Sara Naison-Tarajano, global head of capital markets at Goldman Sachs Private Wealth and Meena Flynn, co-head of One Goldman Sachs

Amid recent $10 billion NBA and NFL team valuations to a $500 million WNBA milestone, Goldman Sachs’ report highlights both the growth and gap in sports investing.

A new report from Goldman Sachs highlights sports as a growing investment theme for family offices, but a wide gap remains in interest to invest in men’s sports versus women’s sports.

Among the 245 family office decision makers surveyed by Goldman Sachs, 50% said they are invested in sports currently or plan to invest in the industry in the future. Major-league men’s teams are the most prominent sports investment for family offices at 71%. In April, Goldman served as an advisor for a group led by William Chisholm, managing partner of private equity firm Symphony Technology Group (STG), in its deal to buy the NBA’s Boston Celtics for $6.1 billion. At the time, this sale set a record price for a North American sports team.

STG notably struck a separate deal in June to buy financial data firm Yodlee from wealthtech giant Envestnet. STG’s purchase price for the Celtics was quickly outpaced by the Abu Dhabi-backed Los Angeles Lakers sale for $10 billion. The NFL’s New York Giants were similarly valued at $10 billion earlier this month in its 10% stake sold to the Koch family.

“The influx of capital into the sector has led to climbing valuations over the past decade and the sector continues to offer the possibility for long-term value accretion,” reads the report from Goldman Sachs. “Its growth as an investment theme has been driven by factors including the widening of sports franchise ownership to permit for more institutional capital, such as private equity.”

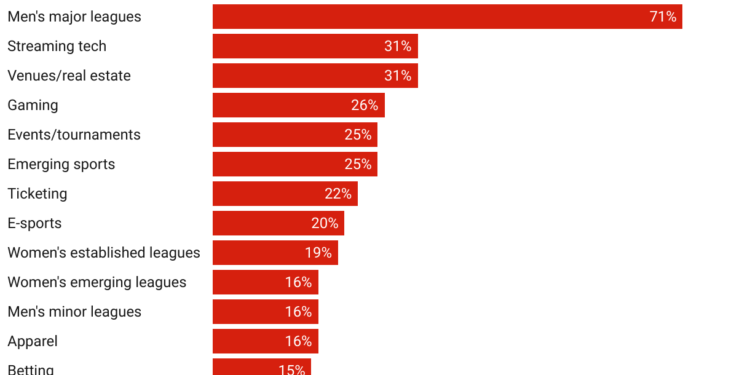

Large RIAs such as Arax Investment Partners have embraced its ties to the sports industry via its investment from RedBird, one of the most active private equity firms in sports. Goldman’s report found that after major men’s teams, the most attractive sports investments for family offices are streaming tech (31%), venues/real estate (31%), and gaming (26%). Women’s established leagues (19%) and women’s emerging leagues (16%) have caught up to men’s minor leagues (16%).

“This is an area that’s likely to see less disruption, especially given live entertainment and there’s multiple streams of revenue. Think about the franchise itself, the real estate, media rights — many of these families are looking to build out the communities and everything around that when they’re doing these sports investments,” said Meena Flynn, co-head of One Goldman Sachs. “It really combines their interest from a passion perspective, as well as long term value creation.”

While viewership and investment in women’s sports has increased in recent years, Goldman’s data indicates a significant remaining investment gap with family offices being approximately four times more likely to invest in men’s sports compared to women’s sports. In June, the WNBA’s Golden State Valkyries became the first women’s pro team to reach a $500 million valuation.

“If you think about it versus where it was maybe 10 years ago, five years ago, I think [women’s sports] have been very material in our client conversations,” Flynn told InvestmentNews. “What’s probably not in this report is, how do I multi-purpose some of my real estate or stadiums to do more with women’s sports.”

Major women’s leagues such as the WNBA announced plans to expand from 15 to 18 teams by 2030, with new teams coming to Cleveland, Detroit, and Philadelphia. Over the past five years, National Women’s Soccer League expansion fees have increased from $2 million to $110 million for teams, according to Front Office Sports. On the men’s side, both NBA commissioner Adam Silver and MLB commissioner Rob Manfred have indicated interest in adding expansion teams to their leagues.

“In some of these women’s sports areas, you’re developing more teams and [investors] want to get in at the earlier stages,” said Flynn. “You’re not paying a premium from an exclusivity perspective, because there’s still so much more to create.”

RIAs such as Validus Capital and Corient, as well as active RIA investor Elevation Point, brand themselves as proponents of family office services. Flynn esimated that there are fewer than five RIAs that target the ultra-high-net-worth space, which is coveted by family offices.

“I think the RIAs come a bit more into play when somebody wants to outsource either the investing or candidly some of the actual in-house more administrative function of a family office. That can clearly be done by an RIA, but it can also be done by a Goldman Sachs private wealth advisor,” said Sara Naison-Tarajano, global head of capital markets at Goldman Sachs Private Wealth.