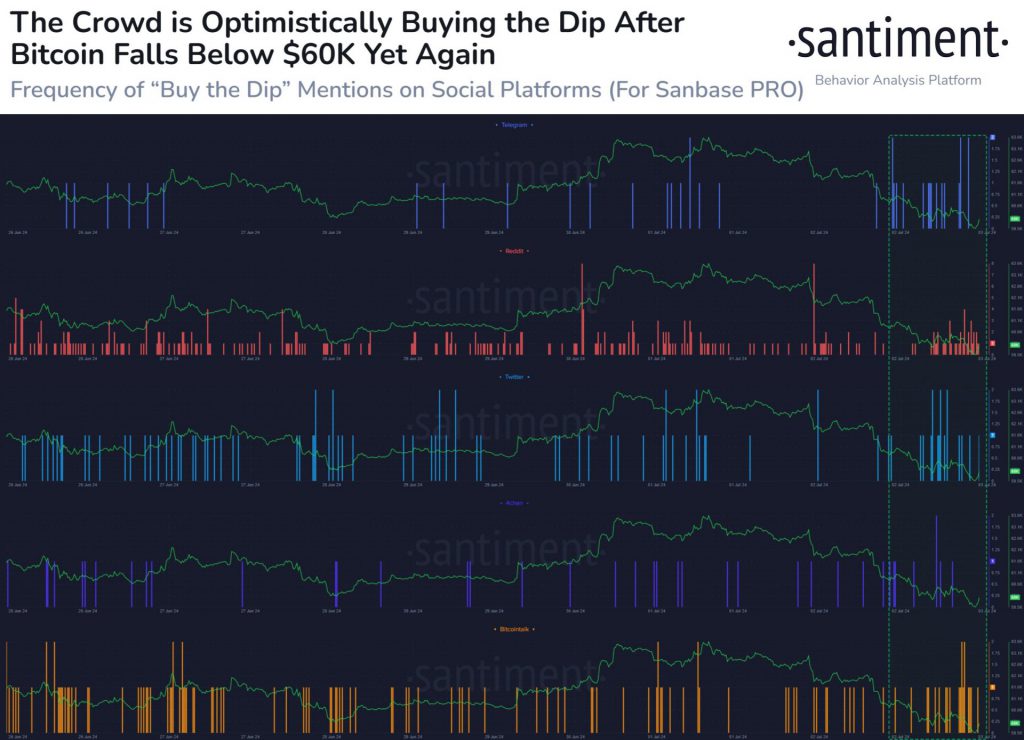

The Bitcoin market is divided between investors who sell quickly during a price drop and those who continue accumulating. Data from Santiment revealed that that retail buyers are actively acquiring Bitcoin below $60,000. Santiment said,

“The crowd is showing signs of seeing this as a buy-the-dip opportunity. Ideally, we wait for their enthusiasm to settle down. The time to buy is when they are impatient and skeptical.”

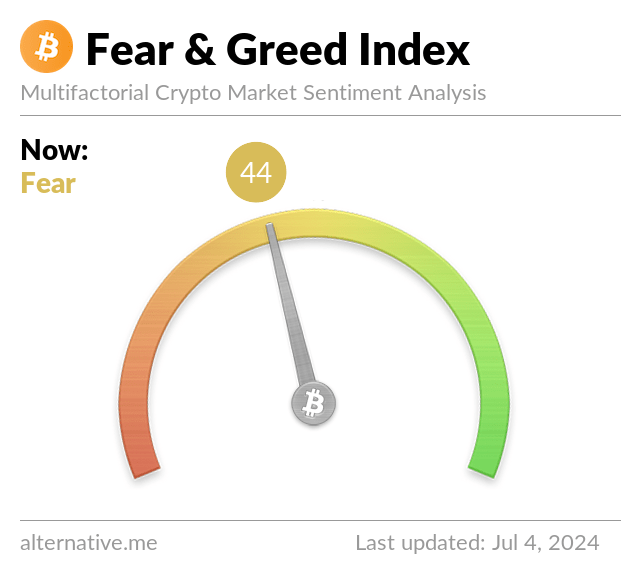

The above image shows how, in the two days that have followed Bitcoin’s most recent decline, references to “buy the dip” on Reddit, X, 4chan, and Bitcoin Talk have doubled. In addition, with a score of 44 out of 100, the Crypto Fear and Greed Index, which gauges investor attitude toward Bitcoin and the cryptocurrency market as a whole, is now in the “Fear” zone. On June 25, it reached an 18-month low of 31, and it has since been bouncing between 30 and 53.

Also Read: Cryptocurrency: 3 Trending Coins To Buy Before Bitcoin Hits $75K