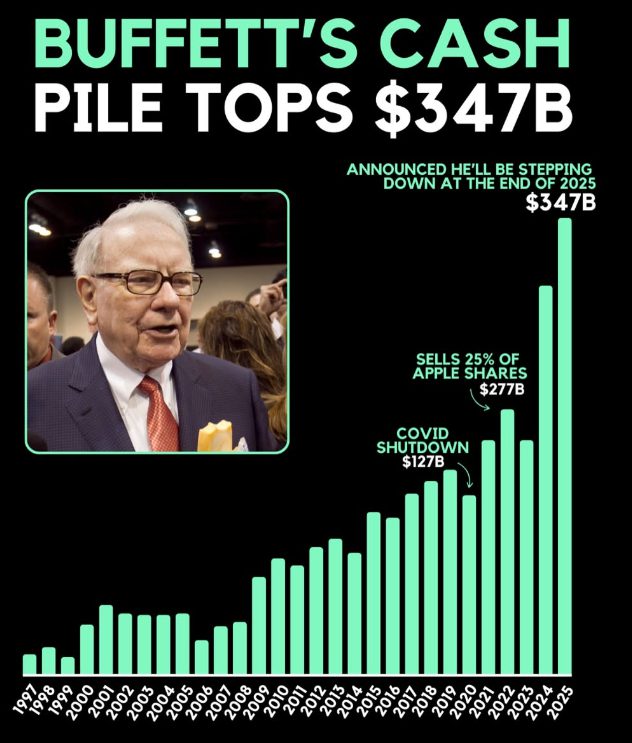

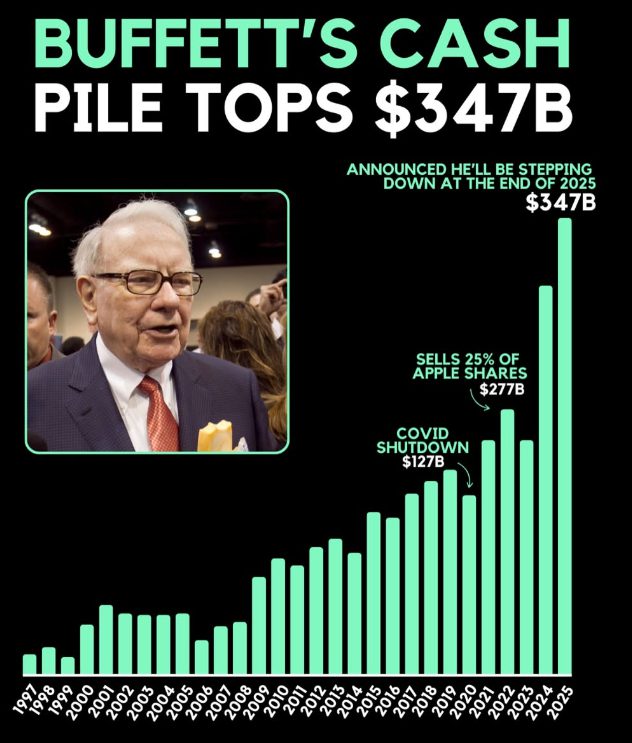

Buffett’s $347B cash pile now stands as an unprecedented force in market dynamics, with Berkshire Hathaway cash reserves reaching levels that could, in many ways, reshape Warren Buffett holdings and the entire S&P 500 investment landscape. His war chest right now dominates market buying power unlike any individual investor in history.

Also Read: Our Dollar, Their Problem: Economist Explains How American Arrogance Is Costing Us Currency Power

How Buffett’s $347B Portfolio Could Reshape Market Power

Unprecedented Financial Position

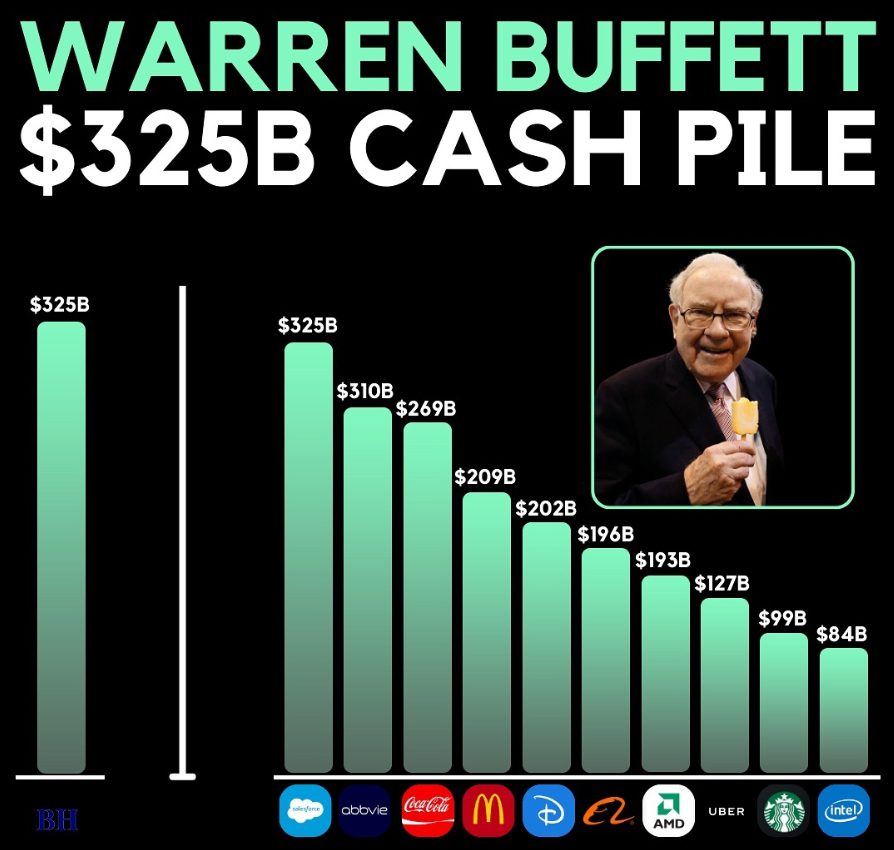

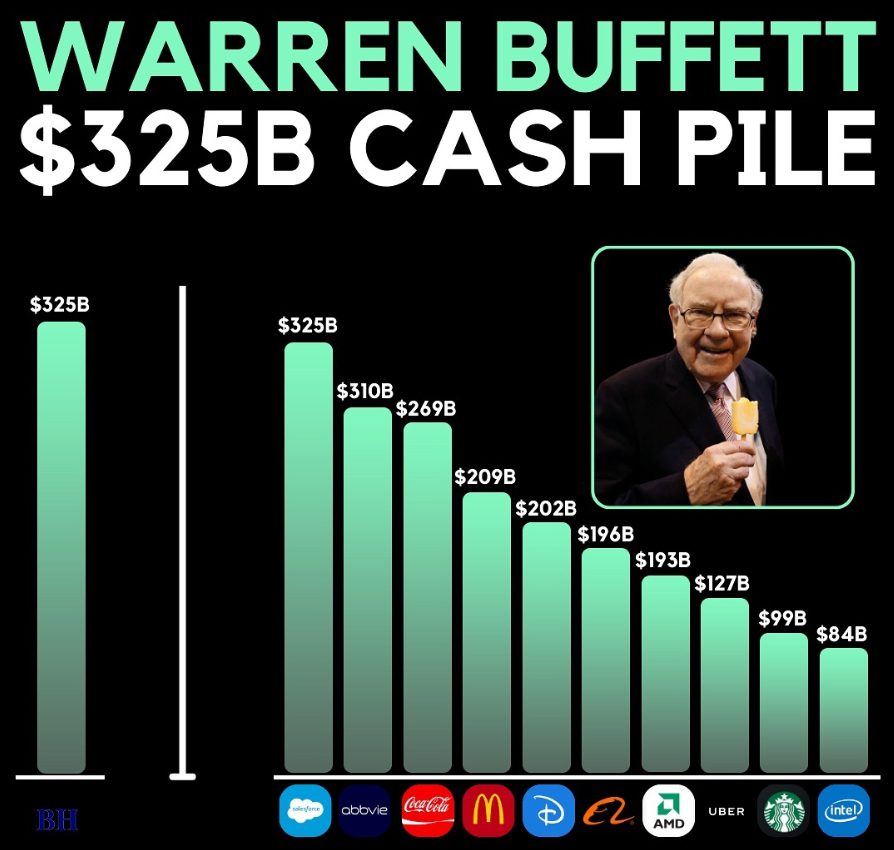

Buffett’s $347b portfolio has grown to an astonishing size that exceeds the market capitalization of roughly 95% of all S&P 500 companies. This massive Berkshire Hathaway cash position also represents about 5.1% of the entire U.S. Treasury bill market at the time of writing, and continues to draw attention from investors worldwide.

Financial analyst Marcus Peterson stated:

“This cash position gives Berkshire unprecedented advantage in today’s market.”

Strategic Waiting Game

The legendary investor’s move to keep such huge Warren Buffett holdings in cash is reflective of his patient approach towards value seeking. Notwithstanding the criticisms on missed opportunities and questions from the shareholders, Buffett’s $347 billion portfolio continues to grow, as he waits for his perceived type of market conditions with a strategic eye on future opportunities.

Also Read: Goldman Bets $1.4B on Blackrock’s Bitcoin ETF: 516 Trillion SHIB Set to Be Hit

Economic Implications

Berkshire Hathaway cash reserves now carry significant macroeconomic weight, effectively making Buffett a major government creditor through Treasury holdings, as well as a potential market-moving force when he decides to deploy capital, considering the power of the Buffett’s $347B cash pile.

Economist Dr. Sarah Williams noted:

“When one investment firm controls over 5% of the Treasury market, it creates an unusual dynamic.”

Potential Acquisition Landscape

Market buying power of this magnitude means Warren Buffett holdings could potentially target almost any company aligning with his investment criteria, making efficient use of his $347 billion portfolio. Several sectors appear particularly suited to his historical preferences, such as energy, insurance, and also consumer staples.

Also Read: Standard Chartered Taps FalconX to Boost Institutional Crypto Flow

Investor Reactions

The investment community remains divided on Buffett $347B cash pile strategy, with some seeing it as a warning about current market valuations, and others questioning the opportunity costs.

Portfolio manager James Chen said:

“Buffett’s cash hoard essentially acts as a put option on the entire market.”

The S&P 500 investment community remains on the lookout for indications of the direction and timing of this buying power’s possible use as many analysts feel that such a buying power might have a strong impact on sector valuations, especially given the Buffett’s $347B cash pile.