CRED is in talks to acquire Kuvera, a startup that operates an online wealth management platform, a source familiar with the matter told TechCrunch, in what is a sign of the Indian fintech giant’s growing interest in the lucrative category of mutual funds.

The acquisition deliberations are ongoing and a deal could finalize within weeks, the source said, requesting anonymity as the details are private. CRED and Kuvera didn’t immediately respond to a request for comment.

Kuvera, founded by industry veterans seven years ago, has emerged as one of the fastest-growing mutual fund apps in India, winning affluent individuals with its zero commission offering, reliable customer support service and a wide-range of investment tools such as the ability to automatically adjust the portfolio to avoid over reliance on a particular asset.

The startup’s eponymous platform, backed by Eight Roads, focuses on stable and conservative long-term investments.

Kuvera, which has raised about $10 million to date and has worked with a number of firms including Amazon, has an AUM of about $1.4 billion, according to a person familiar with the matter.

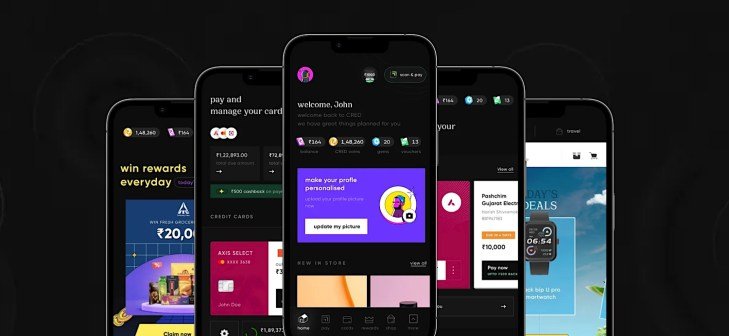

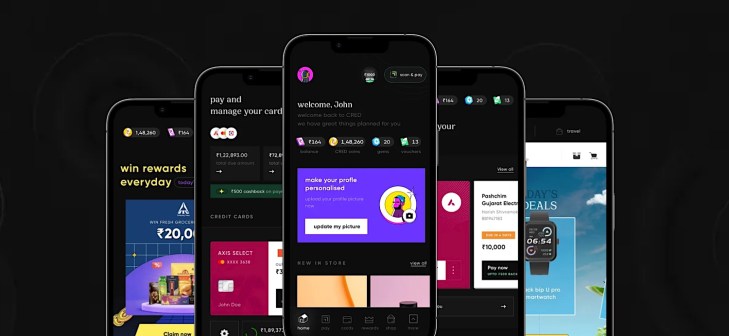

CRED’s interest in Kuvera comes at a time when the Indian fintech giant is expanding its offerings. CRED, which originally launched with the feature of helping its members pay their credit card bills on time, has over the years expanded to e-commerce and lending.

The startup has been eyeing broadening its wealth management offerings for some time. Last year, it held talks with Bengaluru-headquartered Smallcase, but the talks didn’t materialize into a deal.

The Indian mutual fund market is one of the largest and fastest-growing in the world. According to the Association of Mutual Funds in India (AMFI), the assets under management (AUM) of the Indian mutual fund industry stands at about over $575 billion, up over 20% from a year ago.

India’s expanding middle class, benefiting from higher disposable incomes, is fueling the growth of the mutual fund industry. Rising financial literacy and surge in digital apps have heightened awareness while historical returns have solidified their appeal among Indian investors.

More to follow.