An AI crypto portfolio demonstrated strong performance in SimpleSwap’s five-week experiment, though the community portfolio ultimately finished on top at $4,779 USDT, followed by AI at $4,457 USDT and the team at $4,147 USDT. The test involved over 4,000 participants and tracked different approaches to crypto market performance through strategic BTC ETH SOL allocation and varied altcoin allocation methods.

SimpleSwap had this to say:

“Who’s smarter — you, AI, or the crypto team? That question powers our public Crypto Portfolio Showdown, where three sleeves — Community, Team, and AI — run side by side in the open.”

How AI Crypto Portfolio Outperformed Humans With BTC ETH SOL Strategy

The AI crypto portfolio excelled during periods of strong trend persistence, leaning into BTC ETH SOL leaders and momentum plays. Each portfolio strategy demonstrated different strengths, with the AI crypto portfolio showing particular advantage when market breadth was strong, though the community’s equal-weighted approach to altcoin allocation proved most resilient overall.

Portfolio Strategy and Asset Distribution

The community maintained a balanced portfolio strategy with BNB (24.88%), BTC (20.11%), ETH (19.03%), SOL (18.42%), and XRP (17.56%). This clean, equal-weighted approach to major tokens demonstrated solid risk management during volatile crypto market performance.

The team’s altcoin allocation included ETH (17.81%), XRP (16.08%), BTC (14.12%), ONDO (11.93%), LINK (8.06%), and OTHERS (32%). This diversified portfolio strategy captured event-driven opportunities but diluted conviction with the wide “others” sleeve.

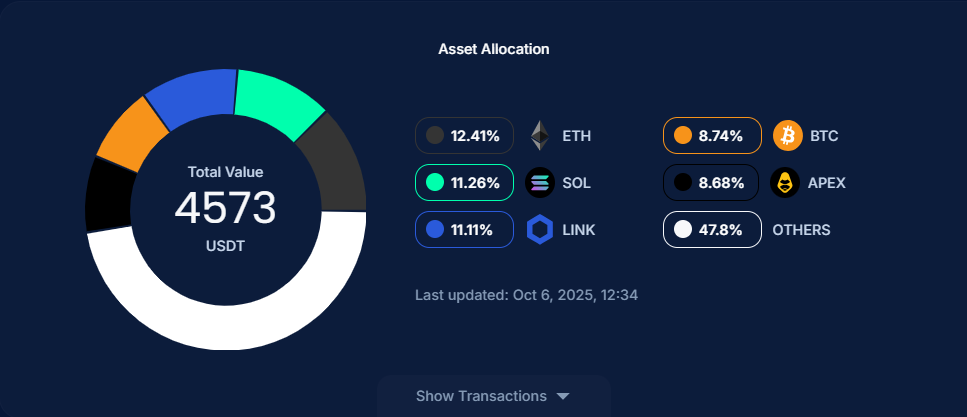

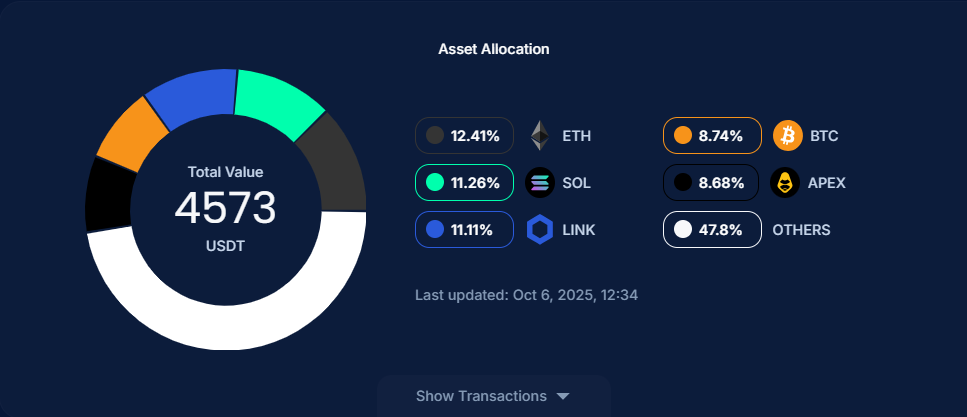

The AI crypto portfolio focused on ETH (12.31%), SOL (11.53%), LINK (11.15%), BTC (8.89%), WLD (7.94%), and OTHERS (48.18%). The algorithm identified strong signals but the over-diversified tail muted impact during choppy crypto market performance conditions.

Also Read: Why Silver & Ethereum Deserve a Spot in Your Portfolio: 2 Key Reasons

Week-by-Week Performance Analysis

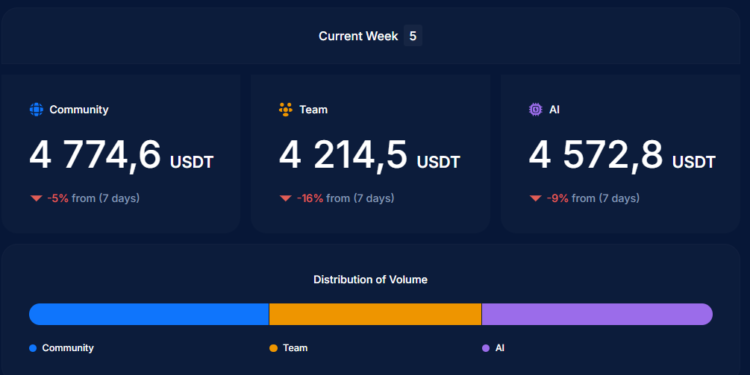

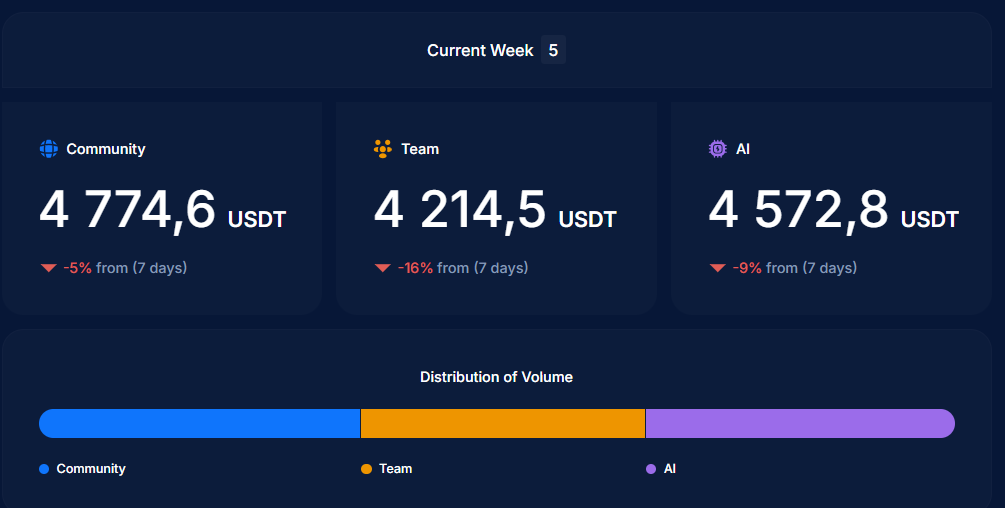

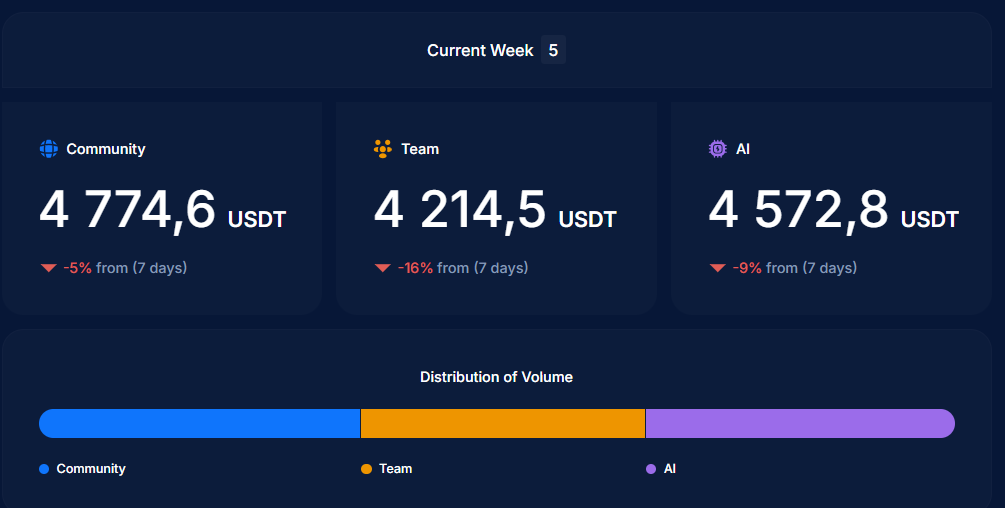

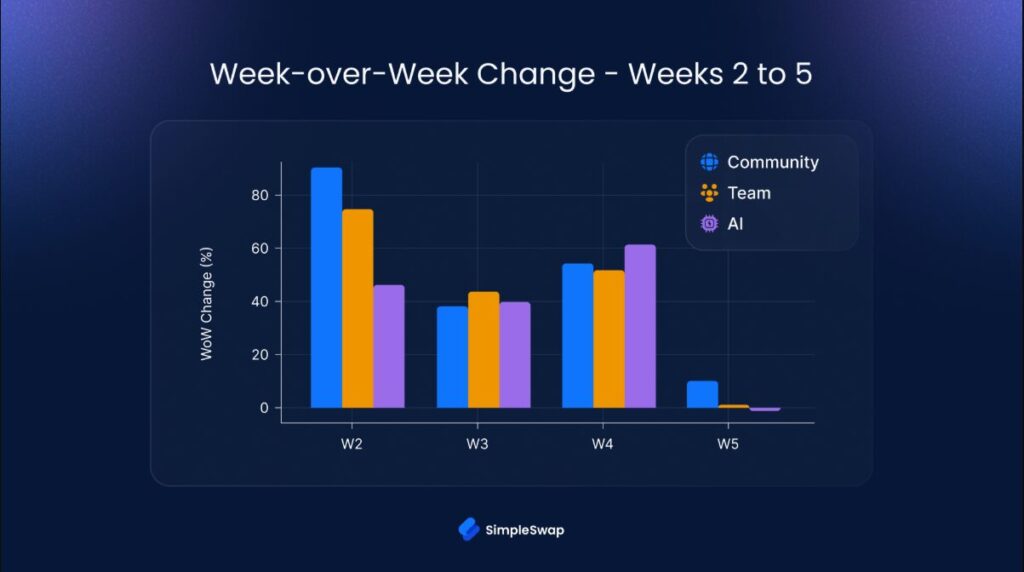

All portfolios showed substantial growth through week four, with the AI crypto portfolio sprinting to an early lead by capitalizing on BTC, ETH, & SOL momentum and AI-adjacent tokens. The crypto market performance peaked before a weekend liquidity shock on October 11-12 tested each portfolio strategy.

The week-over-week data revealed how different altcoin allocation approaches handled volatility. Week two saw explosive growth of 40-90% across all portfolios, while week five brought corrections that separated disciplined strategies from over-leveraged positions.

SimpleSwap stated:

“In uncertain regimes, collective intelligence > any single analyst, and process beats prediction. Our job at SimpleSwap is to channel that collective edge into clear playbooks, transparent measurement, and tools that help you execute with discipline.”

The experiment showed that the AI crypto portfolio works best in strong-trends markets whereas the community wisdom works best in the choppy markets. The point made herein: the reactive nature of portfolio strategy is dependent on the adaptability to the current trends of the crypto market instead of any one approach being applied strictly.

Also Read: Morgan Stanley Taps Crypto With 4% Bet on Growth Portfolios