Stocks in Asia declined ahead of the Federal Reserve’s last decision this year, led by selling in China after a top leadership meeting disappointed investors with a lack of strong economic support measures.

A regional gauge slipped as much as 0.4% as shares fell across the board in both Hong Kong and mainland China, with property developers among the biggest losers. The losses came after China’s annual economic work conference this week prioritized industrial policy and indicated little desire for large-scale stimulus.

ADVERTISEMENT

CONTINUE READING BELOW

“There was no surprise from the conference,” said Hao Hong, chief economist at Grow Investment Group. “The focus on security and risk, as well as high-quality development, naturally implies that at this stage high-quality growth trumps fast growth.”

Japan’s Topix index turned flat after an earlier advance, while stocks in Australia pared gains. US stock futures edged up after the S&P 500 hit the highest since January 2022 on Tuesday. Wall Street’s “fear gauge” — the VIX — slid toward a four-year low.

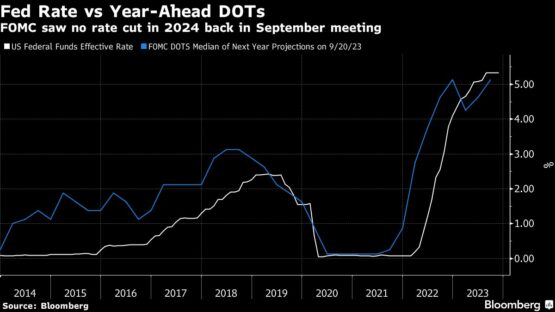

Globally, the focus is on the conclusion of the Fed’s policy meeting later Wednesday. While the central bank is widely expected to be on hold, the latest US inflation data raised doubts about the likelihood of an aggressive pivot toward policy easing. Markets have trimmed bets on rate cuts next year, with the first one projected to occur in May.

The dollar was little changed and Treasuries were steady. Long-term Treasuries swung to a small gain Tuesday after solid demand in a $21 billion sale of 30-year bonds.

Signals from Powell

Following the last Fed decision, Chairman Jerome Powell reminded investors that inflation progress will “come in lumps and be bumpy.” The fact that Tuesday’s consumer price index was roughly in line with estimates — and ticked up a bit — underscored the choppy nature of getting prices back to the 2% target — especially in the service sector, which the Fed has zoned in on as the last mile in its inflation fight.

“From a Fed policy perspective, the bar to hike or cut, both are high,” Neeraj Seth, head of Asian credit and a portfolio manager at BlackRock, said on Bloomberg Radio. “The Fed will remain data dependent and at this point the data warrants a pause, a continued pause, but I don’t think we are at a point where the Fed will start signaling any form or shape of cuts coming soon.”

With the Fed widely expected to keep its target rate range steady for the third straight meeting at 5.25% to 5.5%, traders will carefully scrutinize any signals from Powell on the path for policy and the update to the central bank’s quarterly forecasts.

Signs of disinflation helped drive the US bond market last month to its biggest gain since the mid-1980s, with yields tumbling sharply on speculation the Fed will cut its benchmark rate by over a full percentage point in 2024.

ADVERTISEMENT

CONTINUE READING BELOW

US Treasury Secretary Janet Yellen said Tuesday she doesn’t believe the “last mile” in returning inflation to the Fed’s 2% goal will be especially difficult.

How the Fed frames its outlook for rate policy ending next year and 2025 via its “dot plot” could inject some uncertainty into a market that has run ahead of the central bank’s current forecast.

Elsewhere, Argentina devalued the peso by 54% after the close of local markets on Tuesday and announced a swath of spending cuts, in the first steps of President Javier Milei’s shock-therapy program to revive the nation’s troubled economy. The nation’s central bank now targets a 2% currency devaluation per month.

Oil extended a decline after plunging to the lowest level in five months Tuesday as signs of robust supplies piled up. Gold was flat as investors awaited the Fed’s rate decision.

Key events this week:

- Eurozone industrial production, Wednesday

- US PPI, Wednesday

- Federal Reserve policy meeting and news conference with Chair Jerome Powell, Wednesday

- European Central Bank policy meeting followed by news conference with ECB President Christine Lagarde, Thursday

- Bank of England policy meeting, Thursday

- Swiss National Bank policy meeting, Thursday

- US initial jobless claims, retail sales, business inventories, Thursday

- China 1-yr MLF rate and volume, property prices, retail sales, industrial production, jobless rate, Friday

- Eurozone S&P Global Manufacturing PMI, S&P Global Services PMI, Friday

- US industrial production, Empire manufacturing, cross-border investment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 1:46 p.m. Tokyo time. The S&P 500 rose 0.5%

- Nasdaq 100 futures rose 0.2%. The Nasdaq 100 rose 0.8%

- Japan’s Topix index fell 0.1%

- Hong Kong’s Hang Seng Index fell 0.7%

- China’s Shanghai Composite Index fell 0.5%

- Australia’s S&P/ASX 200 Index rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0788

- The Japanese yen fell 0.1% to 145.62 per dollar

- The offshore yuan was little changed at 7.1966 per dollar

- The Australian dollar was little changed at $0.6555

Cryptocurrencies

- Bitcoin fell 0.5% to $40, 871.07

- Ether fell 0.3% to $2,165.39

Bonds

- The yield on 10-year Treasuries declined one basis point to 4.19%

- Japan’s 10-year yield declined 3.5 basis points to 0.700%

- Australia’s 10-year yield declined five basis points to 4.27%

Commodities

- West Texas Intermediate crude fell 0.2% to $68.50 a barrel

- Spot gold was little changed

© 2023 Bloomberg