- Completed enrollment in pivotal Phase 3 “DRAGON” trial for Tinlarebant in adolescent Stargardt disease (“STGD1”) with 100 subjects enrolled across 11 countries worldwide

- First subject dosed with Tinlarebant in pivotal global Phase 3 “PHOENIX” trial in Geographic Atrophy (“GA”)

- Oral, once-daily Tinlarebant continues to be safe and well tolerated, slowing expansion of autofluorescence, reducing incident atrophic retinal lesion growth rate, and stabilizing visual acuity up to 18-months in Phase 2 STGD1 trial (“LBS-008-CT02”)

- Strengthened balance sheet with $30 million of gross proceeds from the underwritten public offering

- Final 2-year data of LBS-008-CT02 in STGD1 expected in Q4 2023 and interim Phase 3 safety and efficacy data from pivotal “DRAGON” trial expected in mid-2024

- Conference Call and Webcast Wednesday, August 9, 2023, at 4:30 p.m. ET

SAN DIEGO, Aug. 08, 2023 (GLOBE NEWSWIRE) — Belite Bio, LLC (NASDAQ: BLTE) (“Belite” or the “Company”), a clinical stage biopharmaceutical drug development company focused on advancing novel therapeutics targeting retinal degenerative eye diseases which have significant unmet medical needs, today announced its financial results for the three months ended June 30, 2023 and provided a general business update.

“We continue to execute on key milestones and make significant progress across our late-stage program for Tinlarebant, an oral, once-daily treatment for retinal degenerative diseases including STGD1 and GA,” said Dr. Tom Lin, Belite’s Chairman and CEO. “We are pleased to have dosed the first subject in our pivotal PHOENIX trial for GA, in addition to completing enrollment in the pivotal DRAGON trial in adolescent STGD1. We have several potential inflection points over the next 12-18 months and anticipate the final 2-year data of LBS-008-CT02 will become available during the fourth quarter of this year, and the interim Phase 3 safety and efficacy data from our pivotal DRAGON trial will become available in mid-2024.”

Dr. Nathan L. Mata, Chief Scientific Officer of Belite Bio added, “The slowing of lesion growth and stabilization of visual acuity up to 18-months in the Phase 2 STGD1 trial with Tinlarebant is encouraging and reinforces the potential to treat other retinal degenerative diseases like GA. Oral vitamin A based approaches like fenretinide have previously demonstrated promise for the treatment of GA, but were limited to only a subset of patients due to the poor bioavailability and potency of fenretinide. We believe the chemical design of Tinlarebant overcomes the limited potency and bioavailability associated with fenretinide and offers the potential for enhanced efficacy outcomes across a broader patient population with a more selective targeting for improved safety.”

Second Quarter 2023 Business Highlights and Upcoming Milestones:

Clinical Highlights

Tinlarebant (LBS-008) is designed to be an oral, potent, once-daily retinol binding protein 4 (RBP4) antagonist that decreases RBP4 levels in the blood and selectively lowers vitamin A (retinol) delivery to the eye without disrupting systemic retinol delivery to other tissues. Vitamin A is critical to normal vision but can accumulate as toxic byproducts leading to retinal cell death and vision loss diseases such as STGD1 and GA, the advanced form of dry Age-Related Macular Degeneration (dry AMD).

- Stargardt disease (STGD1): Accumulation of cytotoxic bisretinoids has been implicated in the onset and progression of STGD1. Tinlarebant has been granted Fast Track and Rare Pediatric Disease (RPD) designations by the U.S. Food and Drug Administration (FDA), and orphan drug designation (ODD) in the U.S. and Europe for STGD1. There are currently no FDA-approved treatments for STGD1.

- LBS-008-CT02 trial: Ongoing, open-label, 2-year Phase 2 trial in adolescent STGD1 subjects

- 18-month efficacy and safety update (n = 12) at 2023 Association for Research in Vision and Ophthalmology (ARVO) demonstrated:

- Tinlarebant continues to be safe and well tolerated

- Nearly 60% of subjects (7 out of 12) had no incident atrophic retinal lesions as assessed by fundus autofluorescence (FAF) imaging

- Tinlarebant stabilized visual acuity with no significant loss and no clinically significant changes in retinal thickness

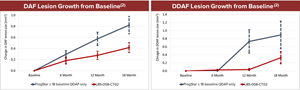

- When compared with participants from the Prospective Cohort Study of Childhood-Onset STGD1 by Georgiou et al., (2020), subjects in LBS-008-CT02 showed a reduced expansion of decreased autofluorescence (DAF) lesions from baseline to 18 months (0.69 ± 0.72 mm2/year versus 0.28 ± 0.28 mm2/year, respectively)(1). Areas of DAF represent the combined area of questionably decreased autofluorescence (QDAF) + definitely decreased autofluorescence (DDAF) lesions

- When compared with ProgStar study participants ≤ 18 years old with only QDAF lesions at baseline, subjects in LBS-008-CT02 treated for up to 18 months showed(1):

- Reduced expansion of DAF lesion size from baseline;

- Reduced expansion in DDAF lesion size from baseline

- 18-month efficacy and safety update (n = 12) at 2023 Association for Research in Vision and Ophthalmology (ARVO) demonstrated:

- Pivotal DRAGON trial: 2-year, randomized, double-masked, placebo-controlled, global, multi-center, pivotal Phase 3 trial in STGD1 subjects aged 12-20 years old:

- Enrollment complete, with 100 subjects across 11 countries worldwide including sites in the U.S., the United Kingdom, Germany, Belgium, France, Switzerland, China, Hong Kong, Taiwan, Australia, and the Netherlands

- Primary efficacy endpoint is slowing of lesion growth rate; safety and tolerability will also be assessed

- Mid 2024: Interim efficacy and safety data expected

- LBS-008-CT02 trial: Ongoing, open-label, 2-year Phase 2 trial in adolescent STGD1 subjects

- Geographic Atrophy (GA): GA, the advanced form of dry AMD, is a chronic degenerative disease of the retina that leads to blindness in the elderly. Accumulation of toxic vitamin A byproducts (bisretinoids) has been implicated in the progression of GA. There are currently no FDA approved orally administered treatments for GA.

- Pivotal PHOENIX Trial: 2-year prospective, randomized (2:1, active:placebo, n ~430), double-masked, placebo-controlled, global, multi-center, Phase 3 trial in subjects with GA.

- Primary efficacy endpoint is slowing of lesion growth rate; safety and tolerability will also be assessed

- First subject has been dosed

- Interim analysis expected at mid-point of the trial

- Pivotal PHOENIX Trial: 2-year prospective, randomized (2:1, active:placebo, n ~430), double-masked, placebo-controlled, global, multi-center, Phase 3 trial in subjects with GA.

Corporate Highlights

- Completed an underwritten public offering of American Depositary Shares (“ADSs”) and warrants for gross proceeds of $30 million

- Hosted two key opinion leader (KOL) events in May focused on a STGD1 disease overview and a discussion of Tinlarebant data in adolescent subjects:

- Professor Hendrik Scholl, M.D. (Chairman of the Department of Ophthalmology, University of Basel) who discussed STGD1 overview and the 18-month data from the LBS-008-CT02 trial evaluating Tinlarebant for STGD1

- Professor Michel Michaelides, M.D. (Professor of Ophthalmology at the UCL Institute of Ophthalmology) who discussed the progression of childhood-onset STGD1 and the relevance of Tinlarebant’s LBS-008-CT02 trial 18-month data

Second Quarter 2023 Financial Results:

Cash and Cash Equivalents: As of June 30, 2023, the Company had $57.4 million in cash.

R&D Expenses:

For the three months ended June 30, 2023, research and development expenses were $5.5 million compared to $1.6 million for the same period in 2022. The increase resulted primarily from an increase in (x) expenses for conducting PHOENIX trial and (y) wages and salaries due to our R&D team expansion. For the six months ended June 30, 2023, research and development expenses were $11.2 million compared to $2.5 million for the same period in 2022. The increase in research and development expenses was primarily attributable to increases in (i) expenses related to conducting DRAGON and PHOENIX trials, and (ii) wages and salaries due to our R&D team expansion.

G&A Expenses:

For the three months ended June 30, 2023, general and administration expenses were $1.4 million compared to $0.9 million for the same period in 2022. The increase resulted primarily from an increase in (i) professional service fees and (ii) wages and salaries. For the six months ended June 30, 2023, general and administration expenses were $2.5 million compared to $1.1 million for the same period in 2022. The increase resulted primarily from an increase in (i) professional service fees and (ii) wages and salaries.

Net Loss:

For the three months ended June 30, 2023, the Company reported a net loss of $6.8 million or ($0.26) per share compared to $2.4 million or ($0.12) per share for the same period in 2022. For the six months ended June 30, 2023, the Company reported a net loss of $13.7 million or ($0.54) per share, compared to a net loss of $3.5 million or ($0.23) per share for the same period in 2022.

Webcast Information

Belite Bio will host a webcast to discuss the Company’s financial results and provide a business update. The call is scheduled on Wednesday, August 9, 2023, at 4:30 p.m. Eastern Time. To join the live webcast please click https://lifescievents.com/event/belitebio/. A replay will be available approximately two hours after the event for 90 days.

About Belite Bio

Belite Bio is a clinical stage biopharmaceutical drug development company focused on advancing novel therapeutics targeting retinal degenerative eye diseases with significant unmet medical needs, such as STGD1 and GA in advanced dry AMD, in addition to specific metabolic diseases. For more information, follow us on Twitter, Instagram, LinkedIn, Facebook or visit us at www.belitebio.com.

Important Cautions Regarding Forward Looking Statements

This press release contains forward-looking statements about future expectations, plans and prospects, as well as any other statements regarding matters that are not historical facts. These statements include but are not limited to statements regarding the potential implications of clinical data for patients, clinical development, regulatory milestones of its product candidates, and any other statements containing the words “expect”, “will”, “believe”, “target”, “anticipate”, and other similar expressions. Actual results may differ materially from those indicated in the forward-looking statements as a result of various important factors, including but not limited to Belite Bio’s ability to demonstrate the safety and efficacy of its drug candidates; the clinical results for its drug candidates, which may not support further development or regulatory approval; expectations for the timing of initiation, enrollment and completion of, and data relating to, its clinical trials; the content and timing of decisions made by the relevant regulatory authorities regarding regulatory approval of Belite Bio’s drug candidates; whether additional clinical trials may be required for DRAGON or PHOENIX studies based on their respective data; the potential efficacy of Tinlarebant, as well as those risks more fully discussed in the “Risk Factors” section in Belite Bio’s filings with the U.S. Securities and Exchange Commission. All forward-looking statements are based on information currently available to Belite Bio, and Belite Bio undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

| BELITE BIO, INC UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (Amounts in thousands of US Dollars, except share and per share amounts) |

||||||||||||||||

| For the Three Months | For the Six Months | |||||||||||||||

| Ended June 30, | Ended June 30, | |||||||||||||||

| 2022 | 2023 | 2022 | 2023 | |||||||||||||

| Expenses | ||||||||||||||||

| Research and development | 1,579 | 5,516 | 2,457 | 11,239 | ||||||||||||

| General and administrative | 927 | 1,355 | 1,102 | 2,513 | ||||||||||||

| Total operating expenses | 2,506 | 6,871 | 3,559 | 13,752 | ||||||||||||

| Loss from operations | (2,506 | ) | (6,871 | ) | (3,559 | ) | (13,752 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Total other income, net | 115 | 62 | 98 | 54 | ||||||||||||

| Loss before income tax | (2,391 | ) | (6,809 | ) | (3,461 | ) | (13,698 | ) | ||||||||

| Income tax expense | – | 3 | – | 9 | ||||||||||||

| Net loss | (2,391 | ) | (6,812 | ) | (3,461 | ) | (13,707 | ) | ||||||||

| Other comprehensive income (loss) | ||||||||||||||||

| Foreign currency translation adjustments, net of nil tax | (182 | ) | (76 | ) | (157 | ) | (60 | ) | ||||||||

| Total comprehensive loss | (2,573 | ) | (6,888 | ) | (3,618 | ) | (13,767 | ) | ||||||||

| Weighted average number of ordinary shares used in per share calculation: | ||||||||||||||||

| – Basic and Diluted | 19,659,441 | 25,785,147 | 14,992,848 | 25,350,949 | ||||||||||||

| Net loss per ordinary share | ||||||||||||||||

| – Basic and Diluted | $ | (0.12 | ) | $ | (0.26 | ) | $ | (0.23 | ) | $ | (0.54 | ) | ||||

| BELITE BIO, INC UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (Amounts in thousands of US Dollars, except share amounts) |

|||||||

| December 31, | June 30, | ||||||

| 2022 | 2023 | ||||||

| Current assets | $ | 42,807 | $ | 59,137 | |||

| Other assets | 1,466 | 1,558 | |||||

| TOTAL ASSETS | $ | 44,273 | $ | 60,695 | |||

| TOTAL LIABILITIES | $ | 2,772 | $ | 4,978 | |||

| TOTAL SHAREHOLDERS’ EQUITY | 41,501 | 55,717 | |||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 44,273 | $ | 60,695 | |||

| Ordinary shares authorized | 492,179,086 | 400,000,000 | |||||

| Ordinary shares issued and outstanding | 24,898,908 | 27,229,255 | |||||

Media and Investor Relations Contact:

Jennifer Wu / ir@belitebio.com

Tim McCarthy / tim@lifesciadvisors.com

| Note: | (1) Although we have compared the published data for the above studies to our interim data in the LBS-008-CT02 trial, the value of such comparisons is limited because they are derived from studies conducted under different protocols, at different sites, with different patient populations, and results were analyzed using non-standardized methods. We note our future trials may not confirm the comparisons or analyses we have made to date. |

| (2) For each subject, the mean lesion size between eyes was determined and the average value for the lesion sizes within each study group was calculated. The data show mean lesion sizes within each group ± standard error of the mean at each timepoint. | |

A chart accompanying this release is available at: https://www.globenewswire.com/NewsRoom/AttachmentNg/729308da-8c18-4067-b087-e5ec2da8e3df

Lesion Growth from Baseline

Lesion Growth from Baseline