The S&P 500 (SPY) continues to dance around 5,000. However, many market commentators are wondering when these large caps are going to hand over the reins to small caps after a 4 year advantage. Lets remember that going back 100 years there is a clear and decided advantage in smaller stocks. Discover what Steve Reitmeister predicts in the coming year including a preview of this top 12 stocks to buy now. Read on below for more.

Should stocks break above 5,000 for S&P 500 (SPY) now?

No…that is not very logical as the start date for Fed rate cuts keeps getting pushed further and further into the future. However, it is an important lesson to appreciate that when you are in a bull market, it is best to just stay invested as you never know when the next bull run will take place.

Meaning that more and more the evidence confirms that market timing is a “fools’ errand“. So, the wise thing to is simply stay bullish during bull markets.

That doesn’t mean that every stock will go up. So, let’s spend our time today discussing the stocks that have the best chance to outperform in 2024.

Market Commentary

This was an interesting week for the market. After 2 straight sessions breaking above 5,000, stocks were sent reeling on Tuesday’s much hotter than expected CPI report which pushed out the likely start date for rate cuts.

The -1.37% decline for the S&P 500 was pretty rough. But even more brutal was the -3.96% slashing of small caps.

This “seemed” to set the stage for a consolidation period under 5,000 and perhaps a stiffer 3-5% pullback as investors await a clearer signal to move ahead. Yet on Wednesday investors obviously got a case of amnesia as stocks closed the session at 5,000.62. And then Thursday pressed further higher to 5,029.73.

If you want a narrative to explain this, then it could be twisted that the much weaker than expected Retail Sales report on Thursday should help with the inflation problem. However, that doesn’t hold much water when GDPNow estimates still call for +2.9% growth in Q1.

That is a touch too hot for Fed’s liking. Meaning these are above trend growth levels for the US economy that bring it with it more inflationary pressures.

No doubt the Fed would prefer a true “soft landing” reading closer to 1% GDP growth that would come with greater moderations of inflationary pressures.

This brings us back to the “animal spirits” part of investing:

Bull markets will be bullish…and bear markets will be bearish.

No one is arguing that we are not in a bull market right now. So, no matter how logical it might seem for the recent stock advance to simmer down until the timing of Fed rate cuts is clearer…it is also unwise to bet against that primary bullish trend.

To sum it up…stay bullish until there are concerns of recession that would increase the odds of a recession forming.

With that being said, I will stick to my earlier prognostications for 2024 that there is not a tremendous amount of upside for the S&P 500 after the tremendous gains the past 17 months from the October 2022 lows. Instead, the large caps, and in particular the Magnificent 7 mega caps, that dominate the index are fully valued to overvalued by most objective standards.

I suspect that 5,250 (about 10% above the 2023 close) is a generous upside for the market this year. Instead, I foresee the 4 year advantage for large caps over their smaller peers is going to end.

This tide started to turn during the late 2023 rally. Yet as the calendar flipped to 2024 investors got back to their old habits.

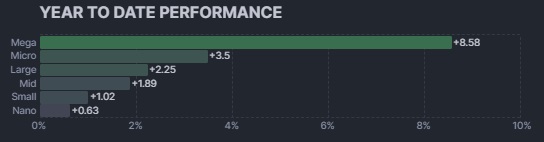

That being a concentration in the Magnificent 7 stocks that has mega caps pulling way ahead of the pack. This is on clear display in the chart below:

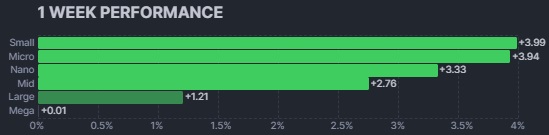

The good news is that this past week small caps are taking the baton to lead the stock investing race. And yes, Mega caps pressed pause at the same time.

My gut continues to believe strongly that this recent trend has legs. That investors will have to look farther and wider to find stocks worthy of more upside.

This will lead them to small and mid caps that have impressive growth prospects. The key being much more reasonable valuations than their large cap peers. The combination of superior growth + attractive valuation = greater upside potential.

This investing playbook is at the very heart of the way I am managing my portfolios this year. And gladly leans into the strength of our POWR Ratings system.

This quantitative system analyzes 5,300 stocks by the same 118 factors. Meaning it can analyze the fundamental and price action merits of Apple and NVIDIA by the same yardstick it can measure a $500 million market cap “under the radar” selection.

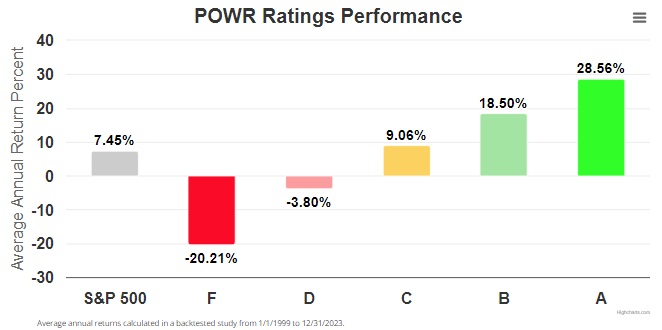

Indeed, it is that daily analysis of 118 different factors for every stock that unearths those with stellar growth and value characteristics that points to future outperformance. And thus, why this POWR Ratings performance chart dating back to 1999 speaks for itself:

Which top rated POWR Ratings stocks am I selecting at this time?

Read on below for the answers…

What To Do Next?

Discover my current portfolio of 12 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

This includes 5 under the radar small caps recently added with tremendous upside potential.

Plus I have 1 special ETF that is incredibly well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these lucky 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares were trading at $500.82 per share on Friday morning, down $1.19 (-0.24%). Year-to-date, SPY has gained 5.37%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

More…

The post Are Small Cap Stocks Ready to Lead? appeared first on StockNews.com

![Chainlink [LINK] Price Prediction: October End 2023](https://lbnntv.com/wp-content/uploads/2023/10/Chainlink-LINK-Price-Prediction-October-End-2023-120x86.png)