Edelman Financial Engines released its second annual Everyday Wealth in America study this week, capturing shifting sentiments around macro concerns, individual threats and what it even means to be wealthy.

Edelman polled 2,022 U.S. citizens over the age of 29 between Aug. 28 and Sept. 8 of this year, in a sample that included 1,013 respondents—45 or older—with between $500,000 and $3 million in household assets who were either already working with a financial advisor or open to doing so.

“Our research shows how the market volatility over the past two years has taken a financial and emotional toll on individuals and families regardless of wealth,” said Edelman Chief Client Officer Kelly O’Donnell. “We’re seeing how it impacts the big financial moments in life, like deciding when to purchase a home or how to retire, as well as our everyday moments, like buying groceries for our families and filling up the car.”

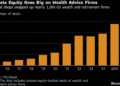

Inflation remained the top concern in 2023, dropping to 84% percent of all respondents from 87% last year, while money issues were unsurprisingly still identified as the leading cause of stress at 46%. (In 2022, 56% of respondents were stressed out by the economy in general, while 43% were worried about their own personal finances.)

Recession fears fell from 86% to 78% but worries about the current political environment appear to have taken their place. This is particularly true among affluent Americans—nine in 10 cited it as their top concern and eight in 10 said they’re specifically worried about the upcoming presidential election. While just 31% of all survey respondents said politics is what keeps them up most nights, it was the main source of stress for nearly half (47%) of the affluent contingent.

While 80% of the respondents in last year’s study indicated they were making sacrifices in the face of inflation and rising interest rates, credit card debt ballooned in 2023 and was seen as the biggest obstacle to wealth-building among both contingents—39% of all Americans and 32% of those deemed affluent.

A third are uneasy with the debt they’ve incurred, while almost a quarter feel emotionally burdened.

Interest rates have also combined with high inflation and low inventory to stress out prospective homebuyers, many of whom have had to put plans on hold in 2023. Among those who were considering buying a home, more than a third of affluent respondents and 45% of the entire sample said they were discouraged, while the percentage climbs to about half of those in their 30s.

The study also looked at the effects of social media on financial expectations and self-esteem.

Nearly three-quarters of those surveyed believe their friends portray themselves as wealthier than they are on social media, but 27% admit it makes them feel worse about their own situation and a full third said it has caused them to spend on items they couldn’t afford.

“Advisors do see that,” said Advisory Services Network Managing Member Tom Prescott. “Most advisors who are any good at what they do, certainly if they are taking a holistic approach to the client, are looking at debt levels, where they own, whether their kids have already been educated and what expenditures they’re going to have to make.”

Prescott believes investors have taken a step back to reconsider holdings that may not be keeping up with the rate of inflation, but said overspending remains a problem that can be hard for an advisor to curb.

Notably, concerns around “missing out” and over-spending are considerably lower among respondents who spend less of their time on social media—dropping from just over half of those who spend more than three hours a day on the apps to just 16% among those who spend less than an hour.

Perhaps one of the most interesting trends noted by the study is the rising standard of what wealth actually means in this country.

The vast majority of those surveyed continue to feel the term ‘wealthy’ excludes them—just 14% in 2023 and 12% in 2022 placed themselves in this category—and the rising cost of goods has moved the goalpost for many. Last year, 57% of all respondents said they would need to have at least $1 million in the bank, compared with more than two-thirds (67%) in 2023.

Among the affluent subset, it costs a lot more to call yourself wealthy.

When it comes to those with more than $500,000, pretty much all (98%) agree that it takes at least twice that much to join the club and more than a third (36%) believe no less than $5 million is the magic number. That’s more than double the full sample and up three percentage points from last year.

‘Let’s face it,” said Prescott. “A million dollars in 1970 and a million dollars today day is wildly different in terms of what you can buy. Unfortunately, inflation and other external factors that none of us control has not helped us in that regard.”

“But I think that’s what has driven much of the independent market,” he added, pointing out that some larger institutions don’t consider a potential client to be significantly wealthy if they have less than $25 million. “If you’re under $25 million, but you’re over a million dollars, where are you going to go to find access to the tools and advice that you need?”

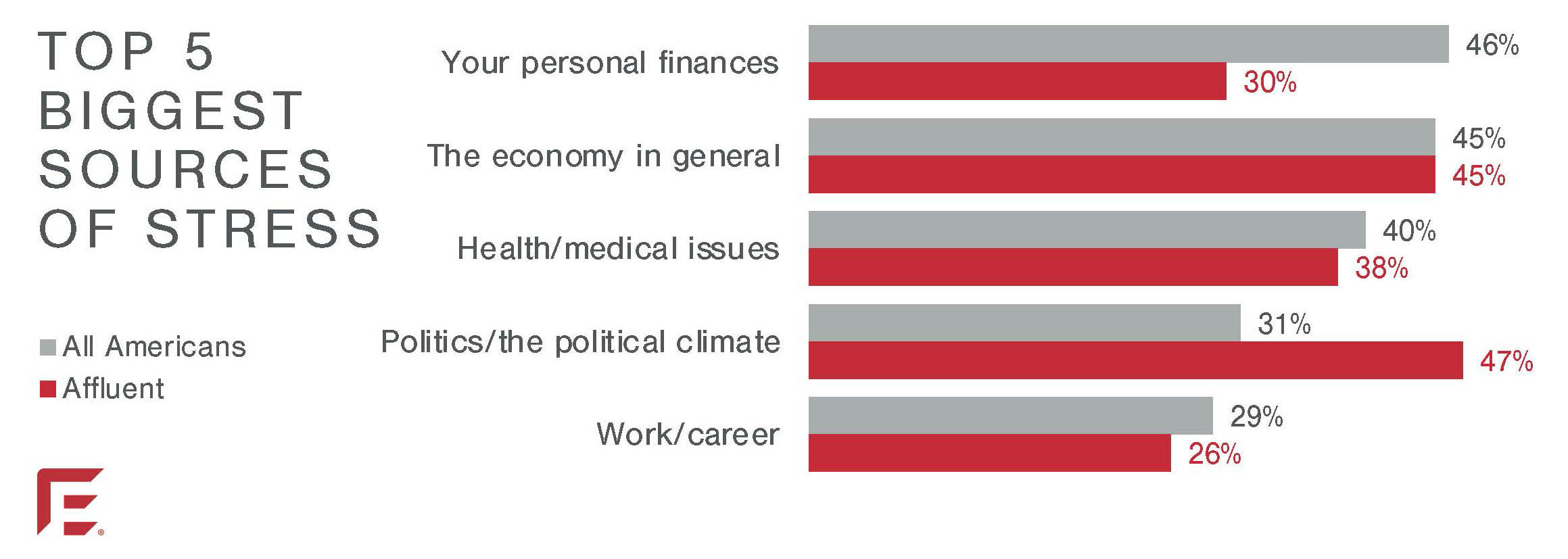

Possibly more interesting is the way respondents view the difference between ‘wealthy’ and ‘worry-free.’

Later in life, proclaiming wealth seems to demand more money than simply being free of financial worries, while those in their 40s think it costs more not to worry (at an average of $2.69 million) than it does to call themselves rich ($1.73 million).

Among all study participants, only 37% said they work with a financial advisor, but 76% of those who do claimed it reduces their fiscal anxiety.

The Edelman study launched last year to gain insights to help advisors better support their clients. The study covers a range of topics, including issues related to families and wealth planning, financial stressors, and personal challenges and perceptions about money, wealth and the larger macro environment.

“No matter how you feel or where you are in your wealth-building journey, a trusted advisor can help navigate a broad range of ‘life and money’ issues,” Edelman’s O’Donnell said. “Insights from research like this deepens our understanding of the challenges Americans face and helps us guide our clients on their own path to everyday wealth.”

Majority owned by Hellman & Friedman and minority backed by Warburg Pincus, Edelman Financial Engines was created in 2018 when H&F merged Ric Edelman’s $21.7 billion AUM RIA, Edelman Financial Services, with Financial Engines, a tech-focused corporate retirement plan advisor with $169 billion in managed assets. Based in Santa Clara, Calif., the firm currently manages around $245 billion for some 1.3 million clients.