A scheme to sell shares in a mural painted by Banksy in Margate, southern England could be illegal, according to a lawyer who specialises in financial regulation.

Banksy’s Valentine’s Day Mascara (2023) depicts a woman with a black eye disposing of her husband in a chest freezer. Intended as a commentary on domestic violence, it was meant to remain on public view in Margate. But within months of it being painted on 14 February, the work was cut from the wall and put up for sale by RedEight gallery in London. When the gallery’s owner, Julian Usher, couldn’t find a buyer, he approached Dreamland amusement arcade in Margate and a deal was struck to display the mural for at least 12 months.

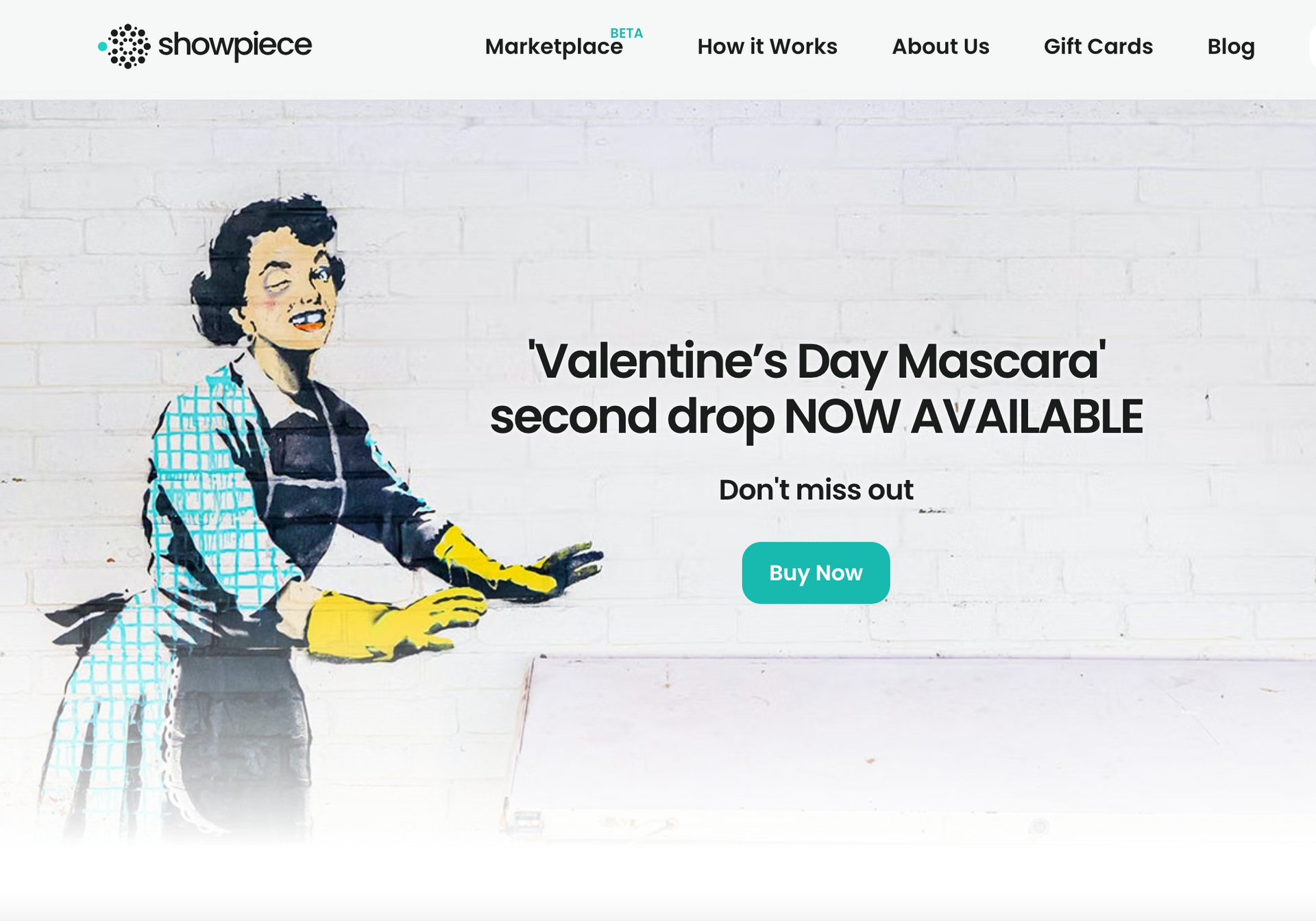

Yet two months later, another deal had been brokered with the online marketplace Showpiece to fractionalise the mural and sell it to a mass market for £120 a share. So far, at least £250,000 has been raised via the sale of more than 2,000 tokens. The mural is currently on show in London as part of the touring exhibition, The Art of Banksy—the show has not been authorised by the artist.

Fractional ownership company Showpiece is offering shares of Banky’s Valentine’s Day Mascara

Courtesy of Showpiece

Daniel Tunkel, a partner at the London law firm Memery Crystal, says there “is a very substantial risk” that if a court case was brought against Showpiece, “[the venture] would be shown to be a collective investment scheme—and the people who are putting it together and selling it are not regulated by the Financial Conduct Authority to do so”. He adds: “If you establish a collective investment scheme without being regulated, technically it’s a criminal offence, and the investors or the acquirers of those fractions will be entitled to a return of their property.”

According to Tunkel, a key determinant of whether something is a collective investment scheme is how the property is managed—and whether investors are excluded from the process. In this case, he believes the mural is being managed by Showpiece. “They are taking it around the country, they are putting it on display, they may be talking to prospective purchasers. And the people who own the fractions are simply not involved,” he says.

In a statement, a spokesperson for Showpiece says it sought “extensive legal opinion on how to structure the Showpiece digital collectibles proposition prior to launching the platform and we are confident this is not a collective investment scheme”. They add: “As a digital collectibles platform, focused on the enjoyment of ownership as opposed to the financial gain, this would not be considered a collective investment scheme […] We differ significantly from fractional investment platforms, in that there is no reference [in marketing material] to proactive sale of the asset nor any mention of future appreciation.”

In its terms of sale published online, Showpiece states that its intention is “to hold and protect” the mural “for the enjoyment of our community of collectors, indefinitely”. However, it “cannot guarantee the collectable will never be sold”. It notes that any decision to sell “will be subject to a vote of all collectors”. To succeed, there must be at least 60% of votes cast in favour.

The terms of sale also state that there may not be a return for buyers if the mural is sold: “We cannot guarantee that any sale of the beneficial and legal title to the collectable would result in sufficient proceeds to generate any profit, return, or reimbursement to any collector.”

Showpiece is entitled to 5% of any sale price. Meanwhile, the company says buyers can resell their fractions on an online “secondary marketplace” managed by Showpiece.

But it is “not enough” for Showpiece to say it is not selling fractions as an investment, says Pierre Valentin, a partner at Boies Schiller Flexner, who specialises in art law. “For the time being, there doesn’t seem to be a market for the resale of these fractions. So it is probably not an investment at this point in time. But, it is suggested that, in due course, there will be a market for the fractions on the Showpiece platform. And, once there is a market, are people really going to buy fractions simply for the pleasure of owning a certificate?”

Authenticity concerns

Another concern, Valentin says, is that Showpiece does not state prominently on its website that Valentine’s Day Mascara has not been authenticated by Banksy’s studio, Pest Control. He also points out that there is a discrepancy over the mural’s value, which is given as £6m on Showpiece’s website. Usher previously told The Art Newspaper that the mural has been valued at £6m for insurance purposes, though he was realistically looking for offers between £1m and £1.5m.

In a statement to The Art Newspaper, a spokesperson for Showpiece says: “It is incredibly rare for street art to be authenticated by Banksy, however, his social accounts did share the work on the date created.” They add: “The mural’s appraisal was organised by RedEight and carried out by Bank Robber, an acknowledged expert in this field [who] assessed the mural against other similar work by the artist. Showpiece has displayed the valuation and authentication provided by Bank Robber along with further documentation which speaks to the mural’s provenance during the extraction, transportation and treatment by expert art conservator, Arte Conservation.”

The lack of authentication makes any valuation a “moot point”, says Ralph Taylor, the global head of post-war and contemporary art for Bonhams. Speaking more generally about Banksy’s market, Taylor says: “If a work purported to be by Banksy doesn’t have a certificate of authenticity from Pest Control, then we wouldn’t value it or handle a work. As an auction house, we are restricted by very clear rules on best practice. And if an artist withholds authentication from a work then we can’t consider it to be by the artist.”

According to Showpiece’s terms of sale, buyers of fractions in Valentine’s Day Mascara are conveyed “beneficial ownership” and receive a digital token “representing the collectable”. The terms also state that buyers “are entitled to participate in key decisions” relating to the mural, including potential loans and sales. “By joining the community, collectors ensure the mural is protected and on display rather than locked away in a vault as so many others have been,” Showpiece says in its statement.

However, Showpiece says the owners of the fractions were not consulted on the mural’s loan to the exhibition, The Art of Banksy (the work is displayed in a section of the show that is free to view). The Showpiece statement says: “With Dreamland being closed for the majority of the winter months the owners felt it was an ideal solution to ensure the artwork was still accessible to collectors and public alike.”

According to a spokeswoman for Dreamland, the work will return to the amusement park after the London show. She says: “Dreamland is committed to act as hosts for the art work for a year and we will honour that once it returns from the exhibition.”

As for the mural’s message about domestic violence, Showpiece says buyers of the fractions can add donations to Refuge and Oasis to their purchases, with funds being transferred to the domestic abuse charities by the end of year. The level of those donations has not been disclosed.